Nvidia Surges Past Microsoft to Lead Global Tech Valuations on AI Momentum

- Nvidia is now the world’s most valuable company at $3.44 trillion, surpassing Microsoft.

- A 50% stock rally since April has been driven by strong AI demand and upbeat earnings.

- Nvidia’s Blackwell servers are now shipping to Big Tech clients, reinforcing its market dominance.

- CEO Jensen Huang is steering the company toward sovereign AI as its next major focus.

Nvidia has officially reclaimed its title as the world’s most valuable company, with its market capitalization hitting an astonishing $3.44 trillion. This surge puts the chipmaker ahead of Microsoft, which now holds a slightly lower valuation of $3.441 trillion.

The milestone reflects a powerful rally in Nvidia’s stock, fueled by strong earnings, relentless demand for artificial intelligence hardware, and investor belief in the company’s long-term strategy.

AI boom fuels relentless Nvidia rally

Nvidia’s share price has risen dramatically since early April when it dipped just above $94. Since then, the stock has gained roughly 50 percent, adding over $1 trillion in market value. This rally has been propelled by bullish sentiment surrounding AI, a technology space that Nvidia dominates through its cutting-edge chips and server platforms.

The company’s strong quarterly earnings, reported on May 28, played a key role in solidifying investor confidence. Despite losing significant revenue from China due to export restrictions, Nvidia showed it could offset those losses through broader global demand and strategic partnerships.

Nvidia Blackwell Platform Attracts Big Tech

Nvidia’s latest performance confirms its central role in powering the AI ambitions of major tech giants. Its Blackwell AI server platform, which had faced early supply chain bottlenecks, is now reaching customers at scale. Microsoft, one of Nvidia’s top clients, has already started integrating Blackwell systems into its own AI infrastructure. Meanwhile, Nvidia’s chip manufacturing partner TSMC reaffirmed robust demand for AI chips this week, reinforcing the narrative that the current AI cycle has significant legs.

The enthusiasm surrounding Nvidia has extended beyond institutional circles. Retail investors have expressed strong optimism across platforms like Stocktwits, where bullish sentiment around the stock remains high. Some analysts now forecast Nvidia’s stock could climb above $170 in the coming year, while others see a path toward $400 based on its AI leadership and market momentum.

Microsoft and Apple struggle to keep pace

Microsoft briefly held the market cap crown in May but has since been overtaken as Nvidia’s rally gained momentum. Apple, once a consistent frontrunner, has seen its market value decline in 2025 by nearly 19 percent. The iPhone maker faces increasing competition in AI innovation and uncertainty over new tariffs that could affect its hardware imports. These factors have made Nvidia’s rise all the more remarkable, given the headwinds facing its peers.

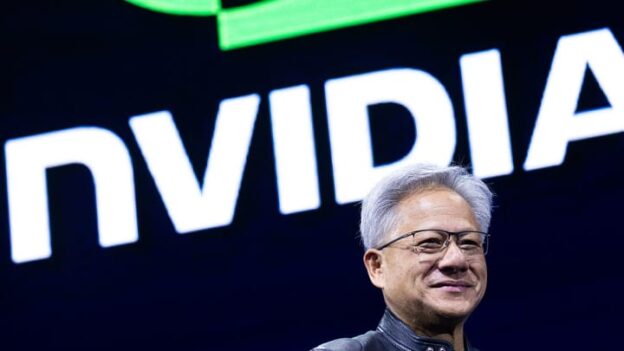

Nvidia’s recent surge also marks a return to positive territory for the year, with shares now up over five percent in 2025. That figure lags slightly behind Microsoft but significantly outpaces Apple’s performance. As Nvidia continues to gain ground, CEO Jensen Huang has pointed to “sovereign AI”, customized AI models built by and for governments ,as the company’s next major area of focus, further broadening its already dominant portfolio.

NVIDIA Corporation (NVDA) Stock; Firm Reclaims Global Market Cap Crown with $3.44 Trillion Valuation