Unmanned aerial vehicles (UAV) are remotely piloted aerial vehicles that play a significant role in the defense and commercial sectors. They are commonly termed drones and are mostly known for their wide usage in various military missions such as border surveillance. These vehicles are also used for mapping, surveying, and determining the weather conditions of a specific area.

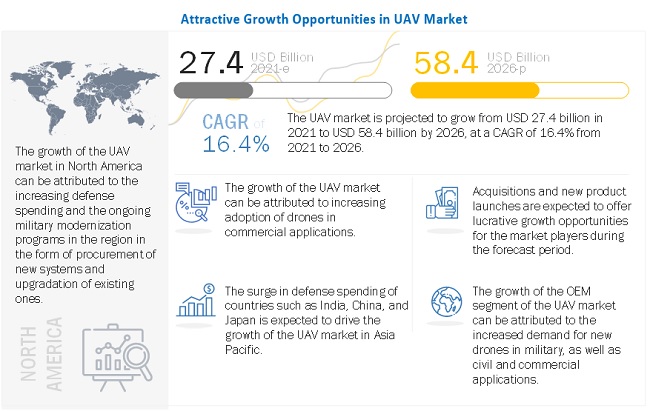

This report covers UAV used in the military, commercial, government & law enforcement, and consumer applications. It also provides information on UAV used in defense & security, agriculture, logistics & transportation, energy & power, construction & mining, media & entertainment, insurance, wildlife & forestry, and academic research. The report covers various UAV systems, including platforms, payloads, ground control stations, data links, and launch & recovery systems. Weapons launched from UAV and systems (weapons carriages and release systems) required for launching them are not considered in this report. The overall UAV (OEM+ aftermarket) is estimated to be USD 27.4 billion in 2021 and is projected to reach USD 58.4 billion by 2026, at a CAGR of 16.4% from 2021 to 2026. North America is projected to account for the largest size of the UAV market from 2021 to 2026.

With the incorporation of new technologies such as artificial intelligence, sense and avoid systems, and cloud computing in UAV, their demand is expected to increase further. The incorporation of artificial intelligence in UAV has not only enhanced their capabilities but has also enabled them to carry out several activities such as takeoff, navigation, data capture, data transmission, and data analysis without human intervention.

To know about the assumptions considered for the study, Request for Free Sample Report

COVID-19 impact on the UAV Market

Prior to the outbreak COVID-19 pandemic, UAVs were widely used by militaries for a variety of missions like border security, while governments and law enforcement agencies used them on an experimental basis. For civil & commercial applications they are being used for the transportation of medical supplies by companies like Zipline and mostly for aerial photography purposes for the entertainment and news industry. The situation has altered drastically post COVID-19. Due to intermittent lockdowns and imposition of social distancing protocols worldwide, there has been halts in production of UAVs due to shortage of raw materials and staff to carry out manufacturing operation in 2020. In 2021 as well, due to reemergence of second wave of infections, the UAV production is hampered and it might need more than six months to get back to pre-Covid 19 production scale or to retain normal functioning of UAV supply chain.

UAV Market Dynamics:

Driver: Risen demand for UAV in military applications

Drones have been employed by military forces of different countries for over a decade. Predator UAV is the most popular one. Compact drones are currently being used by ground forces on a routine basis. Military expenditure for UAV technology is anticipated to grow as a total percentage of military budgets, offering growth opportunities to specialized drone manufacturers and software developers. A primary analysis of the budget request of the Department of Defense for 2019 resulted in the identification of USD 9.39 billion for drone-related procurements, research and development projects, and production. This amount is 26% higher than the amount spent in 2018. There were orders for at least 3,447 new unmanned air, ground, and sea systems in 2019, that is, a threefold rise in the orders of 2018. Approximately 95 countries across the world already have some form of military drones. Various drones are being designed solely for surveillance operations. However, some drones have been designed for critical operations, such as carrying munitions. Countries such as China, India, Germany, and Azerbaijan use remotely piloted UAV designed for carrying munitions for dense forces. Drones are also used as loitering munitions. The loitering munitions are defined as weapons or flying bombs that contain high-resolution cameras and infrared systems for conducting surveillance activities. They hover over the targets, search for the location of targets, and attack them when targets are visible. Drones are also used to gather data about ongoing and life-threatening military missions with the help of their intelligence, surveillance, and reconnaissance (ISR) capabilities on a real-time basis. Some common examples of military drones or UAV are MQ-4 Reaper, MQ-1B Predator, QF-4 Aerial target, RQ-4 Global Hawk, AeroVironment Wasp AE, RQ-1 Predator, BQM-155 Hunter, CL-289 Piver, etc.

