It is difficult to overstate both the global semiconductor industry’s awe-inspiring growth path to $1 trillion through the end of this decade and the daunting challenges we are facing. In my industry outlook last quarter, I highlighted projections for the industry’s return to growth in 2024 and optimism over the years ahead fueled by multiple disruptive technologies and emerging applications including artificial intelligence (AI), autonomous vehicles, high-performance computing and 6G. Looking to the plethora of killer applications ahead, take your pick of bold phrases to describe the unprecedented opportunities for our industry.

However, our industry also faces unprecedented challenges. I called out the Talent Gap, Sustainability Pressure, Supply Chain Disruptions and the Geopolitical and Regulatory Landscape in last quarter’s outlook, and they continue to remain top of mind for industry CEOs. With guidance from leaders on our global and regional advisory boards, SEMI is spearheading unprecedented collaboration and actions to advance growth for the global semiconductor industry. Following is an update on the industry’s outlook through the first quarter and SEMI member-led programs to pave the way to $1 trillion and beyond.

Semiconductor Production Capacity Expansion and Record Investment

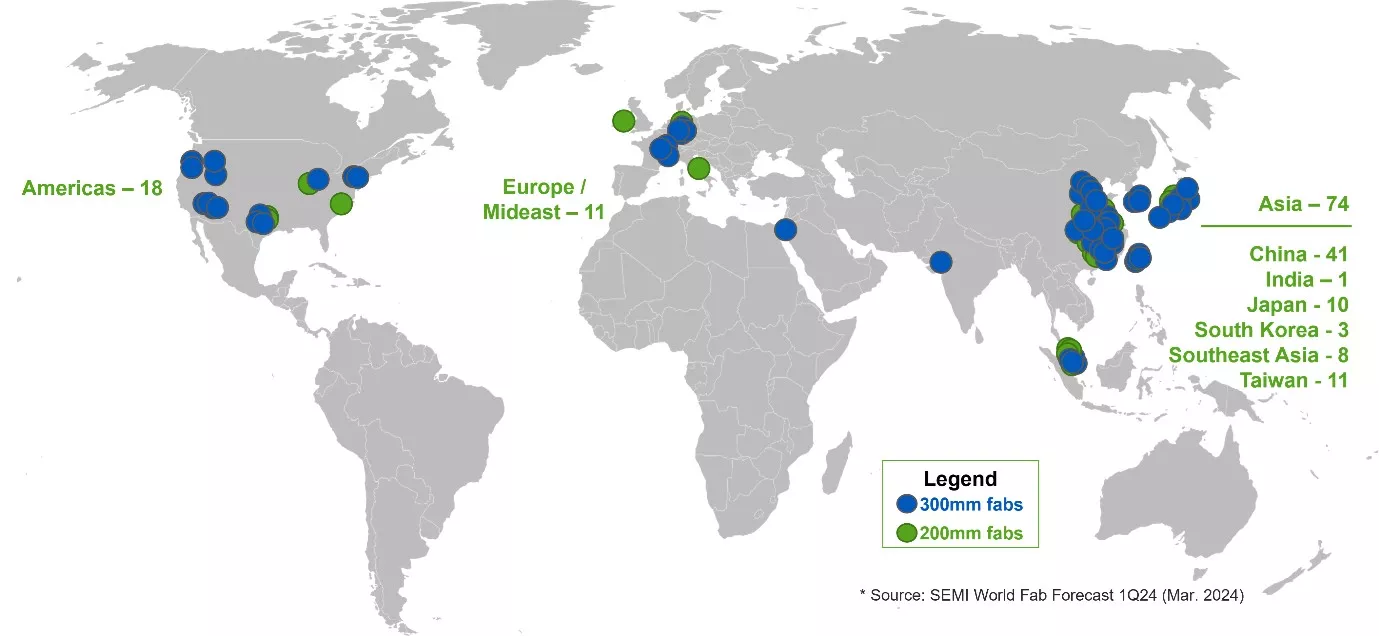

The global semiconductor industry is expanding production capacity to support the proliferation of AI and a diverse range of disruptive technologies and emerging applications, with a robust 103 new fabs expected to come online between 2023 and 2027, as the most recent SEMI World Fab Forecast report highlights. Eighty of these facilities are fabs for 300mm wafers, and 23 for mature technologies on 200mm wafers. Of the 103 fabs, 43 are under construction, 22 in early stages of operation, and 14 equipping. It’s important to note that more fabs will be needed through the end of the decade to support projected demand for chips on the industry’s path to $1 trillion in revenue.

The global semiconductor industry is expanding production capacity to support the proliferation of AI and a diverse range of disruptive technologies and emerging applications, with a robust 103 new fabs expected to come online between 2023 and 2027, as the most recent SEMI World Fab Forecast report highlights. Eighty of these facilities are fabs for 300mm wafers, and 23 for mature technologies on 200mm wafers. Of the 103 fabs, 43 are under construction, 22 in early stages of operation, and 14 equipping. It’s important to note that more fabs will be needed through the end of the decade to support projected demand for chips on the industry’s path to $1 trillion in revenue.

