UK’s Vodafone Plc and Aditya Birla Group are considering all options, including putting in some fresh equity into Vodafone Idea (Vi), to further build on the recent relief package and signal to potential global investors that the telco’s future is

UK’s Vodafone Plc and Aditya Birla Group are considering all options, including putting in some fresh equity into Vodafone Idea (Vi), to further build on the recent relief package and signal to potential global investors that the telco’s future is secure.

Sources close to ABG said no decision has been taken yet, but “the pros and cons of a fresh capital infusion are back on the discussion table”. This is since the telco’s battery of lenders and prospective overseas investors want Vi’s co-promoters to inject some capital quickly to demonstrate their keenness to revive the telco and consolidate the gains after the government moved to provide financial relief.

Vi’s co-promoters, in fact, are believed to have committed to the government that they will take all necessary steps to ensure Vi is revived. Till date, they had stuck to their stance not to put in any fresh equity in the loss-making telco. Vodafone Plc owns 44.39% in Vi while ABG holds 27.66%.

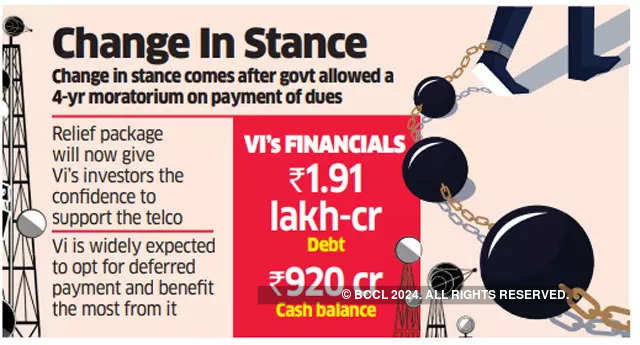

The possible change in stance of Vi’s promoters comes after the government allowed a four-year moratorium on adjusted gross revenue (AGR) and spectrum payouts, which is estimated to give Vi a shade over ₹1 lakh-crore in potential cash flow relief. Weighed down by ₹1.91 lakh-crore of debt and with a cash balance of just ₹920 crore, Vi is widely expected to opt for the deferred payment and benefit the most from it. The government has also recently introduced a bill to scrap the retrospective tax amendment that was introduced back in 2012, which could end the decade-old tax dispute between UK’s Vodafone Group and the Indian government. Spokespersons for Vi, Vodafone Plc and the Aditya Birla Group did not reply to ET queries till press time.

Apart from potential investors, Vi’s lenders are also pushing the telco’s promoters to put in funds, which could trigger other investors to also pump in capital. Lenders want the cash-strapped telco to be prepared to start clearing its upcoming financial dues, starting December. Brokerage Kotak Securities estimates Vi’s total borrowings at ₹23,400 crore and its annual payout towards interest on bank loans at ₹2,600 crore. Further, the telco is staring at a ₹6,000 crore payout towards redemption of non-convertible debentures, also starting December.

“It’s time Vi’s promoters infuse some capital and signal their intent to rebuild the company to complement the relief package…such a move would also give potential overseas PE investors the confidence to participate and close Vi’s long pending fundraise that would also help it clear its upcoming financial dues,” a person close to a prospective US private equity investor told ET.

A senior banker with one of Vi’s lenders backed the view, saying “the government had done its bit, and it’s now time for the company’s promoters to bring in new equity and demonstrate their own confidence in the telco”.

https://cfo.economictimes.indiatimes.com/news/vodafone-aditya-birla-group-may-put-fresh-equity-into-vodafone-idea/86416469