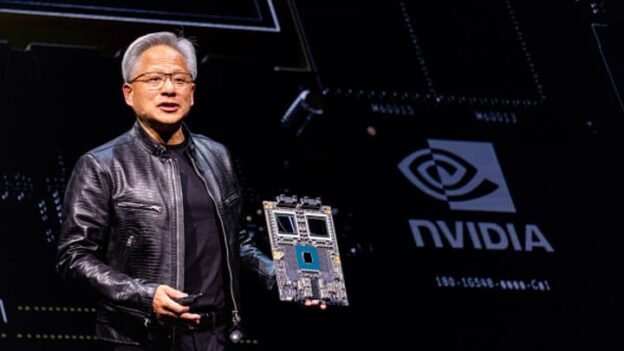

Western Digital Corporation WDC recently announced that its PCIe Gen5 DC SN861 E.1S enterprise-class NVMe SSDs are certified for NVIDIA’s NVDA GB200 NVL72 rack-scale system.

As the digital landscape evolves, the demand for emerging technologies like artificial intelligence (AI), machine learning and large language models (LLMs) is intensifying. Data generation and consumption are proliferating, forcing organizations not only to manage robust datasets but also to derive meaningful insights from them faster. This rapid transformation is especially relevant for increasing storage demands, where AI technology stacks need to be capable of delivering performance, scalability and efficiency.

Certified to support NVIDIA’s GB200 NVL72 system, WDC’s innovative SSD is uniquely suited for accelerated AI computing environments by delivering high-speed data processing with minimal latency and maximum efficiency. The GB200 NVL72 system serves as a reference architecture, enabling data centers to build more than 100 custom configurations for system designs that meet their specific requirements while maintaining consistency and performance.

Cutting-Edge Features of WDC’s DC SN861 SSD

Western Digital’s DC SN861 E.1S SSD is infused with advanced capabilities designed to optimize the AI data cycle, supporting key stages like AI model training, interface and inference. With capacities up to 16TB, the new enterprise-class PCIe Gen 5.0 offering delivers up to 3x better random read performance than the previous generation, ensuring low latency and responsiveness for LLM training and AI deployment.

AI models are computationally intensive, often requiring significant power. Western Digital’s SSD is designed with a low power profile that delivers higher IOPS/Watt, helping organizations reduce their total cost of ownership. The enhanced PCIe Gen5 bandwidth addresses the surging demand for high-speed, low-latency computing amid the AI boom. Engineered to handle mission-critical workloads, it boasts a comprehensive feature set, including NVMe 2.0 and OCP 2.0 support, along with a durable five-year limited warranty, making it an ideal choice for compute-intensive AI applications.

WDC’s Investment in SSD Market to Drive Top-Line Growth

WDC is expanding its footprint into the emerging SSD market. In the last reported quarter, management highlighted that it witnessed a 60% sequential increase in demand for enterprise SSD solutions, driven by AI-related workloads. It expects SSD enterprise to comprise a double-digit percent share in the portfolio for the fiscal 2025. It is currently sampling 64 terabyte SSDs and aims to deliver in volume shipments by the end of 2024. For the fiscal first quarter, the company expects Flash revenues to witness mid-to-high teens growth sequentially owing to continued innovation in SSD offerings and momentum in mobile.

Nonetheless, cutthroat competition in the storage space and customer concentration risks pose major headwinds for WDC. A high debt burden and macroeconomic uncertainty remain additional concerns.

WDC’s Zacks Rank & Stock Price Performance

WDC currently carries a Zacks Rank #4 (Sell). In the past year, WDC shares have gained 46.1% compared with the sub-industry’s growth of 49.6%.

Image Source: Zacks Investment Research

Stocks to Consider

Some better-ranked stocks from the broader technology space are Workday Inc. WDAY and SS&C Technologies Holdings, Inc. SSNC. WDAY presently sports a Zacks Rank #1 (Strong Buy), whereas SSNC carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

WDAY is a leading provider of enterprise-level software solutions for financial management and human resource domains. The company’s cloud-based platform combines finance and HR in a single system, making it easier for organizations to provide analytical insights and decision support. In the last reported quarter, it delivered an earnings surprise of 7.36%.

SS&C Technologies Holdings delivered an earnings surprise of 3.1%, on average, in the trailing four quarters. In the last reported quarter, SSNC pulled off an earnings surprise of 4.9%. The Zacks Consensus Estimate for its earnings is pegged at $5.18.

https://finance.yahoo.com/news/western-digital-ssds-certified-nvidia-122600352.html