Ease of Doing Business for MSMEs: One does not need much effort to observe that all unicorns or high-value startups are hyper-focused on technology — the lack of which is a major demerit for MSMEs.

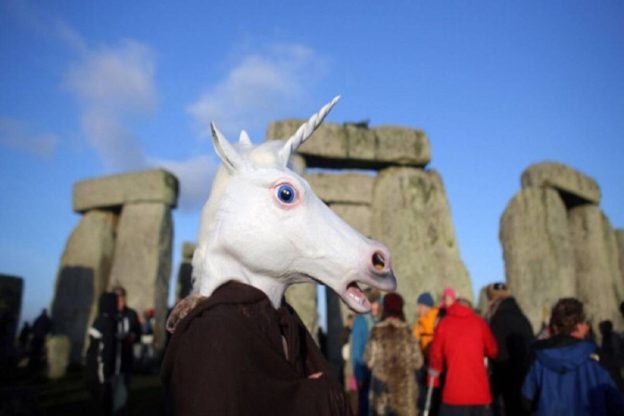

Ease of Doing Business for MSMEs: At this very moment, our country is forging ahead with around 70 unicorns. A unicorn is basically a startup that reaches a valuation of $1 billion. These companies together cover a broad range of sectors including but not limited to e-commerce, fintech, information technology, and edtech. More than half of these startups have attained this illustrious status in the last two years. Clearly, this is a precursor to the significant increase in the economic activity of the country and the evolution of newer markets.

At the other end of the spectrum lies the Micro, Small & Medium Enterprises (MSMEs). These are enterprises from the manufacturing and services industry with investment and turnover up to the prescribed limits. Although these were first highlighted in the Micro, Small, and Medium Enterprises Development (MSMED) Act in 2006, the government continues to focus on their promotion and enhancing the competitiveness of this sector. The objective of this piece is to discuss and explore the possibilities of whether MSMEs can be transformed into future unicorns by enquiring into some key differences between them.

The most visible difference between a valuable startup and an MSME is the people who govern these entities. While unicorns typically portray examples of highly qualified risk-taking individuals running the show, MSMEs are often run by people with limited knowledge who lack the means to realise their vision. This fundamentally creates a stark difference in consideration of an entity as a high-value business that is attractive enough for private equity funds to hold some stake.

One does not need much effort to observe that all unicorns or high-value startups are hyper-focused on technology — the lack of which is a major demerit for MSMEs. It is only through leveraging technology that a business can expect to constantly achieve multifold growth in revenue year on year. Unicorns like Urban Company, PharmEasy, and PolicyBazaar have demonstrated that it is possible to add significant value by building scalable business models revolving around activities that exist in traditional markets. Moreover, tools like data science, automation, and behavioral analytics allow to bring in efficiencies to businesses. MSMEs, most of which are focused on manufacturing, end up being a node in the supply chain and offering a solution to startups without gaining much.

The third difference is essentially the strategy and innovation through which present-day unicorns are on their way to tap significant market share in their industry. It is only through constant idea generation and problem-solving methodology that one can achieve a high-value sustainable model. On the contrary, MSMEs are run in a traditional manner with a limited scope of growth.

Modern-day startups offer these merits which in turn become a value proposition to investors thus gaining their interest in terms of medium to long-term growth potential.

But there are a few differences that make it difficult to compare unicorns and MSMEs on a similar yardstick. One of these is the fact that most unicorns provide services by utilising the potential of MSMEs. E-commerce platforms like Flipkart, Snapdeal, ShopClues, and PayTM Mall offer products manufactured by MSMEs such as handicrafts, textiles, cosmetics, food items, etc. This poses the argument that startups and MSMEs coexist in economic equilibrium.

The government has been at the forefront to promote the development of MSMEs through various schemes. Financial inclusion and access to cheap credit have been the greatest challenge so far even as initiatives like Udyam Registration, Loan in 59 Minutes, Mudra loans, and Credit Guarantee Fund Scheme have been empowering MSMEs to access capital. But, it is imperative that public policy should not promote industrialisation through foreign interference at the cost of MSMEs that contribute about 30 per cent to the country’s gross domestic product. This shall truly imbibe the ambition of building Atmanirbhar Bharat. Furthermore, it is felt that public schemes should be promoted at the district level using a dedicated task force so as to increase penetration and effect change to a greater extent.

Subscribe to Financial Express SME newsletter now: Your weekly dose of news, views, and updates from the world of micro, small, and medium enterprises

Incubation of MSMEs is also necessary so that potential high-value entities can get a launchpad instead of always struggling to be financially healthy. The government can initiate one such programme in joint participation with private equity venture capital funds to adopt few MSMEs and provide them support.

A number of indigenous MSMEs produce goods and services that have supply limited to local geography only. These include food and food processing-related goods, ayurvedic medicines and supplements, handicrafts, etc. There is potential for creating markets for such products, both in and outside India. Initiatives like GeM (Government e-Marketplace) portal are a step in the right direction. This can fulfill the objective of demand discovery and the creation of new markets.

It is not late for us to realise that MSMEs hold the future to become the most valuable ventures in the country. The sector requires the right nurturing and attention for its growth. If the challenges faced by MSMEs are addressed in the right manner, India can soon witness a thousand unicorns raising the bar in India’s pursuit to become a developed economy.

https://www.financialexpress.com/industry/sme/cafe-sme/msme-eodb-unicorns-can-msmes-turn-themselves-around-to-become-billion-dollar-businesses-in-india/2351098/