Opportunity: Ongoing technological advancements in UAV

Technological advancements in UAV are taking place at a high pace. These advancements are expected to lead to an increased used of drones in a broad variety of sectors, ranging from commercial to military. One key area of innovation is the development of armed UAV. The US has been a leader in terms of the usage of UAV in warfare for a long time. The three major drones being employed presently by the US are the MQ-1 Predator, MQ-1C Sky Warrior, and MQ-9 Reaper, which are powered by General Atomics. The MQ-1 Predator persists to be a commonly used drone by the military of the US presently. Due to its proven track record, the army of the country initiated the development of its version, Gray Eagle. This drone has 1,075 payload capability, 29,000-feet gliding altitude, 25 hours of working time, and a maximum speed of 167 knots. The Army of the US has given a contract to General Atomics to provide continued logistics assistance to this drone series. Both the Predator series and the Gray Eagle have a reasonably elevated operational time and an impressive cruising altitude. They can manage a large array of tasks, varying from exploration activities to search and destroy missions.

Challenge: Instances of use of drones in terror attacks and drug trafficking

UAV, even though a remarkable technology, can be hazardous when it falls into the hands of extremists. They can be used by terrorists to carry out multiple attacks simultaneously, resulting in their amplified effect. They are cost-effective aircraft with simple operations that can easily access difficult terrains, making them a weapon of choice for terrorist organizations. For instance, in January 2018, a swarm of 13 homemade drones struck two Russian military bases in Syria.

As expensive drones used by military forces and governments of various countries are not easily available to the Islamic State in Iraq and the Levante (ISIL) and other violent non-state actors (VNSA), they use components and technologies that are easily available in the consumer market to develop small drones. Though these drones are of the size of a watermelon or a football and can fly only a few miles, they still pose risks to civilians and critical infrastructures. VNSA often transform these small and inexpensive consumer drones into killer bees capable of the significantly damaging and intimidating civilian population and military forces. Apart from threats of terror attacks, North American countries such as the US, Colombia, and Mexico are also witnessing the use of drones for drug smuggling.

UAV Market Ecosystem

The key stakeholders in the UAV market ecosystem are the platform manufacturers, subsystem manufacturers, service providers, software providers, and miscellaneous (insurance companies). The following figure lists some global platform manufacturers, subsystem providers, service providers, and software providers.

To know about the assumptions considered for the study, download the pdf brochure

“The commercial segment of the market is projected to grow at the highest CAGR during the forecast period”

Based on application, the UAV market has been classified into the military, commercial, government & law enforcement, and consumer. For this segment for UAV Market, the military segment of the UAV market is projected to grow from USD 12,760 million in 2021 to USD 19,641 million by 2026, at a CAGR of 9.0% from 2021 to 2026. The commercial segment of the market is projected to grow at the highest CAGR of 28.0% during the forecast period; the growth of this segment can be attributed to the developments and advancements in drone technology.

