Foreign Direct Investment (FDI), being a key driver of economic growth, has been a significant non-debt financial resource for India’s economic development. Foreign corporations invest in India to benefit from the country’s particular investment privileges such as tax breaks and comparatively lower salaries. This helps India develop technological know-how and create jobs as well as other benefits. These investments have been coming into India because of the government’s supportive policy framework, vibrant business climate, rising global competitiveness and economic influence.

The government has recently made numerous efforts, including easing FDI regulations in various industries, PSUs, oil refineries, telecom and defence. India’s FDI inflows reached record levels, at US$ 84.83 billion during 2021-22. Information and technology, telecommunication and automobiles were the major receivers of FDI in FY22. With the help of significant transactions in the technology and health sectors, Multinational companies (MNCs) have pursued strategic collaborations with top domestic business groups, fuelling an increase in cross-border M&A of 83% to US$ 27 billion in 2020. According to the World Investment Report 2023, India emerges as the FDI powerhouse and secures the third-highest foreign investment in 2021-22. The total amount of FDI inflows received during the last ten years (April 2014-June 2023) was US$ 614.02 billion. This FDI has come from more than 101 countries that have invested across 31 UTs and States and 57 sectors in the country.

MARKET SIZE

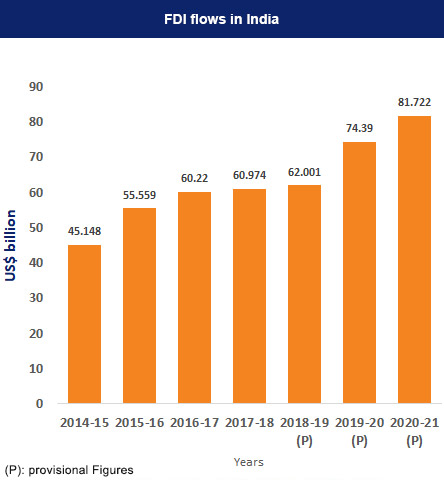

India’s FDI inflows have increased 20 times from 2000-01 to 2023-24. According to the Department for Promotion of Industry and Internal Trade (DPIIT), India’s cumulative FDI inflow stood at US$ 937.58 billion between April 2000- June 2023, mainly due to the government’s efforts to improve the ease of doing business and relax FDI norms. The total FDI inflow into India from April 2023 to June 2023 stood at US$ 17.56 billion and FDI equity inflow for the same period stood at US$ 10.94 billion.

From April 2000–June 2023, India’s service sector attracted the highest FDI equity inflow of 16% amounting to US$ 105.40 billion, followed by the computer software and hardware industry at 15%, amounting to US$ 95.88 billion, trading at 6%, US$ 40.05 billion, telecommunications at 6%, US$ 39.27 billion and automobile industry at 5%, US$ 35.14 billion.

India also had major FDI inflows during April 2000-June 2023, coming from Mauritius at US$ 164.83 billion with a total share of 26%, followed by Singapore at 23% (US$ 151.16 billion), the USA at 9%, (US$ 61.26 billion), Netherlands at 7%, (US$ 45.28 billion) and Japan at 6%, (US$ 39.94 billion).

The state that received the highest FDI during April 2000-June 2023 was Maharashtra (US$ 58.43 billion) at 29%, followed by Karnataka (US$ 45.92 billion) at 23%, Gujarat (US$ 32.63 billion) (16%), Delhi (US$ 27.06 billion) (14%), and Tamil Nadu (US$ 9.13 billion) (5%).

In 2022 (until August 2022) India received 811 Industrial Investment Proposals which were valued at Rs. 352,697 crore (US$ 42.78 billion). Cumulatively, the total amount of Industrial investment proposals for 2022 increased to US$ 298 billion (Rs. 23.6 lakh crore) as compared to US$ 169.5 billion (Rs. 13.8 lakh core) in the previous year.

