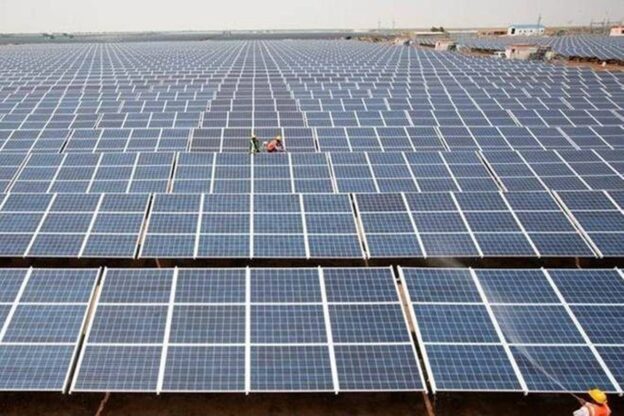

- Gulf countries are preparing to export renewable electricity are a large scale.

- Despite technological readiness, power export ambitions hinge on improved regional interconnections and the creation of functional electricity markets.

- Strong growth in renewables across the UAE, Saudi Arabia, Oman, and Egypt could position the region as a clean power hub.

The energy transition through the perspective of the power sector came into view last week at the annual Middle East Energy conference and exhibition in Dubai.

What appeared was a region ready to think about leveraging its growing array of renewable energy resources to maintain its role as a leading energy exporter. Exports of power from the Gulf’s thriving renewables sector, to countries needing more clean power to meet climate goals, could become an important driver of the region’s economic growth.

Conference participants expressed enthusiasm as well as caution. While the technology is proven, the markets are not quite ready. The Gulf countries themselves will need to greatly enhance intra-regional grid connectivity and market mechanisms before significant international power trading can take off.

Undersea advances

For renewable energy, grids are the highways of the system and international connections require subsea cables. Two projects, seen almost as prototypes, were much discussed in Dubai.

The Abu Dhabi National Oil Company (Adnoc), in a shift from gas-fired to low-carbon power in its operations, is working with Abu Dhabi National Energy Company (Taqa), on high-voltage direct current (HVDC) subsea cables. Two HVDC segments, each more than 130 km, will connect the onshore power grid to two islands in the Gulf, from which power will be distributed to offshore production platforms.

The $3.8 billion project is planned to begin operation this year. It is the first subsea transmission system in the Middle East, with grid power from solar and nuclear sources, according to the companies.

“Once the link is commissioned it will help Adnoc decarbonize more than 30 percent of offshore facilities, allowing them to electrify and reduce a lot of emissions,” said Esam Al Murawwi, Chief Projects Officer, TAQA Transmission.

Rekated: Could Shell or Chevron Make a Move on BP?

Al Murawwi also mentioned a much bigger plan to move power undersea.

“We are a major investor in Xlinks, a link between Morocco and the UK, with renewable generation in Morocco to support the UK’s demand for clean power,” he said.

“When commissioned, it will be the largest HVDC in the world with 4000 km of subsea cables.”

Xlinks, led by a high profile board of power sector veterans, has investors including TAQA, Total Energies, Octopus, GE Vernova, and others for its flagship Morocco-UK Power Project.

According to plan, it will build an enormous solar, wind and battery facility in Tan-Tan province, Morocco to begin supplying energy in the 2030s, connecting to the British national grid at the Devon coast. Once complete, it will supply 3.6GW, approximately 8% of the UK’s current electricity needs, according to the company.

The project, which will boost Britain’s effort toward its national renewable energy targets, was named a ‘project of national significance’ by the UK’s energy secretary in 2023. Still, government approval is pending and the project has stalled despite significant financial backing. There has been recent talk of shifting the connection to Germany but Xlinks says it remains committed to the UK for now.

Surveys have been completed with cables to be installed below the seabed. Anticipated transmission losses from the long cables will be relatively high at 13 percent, but the project will benefit from climatic variation that makes power from Morocco available at higher prices when the UK lacks solar and wind power.

Frank Wouters, director of MED-GEM network, an EU-funded initiative to support clean energy development in the southern Mediterranean area, says the project is technically feasible.

“Of course you don’t want to lose anything but at the same time, if the power source is so cheap, it won’t break the business case, the losses are not determining,” says Wouters.

“It’s not so much a technical issue because the production in Morocco is low cost,” he says. “It has been more a market issue, when the European market was not ready, when Europe’s electricity markets were not yet open.”

Connecting countries

That situation is changing. Other long-distance undersea power connections are now in consideration, including a Saudi Arabia-India connector. But Gulf countries may find more potential westward.