In parallel, global 300mm fab equipment spending is projected to reach a record US $137 billion by 2027, driven by demand for high-performance computing for both cloud and edge, automotive applications, and the memory market, the SEMI Market Intelligence Team reported in March in its 300mm Fab Outlook for the first quarter of 2024. The report shows equipment investments reaching new highs.

Fab equipment spending is expected to reach US $97 billion in 2024, showing a 1% YoY increase. In 2025, the investment is predicted to grow by 20% to US $116.5 billion before rising 12% to US $130.5 billion in 2026.

Foundry equipment segment spending is set to decline slightly this year but projected to grow at a 7.6% CAGR to US$79.1 billion by 2027. However, the memory segment is expected to post US $41.5 billion in equipment investments in 2027, a 20% CAGR from 2023, with DRAM investment taking the lead fueled by surging demand for high-bandwidth memory – essential for supporting AI innovation.

SEMI World Fab Forecast: 103 new fabs worldwide expected to come online

between 2023-2027

Collaborations to Ensure Industry Growth

On the flip side, the fab boom threatens to widen the industry’s talent gap and slow its sustainability progress but also help diversify the global supply chain as more regions build out their chip ecosystems. Overcoming headwinds to growth requires unprecedented collaboration across a quadruple helix of stakeholders: industry, government, academia, and civil society. In the first quarter of 2024, SEMI programs engaged this quadruple helix in multiple areas to advance the industry.

First and foremost, SEMI expanded our Global Advocacy and Public Policy efforts with a unique platform to strengthen alignment on geopolitical concerns across the quadruple helix, the SEMI International Policy Summit (SIPS). SEMI hosted the second edition of SIPS in Brussels March 4-5, 2024, bringing together top industry executives, members of academia, and government policymakers from key regions around the globe. The platform has two primary focuses, workforce development to address the talent gap and sustainability to address climate concerns and chemical regulations.

Ajit Manocha and ASM CEO Benjamin Loh recap the Talent session at SIPS in Brussels.

The top outcome of the Summit was the formation a SIPS Steering Committee made up of top executives, policymakers and leaders from academia in key regions. The Council will evaluate progress on addressing semiconductor industry challenges via the SEMI Workforce Development Program, Sustainability Initiative and Environment, Health and Safety (EHS) Program, and they will provide guidance on planning future SIPS gatherings.

Additional top actions and outcomes of SEMI programs in the first quarter include:

Workforce Development

- The SEMI Foundation, our non-profit arm focused on talent, expanded its apprenticeship programs to fast-track semiconductor careers with help from a $4 million grant in Arizona.