INVESTMENTS/DEVELOPMENTS

India has become an attractive destination for FDI in recent years, influenced by various factors which have boosted FDI. India ranked 40th in the World Competitive Index 2023 jumping 3 positions from the 43rd rank in 2021. India was also named as the 48th most innovative country among the top 50 countries, securing 40th position out of 132 economies in the Global Innovation Index 2023. India rose from 81st position in 2015 to 40th position in 2023. These factors have boosted FDI investments in India. Some of the recent investments are as follows:

- In October 2023, Reliance Retail Ventures Limited (RRVL) announced that a wholly owned subsidiary of the Abu Dhabi Investment Authority (ADIA) will invest Rs. 4,966.80 crore (US$ 596.63 million) into the company.

- In September 2023, Hindalco signed a technology partnership with Italy-based, Metra SpA, to bring the latest aluminium extrusion technology to India for building rail coaches.

- In September 2023, US chipmaker, Nvidia Corporation announced separate partnerships with Reliance and Tata group companies to help them develop AI-powered supercomputers, AI clouds and generative AI applications.

- In September 2023, Singapore’s investment firm, Temasek led US$ 140 million Ola Electric funding at a US$ 5.4 billion valuation.

- In August 2023, Qatar Investment Authority (QIA) invested Rs. 8,278 crore (US$ 994.39 million) in Reliance Retail Ventures Limited (RRVL) to get an equity stake of 0.99%.

- In August 2023, the global investment firm Temasek invested Rs. 1,200 crore (US$ 144,15 million) in its electric vehicle subsidiary Mahindra Electric Automobile Ltd (MAEL).

- In August 2023, Brookfield Asset Management entered into an agreement with Reliance Industries (RIL) to invest US$ 20-30 billion over the next decade in Australia’s renewable energy sector.

- In August 2023, Walmart paid US$ 1.4 billion to buy out hedge fund Tiger Global’s stake in Flipkart.

- In July 2023, Jio Financial partnered with BlackRock to launch an asset management firm with a combined investment of US$ 300 million.

- In July 2023, U.S.-based investment firm, Bain Capital announced that it has entered into an agreement to acquire 90% of Adani Capital and Adani Housing.

- In July 2023, Walt Disney is considering options for its Star India business, including a joint venture or sale, as it looks to help the India business grow and reduce costs.

- In July 2023, French advertising and public relations company Havas’s India arm announced the acquisition of PivotRoots.

- In June 2023, Allcargo Logistics completed the acquisition of a 30% stake in Gati-Kintetsu Express (GKEPL) for Rs. 406.71 crore (US$ 49.48 million).

- In June 2023, BPEA EQT group (formerly Baring Private Equity Asia), in partnership with ChrysCapital, is set to acquire around 90% stake in Housing Development Finance Corporation’s wholly-owned education financial subsidiary HDFC Credila Financial Services Ltd (HDFC Credila) for Rs. 9,060.5 crore (US$ 1.10 billion).

- In June 2023, Private equity (PE) investors Blackstone Inc., BPEA EQT ((formerly Baring Private Equity Asia), CVC Capital Partners, and General Atlantic Service Company are competing to acquire Mumbai-based Indira IVF Hospital Pvt. Ltd.

- In April 2023, Sheares Healthcare, a subsidiary of Singapore-based Temasek, agreed to purchase a majority position in Manipal Health Enterprises, increasing its holding from 18% to nearly 59% for around Rs. 16,400 crore (US$ 2 billion).

- In February 2023, Singapore Airlines acquired a 25.1% share in the Air India group after investing US$ 267 million.

- VilCart, the rural economy-focused technology startup bagged US$ 18 million in January 2023 from Asia Impact SA, Nabventures Fund and Texterity Pvt Ltd in order to expand their operations.

- Data Science and AI Solutions company, Tredence raised US$ 175 million in series B funding from Advent International in December 2022.

- In December 2022, a portfolio company of Edelweiss Alternative Asset Advisors Ltd.’s Infrastructure Yield Plus Strategy, Epic Concesiones Pvt Ltd., acquired a 100% equity stake in L&T Infrastructure Development Projects Limited (L&T IDPL) for an enterprise value of approximately Rs. 6,000 crore (US$ 734.57 million).