A long-planned HVDC interconnection between Egypt and Saudi Arabia is expected to begin operating this year, facilitating the exchange of up to 3GW of power. Meanwhile Egypt is part of planning for international power connections across the Mediterranean.

The Master Plan of Mediterranean Interconnections (2022), developed in collaboration among 22 Transmission System Operators in the region, shows a robust network of subsea connections with 19 proposed projects. Of these, Spain-Morocco, Italy-Tunisia, and Israel-Cyprus-Greece, are under development. Other projects in planning include Cyprus-Egypt, and Egypt-Greece.

Should these projects move forward, they will create connections for Gulf countries to reach the eastern Mediterranean, opening the way to export renewable power to Europe. Electricity cables connecting Egypt-Cyprus-Greece and possibly Israel-Cyprus -Greece would forge links between the GCC, Eastern Mediterranean, and EU systems.

Such a scenario is made more feasible with the ongoing rise of renewable power in Egypt, Saudi Arabia, the UAE, and Oman. These countries are making significant strides in 24/7 renewable power with utility-scale battery energy storage systems, embracing ongoing advances in batteries, transformers and other hardware required to support large shares of renewable power.

In the UAE, the expansion of solar power and nuclear energy pushed the share of power generated by low-emissions sources to 35 percent last year according to the IEA’s Electricity 2025 report. The country now has four huge solar power plants and a large nuclear plant displacing thermal generation, which is down by almost 8 percent annually, according to the IEA report.

Saudi Arabia is catching up. The country now targets 50 percent of its power from renewable energy by 2030, the most ambitious among Gulf Cooperation Council (GCC) countries. Its renewable capacity, expected to be 12.7 GW this year, would reach 130 GW, or half of its electricity generation, a mix of solar and wind power by 2030. The country’s National Renewable Energy Program last year included 3.7 GW of solar PV projects, with all bids below $.02/kWh.

Oman and even Qatar are also making important strides. But for carbon-free energy to find export markets, the GCC countries will need to create new market structures that facilitate trade.

Missing market

For now the Gulf countries, working through the GCC Interconnection Authority (GCCIA), are building new connections to power-starved Kuwait and Iraq. They are also, like most countries, facing increasing domestic demand for electric power.

Before they become big power exporters to other regions they will likely need to strengthen their own intra-regional connections and create a functioning regional power market.

An insightful recent analysis discusses the shortcomings in the region’s current electricity trade, which does not run on a market basis.

Robin Mills, head of Qamar Energy in Dubai, writes that exports of power from the Gulf countries’ thriving renewables and battery sector could drive sustainable economic development, but restrained grid interconnectivity with neighbors means that electricity trade in the GCC and with Iraq, Egypt, and Jordan falls far short of potential.

His essay, The Reach of the GCC’s Booming Renewables Sector Exceeds Grasp, was published last month by The Arab Gulf States Institute in Washington (AGSIW).

Mills makes the point that the GCCIA’s system does not systematically move large quantities of electricity from lower-cost to high cost areas. Only one GCC country, Oman, has a domestic power market that allows trading.

What’s missing is a regional market. He writes:

“GCC electricity trade in 2021 amounted to only about 0.15 percent of the total generation, while in the much more integrated European Union market, it is about 5%… Unlike the closely integrated power market in Europe…there are no real-time price signals for electricity to flow from one country to another.”

Getting power trade going on a market basis, with financially settled transactions, requires connections and market infrastructure that do not currently exist. He concludes that the GCC, with its impressive adoption of renewables and batteries, now needs to shift to a more ‘strategic perspective’.

Looking ahead

There’s no doubt that the GCC linked to Egypt, Jordan and Iraq, with an open traded power market (spot, term, intraday, balancing), would enjoy all the advantages of risk hedging with major cost savings. This in turn would support long-distance power connections linking systems of the GCC, the Eastern Mediterranean and other regions.

The outlook was decidedly upbeat in Dubai last week as speakers reflected on the technological advances, the remarkable rise of renewables, and ongoing planning to interconnect countries and regions.

The motivating factor for growing this renewable power potential was stated by Dr. Adnan Alhosani, Director of Electricity & Energy Trade at the UAE’s Ministry of Energy and Infrastructure.

He referenced a well known statement by Sheikh Mohamed bin Zayed Al Nahyan, President of the United Arab Emirates and Ruler of Abu Dhabi.

Looking 50 years into the future, Sheikh Mohamed expressed his aspiration for the United Arab Emirates to “celebrate the last barrel of oil.”

A lot more renewable power, together with transmission systems and markets to move it, will be needed to reach that goal.

https://oilprice.com/Alternative-Energy/Renewable-Energy/Middle-East-Eyes-Clean-Energy-Trade-But-Markets-Lag-Behind.amp.html