India’s startup domain is poised to gain further momentum after the unprecedented funding boom created 20 unicorns, or private firms valued at $1 billion or more, this year.

By 2025, the Indian startup ecosystem is set to witness three-fold growth in valuation and a substantial rise in the number of Unicorns, which currently stands at 59, according to a report by early-stage venture capital fund 3one4 Capital.

Founded by Pranav Pai and Siddharth Pai, the fund has invested in startups like micro-blogging site Koo, short video social platform Mitron and Neobanks such as Open and Jupiter among others.

The number of startups will jump to 100,000 in 2025 from about 55,000 currently, the report said. They will attract investment of a whopping $100 billion between 2021 and 2025, employ 3.25 million people and become the second-largest ecosystem in the world after the United States, it said, adding that India will be home to over 150 Unicorns.

150 Unicorns.

The report envisages the valuation of the startup space to leapfrog from the current $315 billion to $1 trillion by 2025.

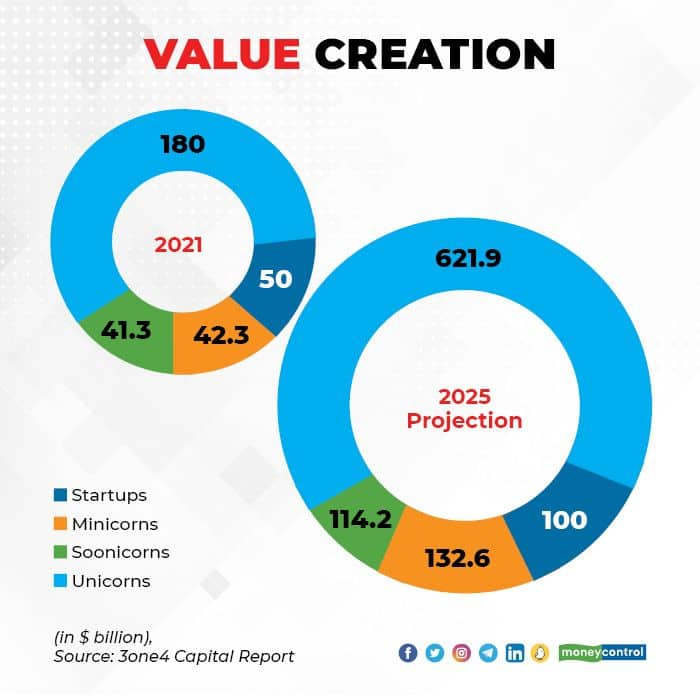

As of today, India’s Unicorns have created $180 billion in value. By 2025, this number is set to grow to $ 621.9 billion. Soonicorns, or potential unicorns, are likely to be valued at $114.2 billion in 2025 from the current $ 41.3 billion. Startups too will see a two-fold growth from the current valuation of $ 50 billion to $ 100 billion by 2025, the report adds.

In the pandemic-stricken year of 2020 Indian startups managed to raise $11.5 billion through 924 deals, over half of them being executed in Bengaluru and New Delhi. In fact, Bengaluru alone saw 45 per cent of the total deal value between 2017 and 2020.

https://www.moneycontrol.com/news/business/ipo/rolex-rings-shares-close-with-30-premium-in-debut-trade-7299141.html/amp