- Indian beer startup Bira 91 raised US$ 70 million from Japanese beverage conglomerate Kirin Holdings in November 2022.

- A business-to-business (B2B) e-commerce startup, Udaan bagged an investment of US$ 120 million in October 2022, from existing shareholders and another US$ 35 million from EvolutionX, started by DBS and Temasek via convertible notes and debt in November 2022.

- A Software-as-a-service (SaaS) company, Icertis bagged a funding of US$ 150 million on October 31st, 2022 from Silicon Valley Bank.

- In October 2022, Byju’s raised US$ 250 million from the existing lead investor Qatar Investment Authority (QIA).

- upGrad, an ed-tech unicorn recently raised US$ 210 million in a funding round led by ETS Global, Singapore’s Kaizen Management Advisors and Bodhi Tree at a valuation of US$ 2.25 billion in August 2022.

- Novo Holdings, a leading international investor in healthcare and life sciences invested US$ 50 million in MedGenome, a health tech startup in August 2022.

- In July 2022, OneCard, a mobile-first credit card company, raised US$100 million backed by Temasek, making it the 104th unicorn in India.

- G.O.A.T Brand Labs raised US$ 50 million led by Winter Capital, 9Unicorns, Venture Catalysts, Vivriti Capital and Oxyzo on June 16th, 2020.

- In April- September 2022, India received FDI investments of US$ 3.21 million in the defence manufacturing sector.

- In May 2022, Italian financial services major Generali completed the acquisition of a 25% stake in Future Generali India Insurance from Future Enterprises for Rs. 1,252.96 crore (US$ 161.92 million).

- In May 2022, GenWorks Health secured a second round of funding worth Rs. 135 crore (US$ 17.44 million) from a consortium of investors, including Somerset Indus Capital Partners, Morgan Stanley, through its funding arm Grand Vista, Evolvence and Wipro GE.

- In May 2022, Toplyne, a Software-as-a-Service (SaaS) start-up, raised US$ 15 million in a funding round led by Tiger Global and Sequoia Capital India.

- In May 2022, Kiranakart Technologies Pvt. Ltd, which runs the 10-minute grocery delivery platform Zepto, raised US$ 200 million in a Series D funding round led by Y Combinator’s Continuity Fund, which valued it at US$ 900 million.

- In May 2022, KoinBasket, a thematic crypto investment start-up, raised US$ 2 million in a pre-seed funding round.

- In May 2022, Invictus Insurance Broking Services Pvt. Ltd, which runs the insurtech platform Turtlemint Insurance Services Pvt. Ltd. raised US$ 120 million in a Series E funding round led by Amansa Capital, Jungle Ventures and Nexus Venture Partners.

- In May 2022, Jaipur-based online furniture and home decor platform Woodenstreet.com raised around US$ 30 million in a Series B funding round led by WestBridge Capital.

- In May 2022, B2B cross-border tech platform Geniemode received US$ 28 million in a Series B funding round led by Tiger Global and Info Edge Ventures.

- In January 2022, Google announced a US$ 1 billion investment in Indian telecom Bharti Airtel, which includes an equity investment of US$ 700 million for a 1.28% stake in the company, and US$ 300 million for a potential future investment in areas such as smartphone access, networks and the cloud.

GOVERNMENT INITIATIVES

In recent years, India has become an attractive destination for FDI because of favourable government policies. India has developed various schemes and policies that have helped boost India’s FDI. These schemes have prompted India’s FDI investment, especially in upcoming sectors such as defence manufacturing, real estate, and research and development. Some of the major government initiatives are:

- Due to the Make in India Initiative, FDI equity inflow in the manufacturing sector between 2014-2022 has increased by 57% over the previous 8 years i.e. 2006- 2014.

- The Reserve Bank of India has taken a number of actions to increase foreign exchange inflows. These actions consist of:

- Exempting additional Foreign Currency Non-Resident (Bank) [FCNR(B)] and Non-Resident (External) Rupee (NRE) deposits from Cash Reserve Ratio (CRR) and Statutory Liquidity Ratio (SLR).

