MUMBAI: Blackstone and its co-investors in Mphasis are in talks with a consortium of 13 banks to raise up to $1.1 billion, or about Rs 8,200 crore, to part-finance buyout of the Bengaluru-based technology firm, three people familiar with the matter said.

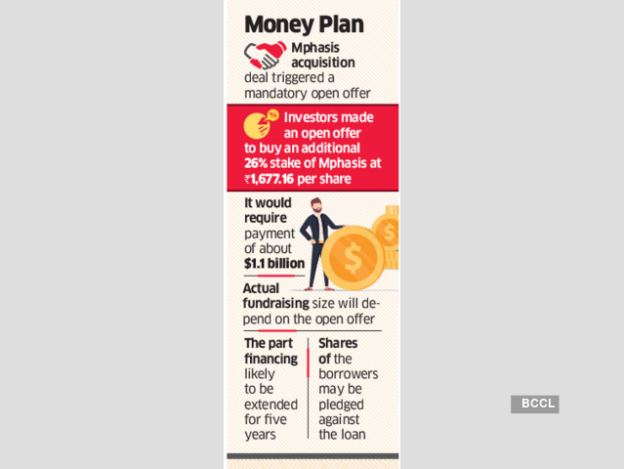

The short-term credit facility could be extended up to five years and is likely to have shares and some form of assurance or commitment from borrowers, they told ET.

The US private equity firm’s co-investors include Abu Dhabi Investment Authority (ADIA), GIC (formerly Government of Singapore Investment Corp) and University of California Investments (UC Investments).

Banks they are in talks include Citigroup, Barclays, Deutsche Bank, DBS, Morgan Stanley, HSBC, UBS, Standard Chartered, MUFG, SMBC, Investec and BNP, the sources said.

Three funds of the US private equity firm – Blackstone Capital Partners VIII, Blackstone Capital Partners Asia NQ LP and BCP Topco IX Pte Ltd – had signed a deal to acquire 55.31% stake of Mphasis for Rs 15,216.9 crore, or about $2 billion, from older fund Blackstone Capital Partners VI.

Funds owned by ADIA, UC Investments (office of the chief investment officer of The Regents, University of California) and others will co-invest, Blackstone had said in April.

The deal had also triggered a mandatory open offer as per stock market regulator Sebi’s guidelines.

Accordingly, the investors had made an open offer to buy an additional 26% stake of Mphasis at Rs 1,677.16 per share. They mandated JM Financial to carry out the open offer that would requirepayment of Rs 8,262.23 crore, or about $1.1 billion, for 26% stake.

But Mphasis share price has soared since then, pushing up the acquisition cost significantly.

The stock closed at Rs 2,365.75 on the BSE on Tuesday, up more than 1% from the previous close. Stock markets remained closed on Wednesday on account of Bakri Eid.

Blackstone, ADIA and UC Investments declined to comment while GIC did not respond to ET’s query as of press time Wednesday.

Individual banks could not be immediately contacted for comments.

Private equity firms use the commitment of capital by its limited partners or investors to its funds as collateral to secure a line of credit that they can use as needed.

Traditionally, when a PE firm sees an investment opportunity, it calls on the capital committed by its investors and uses this to acquire the company. However, in certain circumstances, the funds will have to write cheques faster, the people cited earlier said.

“In such situations, funds will make a bridge loan facility which is dually secured – that happened in the case of Mphasis,” one of the sources said.

“In this case, shares in Mphasis have moved up way higher to its open offer price and thus, banks will be in a much comfortable position to offer a financing deal.”

Blackstone and co-investors will jointly hold up to 75% stake in Mphasis, the US fund had said in April.

Blackstone bought Mphasis in April 2016 when it acquired a 60% stake from Hewlett Packard for around $800 million. The PE firm made a partial exit in May 2018, selling nearly 8% stake through secondary block deals, taking a 2x return within a span of two years.

Late last year, Blackstone had hired JP Morgan to run a process to sell its controlling stake in Mphasis, but was unsuccessful. Later, the New York-headquartered investor decided to shift the ownership from an older fund to newer ones.

Private equity firms do such transfers from older funds to newer funds to hold on to some shares, because PE funds have a fixed lifespan within which investors’ capital has to be returned.

https://m.economictimes.com/markets/stocks/news/blackstone-adia-uc-and-gic-in-talks-to-raise-1-1-bn-loan-for-mphasis/amp_articleshow/84617018.cms