As the world slowly takes the non-fossil, giants Reliance and Saudi Aramco could join hands.

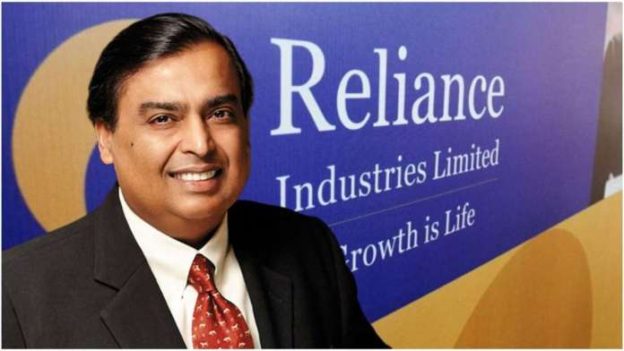

The decision to “re-evaluate” the deal between Reliance Industries and Saudi Aramco was not met with complete surprise. One just has to go back in time by two years when Mukesh Ambani, Reliance’s Chairman, first announced the transaction quite grandly to his shareholders. If it had gone through, it would have seen a fund infusion of a massive $15 billion by Aramco in Reliance’s O2C (oil-to-chemicals) business for a 20 per cent stake. It would have increased Aramco’s sales of crude to India. For Reliance, a steady supply of oil to its refinery was assured plus a shareholding in Aramco.

A possibility emerging of the two collaborating in areas related to green energy could well play out. It is a theme that gets anyone in the business excited. A slew of new technologies are at various stages of evolution and some big money can easily alter the script to make it quite unrecognisable. With scale, a lot of technology that looks expensive and largely distant can become accessible. It is scale that is key to success here and with two players of consequence joining hands, affordability can be achieved.

Deven Choksey, MD, KR Choksey Securities, sees the two partners drop a sunset business to instead look at one that is sunrise. “The decision to not go ahead is in the current context. Green energy is the reality of the future and the two are looking ahead and not at the past,” he says. His view is strengthened by the fact by what Aramco has said publicly. “If you look at it from their point of view, the oil business is not the future. They are looking at the materials business and have already announced the intention of becoming the largest supplier of green hydrogen fuels.”

As one witnesses the scenario playing out, Reliance will be a highly diversified company. “It will have renewables, hydrogen and Jio with 5G technology making it quite formidable,” thinks Vinod Nair, Head of Research, Geojit Financial. It is still early days for them in renewable energy and the announcement to put in $10 billion has been made. Much of this will go into manufacturing, a segment where India needs to cover a lot of ground. How much longer Aramco will wait is a point of debate. There are people who believe it could still make a significant move in the India story and a potential deal is the buyout of state-owned BPCL.

https://www.businesstoday.in/amp/latest/corporate/story/reliance-aramco-may-script-a-renewable-energy-story-313179-2021-11-24