- Authorization for banks to accept new FCNR(B) and NRE deposits without regard to current interest rate regulations until the end of October 2022.

- Inclusion of all new issuances of 7-year and 14-year G-Secs under the Fully Accessible Route (FAR) for FPls.

- Exemption from the short-term limit for FPls’ investments in G-Secs and corporate debt made until October 31st, 2022.

- Permitting FPI in commercial paper and non-convertible debentures with an original maturity of up to one year.

- A temporary increase in the limit for external commercial borrowings (ECBs) under the automated route from US$ 750 million or its equivalent per fiscal year to US$ 1.5 billion.

- Increase in the all-in cost ceiling under the ECB framework by 100 basis points, subject to the borrower having an investment grade rating.

- Permission for AD Cat-I banks to use foreign currency borrowings made abroad to fund foreign currency loans to organisations for a variety of end uses other than exports.

- The Government of India increased FDI in the defence sector by liberalizing it to 74% through the automatic route and 100% through the government route.

- The Foreign Investment Facilitation Portal (FIFP) is a new online single-point interface of the government for investors to facilitate Foreign Direct Investment proposals to evaluate and further authorise them under the Government approval route.

- The sectoral cap for the pharmaceutical industry has been lowered, 74% of FDI is permitted in the Brownfield pharma sector via the automatic method, and 100% is permitted via the approved route.

- In the civil aviation sector, 100% FDI is allowed under automatic routes in brownfield airport projects.

- For single-brand retail trading, local sourcing norms have been relaxed for up to 3 years and 100% FDI is allowed under automatic route.

- The government has amended the Foreign Exchange Management Act (FEMA) rules, allowing up to 20% FDI in insurance company LIC through the automatic route.

- The government is considering easing scrutiny on certain FDIs from countries that share a border with India.

- The implementation of measures such as PM Gati Shakti, single window clearance and GIS-mapped land bank is expected to push FDI inflows in 2022.

- The government is likely to introduce at least three policies as part of the Space Activity Bill in 2022. This bill is expected to clearly define the scope of FDI in the Indian space sector.

- In September 2021, India and the UK agreed to an investment boost to strengthen bilateral ties for an ‘enhanced trade partnership’.

- In September 2021, the Union Cabinet announced that to boost the telecom sector, it will allow 100% FDI via the automatic route, up from the previous 49%.

- In August 2021, the government amended the Foreign Exchange Management (non-debt instruments) Rules, 2019, to allow a 74% increase in FDI limit in the insurance sector.

- Many reforms like National Technical Textiles, Silk Samagra-2 scheme, Seven PradhanMantri Mega Integrated Textile Region and Apparel (PM MITRA) Parks, Production Linked Incentive (PLI) Scheme for Textiles to promote the production of Man-Made Fibre (MMF) Apparel, MMF Fabrics and Products of Technical Textiles, and more initiatives are taken by the government to enhance export and to promote FDI in the textile sector.

ROAD AHEAD

India has recently become a major global hub for FDIs. According to a survey held in 2020, India was among the top three global FDI destinations; about 80% of the global respondents had plans to invest in India. Furthermore, India has provided huge corporate tax cuts and simplified labour laws. According to the OECD FDI restrictiveness index, the country has also reduced its restrictions on FDI; overall FDI restrictions have reduced from 0.42 in 2003 to 0.21 in 2020 (i.e. last 17 years). India has remained an attractive market for international investors in terms of short- and long-term prospects. India’s low-skill manufacturing is one of the most promising industries for FDI. India has also developed excellent government efficiency. The developments in government efficiency are primarily due to relatively stable public finances (despite COVID-induced challenges) and optimistic sentiment among Indian business stakeholders concerning the funding and subsidies offered by the government to private firms. All of these factors may enable India to attract FDI of US$ 120-160 billion yearly by 2025.

https://www.ibef.org/economy/foreign-direct-investment