A group of private-equity firms is nearing a deal to acquire Medline Industries Inc. that would value the medical-supply giant at more than $30 billion, in one of the largest leveraged buyouts since the financial crisis.

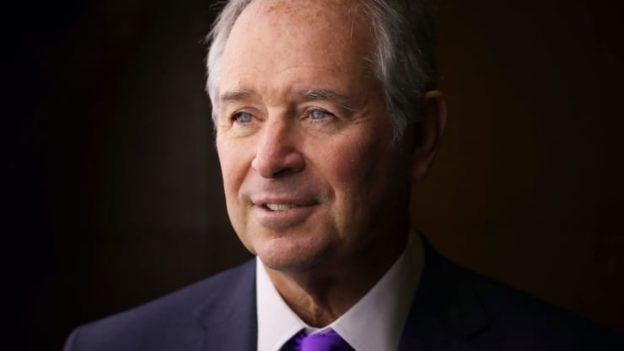

The deal could come together as soon as this weekend assuming the talks don’t fall apart, according to people familiar with the matter. The consortium— Blackstone Group Inc. , Carlyle Group Inc . and Hellman & Friedman LLC— beat out a rival bid from the private-equity arm of Canadian investing giant Brookfield Asset Management Inc. , the people said.

Including debt, the transaction would be valued at about $34 billion, and north of $30 billion excluding borrowings, the people said. That could potentially make it the largest healthcare LBO ever.

Based in Northfield, Ill., family-owned Medline is a little-known but major player in the field of medical equipment. It manufactures and distributes equipment and supplies used in hospitals, surgery centers, acute-care and other medical facilities in over 125 countries.

Medline’s vast array of products include surgical gowns, examination gloves and diagnostic equipment, as well as consumer-facing brands such as Curad bandages. It has some $17.5 billion in annual sales, according to the company’s website.

https://pe-insights.com/news/2021/06/05/private-equity-group-nears-deal-to-buy-medline-for-over-30bn/

https://pe-insights.com/news/2021/06/05/private-equity-group-nears-deal-to-buy-medline-for-over-30bn/