Tensions heat up amid US, China trade and tech war as Taiwan maintains significance in sector

Experts say semiconductors to become increasingly important asset for countries, supply chains

MOSCOW

Geopolitical competition in chip and semiconductor production, especially between the US and China, is on the rise as tensions heat up surrounding Taiwan and its significant role in the field.

The island nation produces 60% of the world’s advanced sub-7-nanometer chips. These chips of 7 nanometers and smaller are used for artificial intelligence (AI), 5G technologies, and military weapons, which posits Taiwan, as the primary manufacturer, at the forefront of a trade and technology war between US and China.

The leading global microchip producer Taiwan Semiconductor Manufacturing Company (TSMC) has become a prominent player in the chip industry, while other Taiwanese chipmakers United Microelectronics (UMC) and MediaTek are among the high-capacity chip manufacturers.

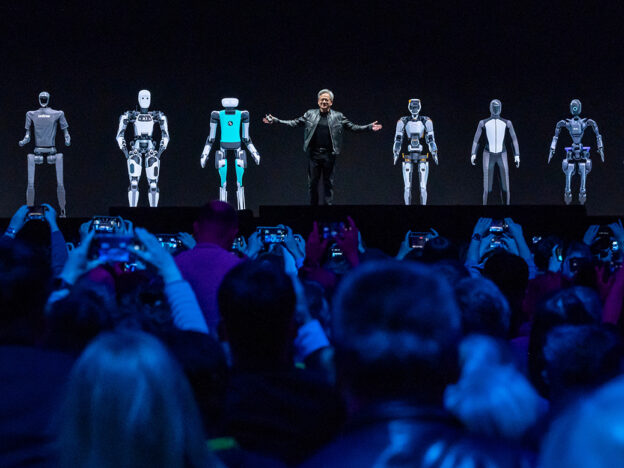

Meanwhile, Netherlands-based ASML and South Korean Samsung are also at the forefront of chipmaking, in addition to US tech giants like Intel, Nvidia, Micron, and Texas Instruments.

The US aims to strengthen its position in the global chip competition with billions of dollars spent in support for the TSMC, as well as other companies under the CHIPS and Science Act this year, while the TSMC’s Arizona plant increased its production by 4 points compared to similar facilities in Taiwan.

Meanwhile, China boasts its own chip and semiconductor production capacity with companies, such as HiSense, Biren, and the Semiconductor Manufacturing International Corporation (SMIC).

Importance of semiconductor, chip manufacturing

Chips and semiconductors are used in many fields, ranging from smartphones to computers, industrial machinery to electrical products, and even to military systems. They pose critical significance to countries for their positions in the global economy and for their national security.

Digitalization accelerates worldwide and demand for advanced chips in health care, finance, and transportation are on rise, and the geopolitically prominent chip competition in the US and China will decide which country gets to have the technological upper-hand in many areas, from military readiness to economic competition.

The US is working to cooperate with Japan and Taiwan to attain superiority in the field, while China aims to lessen foreign dependency and achieve self-sufficiency.

The COVID-19 pandemic and the wars, between Russia and Ukraine, as well as Israel and Palestine, have pushed the boundaries of global supply chains. Consequently, the importance of homegrown production of semiconductors has gained further significance.

‘AI expected to drive significant increase in global semiconductor demand’

Stephen Ezell, vice president of global innovation policy at the Information Technology and Innovation Foundation (ITIF), told Anadolu that the TSMC’s production at its Arizona plant, although successful, is not as advanced as its production in Taiwan.

The TSMC produces its newest state-of-the-art 2-nanometer chips in Taiwan, operating at more advanced process nodes than those found in Arizona.

“None of this diminishes the critical importance of Taiwan in global semiconductor production, particularly of the most advanced semiconductors—Taiwan will remain as crucial as ever to the global semiconductor industry,” said Ezell.

He noted that the global artificial intelligence (AI) sector is estimated to reach $390.9 billion in size next year.

“AI is expected to drive a significant increase in global semiconductor demand, with estimates suggesting a growth rate of around 20% or more due to the surging need for specialized AI chips,” he said.

Highlighting that the chances of a worthy opponent against the Taiwanese, American, and European chipmaking leaders are slim, Ezell stated that despite being a prominent player in the semiconductor sector, China “will not be catching up any time soon.”

“Semiconductors represent the ‘commanding heights’ of the global tech economy and the brains that are driving the global digital revolution,” he said, adding that it’s a high-wage, high-value added industry that will become an ever-more important asset for countries.

‘Since pandemic companies start recognizing how vital semiconductors are to supply chain’

Mario Morales, vice president of enabling technologies and semiconductor at the International Data Corporation (IDC), told Anadolu that the TSMC aims to increase its production capacity in other countries but the firm’s development elements remain in the homeland, and this poses the most important issue.

Morales stated that the recently increasing interest in chips and semiconductors is a long-awaited process, as the world realized after the pandemic that supply chains need to be rebalanced.

“The most advanced process technologies, they’re primarily still in Taiwan and in Korea, so I would say over 95% of the leading edge capacity is still in the Asian region—that had to change because there’s just too much risks associated with the … brewing turbulence between China and Taiwan and China with everybody else too,” he said.

Morales noted that the US and the EU passed laws for chip and semiconductor investments.

“Since the pandemic, (…) companies now start recognizing how vital semiconductors are to the supply chain, so they’re making changes, (…) making investments like the US CHIPS act or the EU Chips act as a way to counter this,” he said.

He added that tech giants like Apple, Google, and Microsoft will also make significant investments, and now geopolitics play a greater role in the semiconductor industry. He said he estimates that two different supply chains will emerge in the future, namely “one that caters to the Western world and the other one that caters to China.”

Taiwan’s vulnerability to China is important strategic task for US

James Lewis, director of strategic technologies program at US-based nonprofit researcher Center for Strategic and International Studies (CSIS), told Anadolu that Taiwan will keep its significance in chip production, “but reducing reliance on chip production in Taiwan, since it is vulnerable to Chinese pressure, is an important strategic task for the US.”

Lewis stated that the global chip demand will rise in the long-term as countries continue their digitalization efforts, and companies such as Samsung, Hynix, Infineon, Arm, and the SMIC will continue to grow, and the current firms in the field will be leaders in 2030.

He noted that countries need to have their homegrown semiconductor industries and they cannot rely on the global market.

“If the US overplays its hand in export bans, there will be short term disruption until American chips can be designed out, a trend the US should to want to accelerate,” he said.

Future of semiconductor production

Pranay Kotasthane, deputy director at India-based research center Takshashila Institution, told Anadolu that the TSMC’s production trend, if it continues in the US, may render Taiwan less important over time.

“Currently, GPUs (graphics processing units) are being used for machine learning applications, but many companies are working on application specific chips that are customized for such workloads—This would require new chip designs and architectures, (and) (t)he need to cramp in more transistors in a given area also means that a lot of focus will shift to innovation in packaging,” he said.

Kotasthane stated that access to semiconductor production will become important in the future, though “it doesn’t need to happen domestically.”

“No country can afford to build and profitably run their own domestic production facilities, (and) Taiwan’s biggest import item is chips even as its biggest export is chips,” he noted.

“Plurilateral cooperation on semiconductors is a necessity and not a choice,” he added.

https://www.aa.com.tr/en/economy/geopolitical-competition-in-chip-semiconductor-production-on-rise/3381759#