“The special purpose drones segment of the UAV market is projected to have the largest market share during the forecast period”

Based on function, the UAV market has been segmented into special purpose drones, passenger drones, inspection & monitoring drones, surveying & mapping drones, spraying & seeding drones, air cargo vehicles, and others. Special purpose drones mainly include decoy drones, swarm drones, combat UAV, etc., that are used in military applications. The special purpose drones segment of the UAV market is projected to grow from USD 9,332 million in 2021 to USD 20,548 million in 2026, at a CAGR of 17.1% from 2021 to 2026 and have the largest market share during the forecast period. It is due to rising usage of Special Purpose Drones in military and Combat Operations.

“The OEM segment of the UAV market is projected to have a higher CAGR as compared to Aftermarket segment”

Based on point of sale, the UAV market has been segmented into original equipment manufacturers (OEM) and aftermarket. The aftermarket segment of the market has been classified into maintenance, repair, and overhaul (MRO), replacement, and simulation & training. The OEM segment of the UAV market is projected to have a higher CAGR as compared to Aftermarket segment. The OEM segment of the UAV market is projected to grow from USD 22.7 billion in 2021 to USD 49.0 billion by 2026, at a CAGR of 16.7% from 2021 to 2026. This is due to the fact that most of the assembly and modifications required in UAV are carried out at the OEM level. The aftermarket segment of the market is projected to grow from USD 4.7 billion in 2021 to USD 9.2 billion by 2026, at a CAGR of 14.5% during the forecast period.

“The payload segment of the UAV market is projected to grow at the highest CAGR from 2021 to 2026”

By system, the UAV market has been segmented into platform, payload, data link, ground control station, and launch and recovery system. Each of them performs a different function and ensures UAV’s functioning in different applications. There are many different types of payloads that can be attached to UAVs such as cameras, infrared sensors, thermal sensors, weapons, and radars. The payload segment of the UAV market is projected to grow at the highest CAGR of 17.7 % from 2021 to 2026.

The report discusses in details about six other segments of UAV market as well.

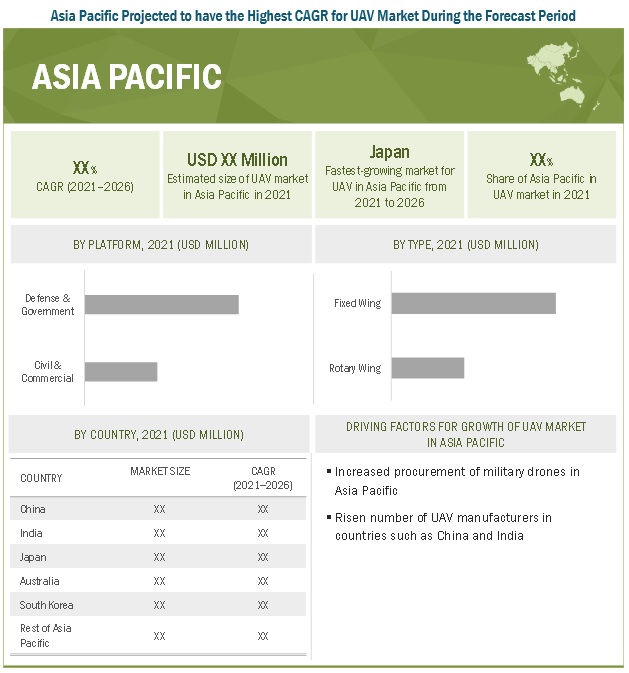

“The UAV market in Asia Pacific is projected to grow at the highest CAGR during the forecast period”

The UAV market in Asia Pacific is projected to grow at the highest CAGR of 18.5% during the forecast period from 2021 to 2026. The growth of the market in this region can be attributed to the increasing demand for UAV from emerging economies such as China and India. China is estimated to lead the UAV market in Asia Pacific in 2021. The UAV market in India is also projected to grow at a significant rate during the forecast period owing to the increasing use of drones in the country for commercial applications.

Major players operating in the UAV market include General Atomics (US), Northrop Grumman Corporation (US), EHang (China), Parrot (France), PrecisionHawk (US), Israel Aerospace Industries Ltd. (Israel), DJI Technology Co., Ltd. (China), AeroVironment, Inc. (US), Lockheed Martin Corporation (US). These key players offer UAVs applicable for Defense & Government and Civil & Commercial sectors and have well-equipped and strong distribution networks across North America, Europe, Asia Pacific, and the Middle East, Latin America, and Africa.

