The electricity transmission infrastructure firm, part of Agarwal’s Vedanta group, has selected Axis Bank Ltd., ICICI Securities Ltd. and JM Financial Ltd. to work on the first-time share sale, the people said.

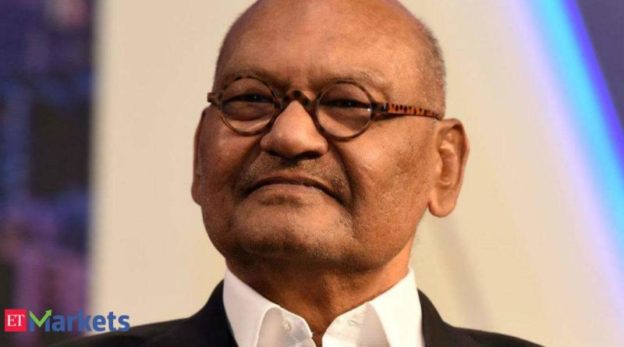

Sterlite Power Transmission Ltd., controlled by Indian billionaire Anil Agarwal, has picked banks for its planned initial public offering in Mumbai, according to people with knowledge of the matter.

The electricity transmission infrastructure firm, part of Agarwal’s Vedanta group, has selected Axis Bank Ltd., ICICI Securities Ltd. and JM Financial Ltd. to work on the first-time share sale, the people said. The company plans to raise about 30 billion rupees ($403 million) by around March, they said, asking not to be identified as the details are private.

The company could file a prospectus as soon as September, they added. The IPO will mainly consist of new shares, and more bankers may be added as plans progress, one of the people said.

Deliberations are ongoing and details of the listing such as size and timing could change, the people said. Representatives for Axis Capital, JM Financial and Sterlite Power declined to comment, while ICICI did not immediately respond to requests for comment.

A unit of Sterlite Technologies Ltd. until 2016, Sterlite Power has a portfolio of infrastructure projects of about 13,700 circuit kilometers and 26,100 megavolt ampere in India and Brazil, according to its 2019-2020 annual report.

Sterlite Power is a sponsor of India Grid Trust, also known as IndiGrid, an infrastructure investment trust that raised $331 million in an IPO in 2017. Sterlite Power sold the majority of its 15 per cent stake in IndiGrid last year to a group of institutional and high net worth investors, though it remains a sponsor of the trust and holds a 26 per cent stake in its investment manager, according to its latest investor presentation.

https://cfo.economictimes.indiatimes.com/news/billionaire-anil-agarwals-sterlite-power-hires-banks-for-403-mn-ipo/84995699