- The Foundation highlighted careers in the industry to more than 1.5 million students in Q1 2024 through its SEMI Stories

- The Foundation’s VetWorks program connected SEMI member companies directly to 2,700 transitioning military veterans and reached more than 16,000 members of the military community through five virtual and three in-person events.

- SEMICON Korea expanded the industry’s talent pipeline with workforce development and diversity, equity and inclusion sessions that drew about 1,000 university students, junior engineers and other young workers.

Sustainability

- The Semiconductor Climate Consortium (SCC) drove alignment on reducing the industry’s greenhouse gas emissions with its expanded governing council and membership and reported on working group progress.

- Addressing the significant challenges around tracking Scope 3 – indirect emissions from companies’ value chains – the SCC released its first Industry Guidelines for Scope 3 Reporting.

- SEMI continued to facilitate the development of innovative green technology to reduce the industry’s water and energy consumption through the Startups for Sustainable Semiconductors(S3) program, naming this year’s semifinalists.

Supply Chain Management

- The SEMI Supply Chain Management Initiative (SCM) Resiliency Working Group has started drafting a Framework for Supply Chain Risk Management which will ultimately become a SEMI Standard. The SCM Agility Working Group is putting together a close-to-real-time dashboard with data points from a variety of sources to track disruptions and make decisions faster.

- Aiding in this endeavor to establish industry benchmarks for operational agility metrics that are not readily available through standard industry reports, the SCM, in collaboration with McKinsey & Company, launched a Semiconductor Supply Chain Survey. SEMI and McKinsey will aggregate and analyze the results and share the findings in a webinar on June 24 and at SEMICON West 2024 in July, enabling the end-to-end value chain to benchmark against peers, swiftly identify key issues, and course-correct in near real-time.

Advancing Technology Innovation

- The SEMI Smart Manufacturing Initiative hosted the industry’s first workshop on Digital Twins in Semiconductor Manufacturing and collaborated with members on a white paper and roadmap. The goal: help member companies optimize semiconductor design, manufacturing processes and equipment maintenance through digital twin technology.

- The SEMI Smart Data-AI Initiative is driving two strategic actions to help the semiconductor industry realize the full potential of AI. First, the initiative’s proof-of-concept (POC) project is bringing together academia, industry and government representatives to develop AI models for digital twins to improve semiconductor R&D efficiencies. Second, the initiative is accelerating innovation for future, sustainable AI hardware starting by offering a series of events on Data, AI and Future of Computing, including a day-long session at SEMICON West.

- Addressing critical cybersecurity topics identified by members, the SEMI Semiconductor Manufacturing Cybersecurity Consortium (SMCC) launched its first Standards activity focused on Computing Device Cybersecurity Status Reporting. The SEMI SMCC also established focused working groups on Factory Cybersecurity Implementation, Compliance Readiness, Supply Chain, Regulations & Standards, Threat Sharing and Pre-Standards Engineering.

- To help the industry continue to boost chip performance while meeting cost demands, SEMI created the Advanced Packaging Heterogeneous Integration (APHI) Technology Community, which is forming working groups to develop industry roadmaps and further education on heterogenous integration.

Unprecedented Industry Support

SEMI eclipsed more than 3,300 member companies in the first quarter of 2024, strengthening our voice in representing the global electronics design and manufacturing supply chain. Across our industry-driven programs and working groups, we are exploring new ways to engage government, academia and civil society to unlock the power of quadruple helix support and propel the semiconductor industry to $1 trillion and beyond. SEMI needs unprecedented industry support to address our shared challenges and, ultimately, to advance technologies that improve the quality of life the world over. Now is the time to join your peers and elevate our collective efforts to new heights.

Discover how SEMI membership can help grow your business and explore opportunities to get involved in SEMI programs to advance the industry.

Ajit Manocha is President and CEO of SEMI.

https://www.semi.org/en/blogs/semi-news/global-semiconductor-industry-outlook-taking-unprecedented-action-to-optimize-growth-address-challenges