Scope of the Report

|

Report Metric |

Details |

| Market size available for years | 2020-2025 |

| Base year considered | 2020 |

| Forecast period | 2021-2026 |

| Forecast units | Value (USD) |

| Segments covered | By applications, MTOW, Range, mode of operation, systems, functions, point of sale ,platform,type and end user. |

| Geographies covered | North America, Asia Pacific, Europe, and Middle East, Latin America, and Africa |

| Companies covered | General Atomics Aeronautical Systems, Inc. (GA-ASI) (US), Northrop Grumman Corporation (US), Elbit Systems Ltd. (Israel), Israel Aerospace Industries Ltd. (Israel), SZ DJI Technology Co., Ltd. (China), AeroVironment, Inc. (US), Lockheed Martin Corporation (US), Thales Group (France), Aeronautics Ltd. (Israel), etc and several others |

This research report categorizes the UAV Market based on applications, MTOW, Range, mode of operation, systems, functions, point of sale, platform, type, and end user.

UAV Market, By Point Of Sale

- OEM

- Aftermarket

UAV Market, By Systems

- Platform

- Payload

- Datalink

- Ground Control Station

- Uav Launch And Recovery System

UAV Market, By Platform

- Civil & Commerical

- Defense & Government

UAV Market, By Function

- Special Purpose Drones

- Passenger Drones

- Inspection & Monitoring Drones

- Surveying & Mapping Drones

- Spraying & Seeding Drones

- Others

UAV Market, By End-Use

- Military

- Public Safety & Security

- Agriculture

- Insurance

- Energy

- Mining & Quarrying

- O&G

- Transport, Logistics & Warehousing

- Journalism & Media

- Arts, Entertainment & Recreation

- Healthcare & Social Assistance

UAV Market, By Application

- Military

- Commercial

- Government & Law Enforcement

- Consumer

UAV Market, By Type

- Fixed Wing

- Rotary Wing

UAV Market, By Operation Mode

- Remotely Piloted

- Optionally Piloted

- Fully Autonomous

UAV Market, By MTOW

- <25 KG

- 25-170 KG

- >170 KG

UAV Market, By Range

- Visual Line Of Sight

- Extended Visual Line Of Sight

- Beyond Visual Line Of Sight

UAV Market, By Region

- North America

- Europe

- Asia Pacific

- Middle East

- Latin America

- Africa

Recent Developments

- In April 2021, DJI developed a new DJI Air 2S. This compact camera drone is an all-in-one answer for effective flight. It is not only equipped with state-of-the-art cameras but also with high-level-grade preprogrammed substance creation devices.

- In March 2021, Northrop Grumman Corporation signed a deal with the US Navy to prototype and incorporate assimilating sense and avoid (SAA) competencies into its high-altitude, long-endurance MQ-4C Triton autonomous system to enable its secure functioning in shared airspace with manned aircraft.

- In March 2021, EHang collaborated with Giancarlo Zema Design Group to develop an eco-sustainable vertiport in Italy.

- In September 2020, General Atomics Aeronautical Systems, Inc. carried out flight demonstrations of captive carrying SparrowHawk small unmanned aircraft systems (sUAS). The SparrowHawk aircraft is an airborne launch and recovery demonstrator aircraft tailored to suit GA-ASI platforms. It is based on attritableONE technologies of the Advanced Battle Management System.

https://www.marketsandmarkets.com/Market-Reports/unmanned-aerial-vehicles-uav-market-662.html?gclid=CjwKCAjwiLGGBhAqEiwAgq3q_oyH4yDYNEZapGmx2pqyXnsAAgf6t6TmEH_ZbdqQyB7ITog_aXc82xoCFFIQAvD_BwE