- The PIF issued $8.5 billion in green bonds in 2022 and 2023, becoming the first sovereign wealth fund to issue that class of bond.

- Of that figure, $5.2bn has been allocated to projects as of June 2024, up from $1.3 billion in June of the previous year.

- The kingdom’s much-touted ambitions have no shortage of critics, who question the sustainability of megaprojects like Neom.

Saudi sovereign wealth fund allocates $5.2 billion in green bonds project amid diversification push

Saudi Arabia’s Public Investment Fund (PIF) has allocated $5.2 billion out of $8.5 billion raised through green bonds to projects as of June 2024, according to its Allocation and Impact Report released on Friday.

This allocation figure is up from $1.3 billion in June of the previous year.

A green bond is a type of income used to finance projects that have environmental benefits. The PIF became the first sovereign wealth fund to issue a green bond back in October 2022. It followed up with a second green bond offering in February 2023.

The mammoth sovereign wealth fund, which oversees $925 billion in assets, has a capital expenditure requirement of $19.4 billion for what it deems “eligible green projects,” according to the PIF’s annual report.

Funds “have been allocated to finance the development in eligible criteria with major expenditure in Renewable Energy, Green Buildings and Sustainable Water Management projects,” the PIF said, adding that the eligible green projects “contribute to the United Nations Sustainable Development Goals.”

Saudi Arabia has a stated goal of reaching net-zero greenhouse gas emissions by 2060 and has poured billions of dollars into what it says are sustainable development projects. The drive is part of Crown Prince Mohammed bin Salman’s Vision 2030 plan, which aims to diversify and modernize the kingdom’s economy, reducing its reliance on oil.

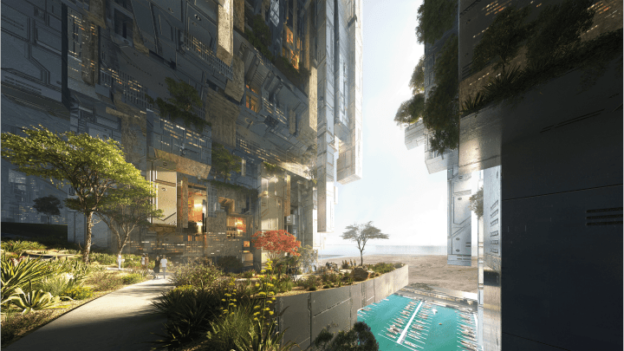

The kingdom’s much-touted Vision 2030 ambitions also have no shortage of critics, who question the sustainability of megaprojects like Neom — a 10,200 square mile urban development on the Red Sea coast — as the requirement for construction and building materials that rely on heavy industry is so high, and while the vast majority of the Saudi economy still relies on its oil production.

The carbon cost of construction for Neom “will overwhelm any environmental benefits,” Philip Oldfield, head of the built environment school at the University of New South Wales, told architecture and design magazine Deezen in 2022, estimating that the project could produce more than 1.8 billion tons of embodied carbon dioxide.

The PIF’s Allocation and Impact Report highlights case studies to back up its sustainability pledges. It describes a water sustainability project planned for Neom that will develop “a fully-circular system to achieve water positivity” enabling “100% wastewater recapture and energy-neutral recycling.”

The PIF also pointed to its focus on green hydrogen, which many industry experts see as playing a vital role in the energy transition. Neom Green Hydrogen — a joint venture between Neom and Saudi firms ACWA Power, Air Products — will be the world’s largest green hydrogen plant and will operate “entirely on renewable energy,” according to the report.

The PIF has provided either partial or full investment and financing for each of the case studies mentioned in the report, all of which have yet to be completed.

https://www.cnbc.com/amp/2024/10/11/saudi-pif-allocates-5point2-billion-in-green-bonds-project-.html