Global investors including Blackstone, BlackRock, Abu Dhabi Investment Authority, Govt of Singapore Investment Corp and Capital International are understood to have held preliminary discussions regarding anchor book allocations in the proposed initial public offering of Life Insurance Corp (LIC) of India, government and banking officials told ET.

Canadian pension managers such as CPPIB and CDPQ, California University Endowment, Brookfield and Kuwait Investment Authority are among the other funds with which meetings are going to be held this week and early next week, they said. The 10 investment banks managing the issue are reaching out to as many as 100 top global fund managers, sovereign and pension money managers and private equity funds. The share sale will likely value the insurance giant at around $110 billion, said people with knowledge of the matter.

The government has hired Goldman Sachs, JP Morgan, Citigroup, Nomura, Bank of America Securities, JM Financial, SBI Caps, Kotak Mahindra Capital, ICICI Securities and Axis Capital to manage the share sale.

“The anchor allocation negotiations are going on. We are seeing good response and approaches were made with only quality institutions,” said one of the people cited above.

The government is looking to offload up to 10% of its stake through the IPO as well as primary issuance of new shares for expansion of the insurer. Although bankers are yet to give a full confirmation on valuation, the finance ministry is expecting Rs 10-12 lakh crore, which will result in mobilising at least Rs 1 lakh crore for the government.

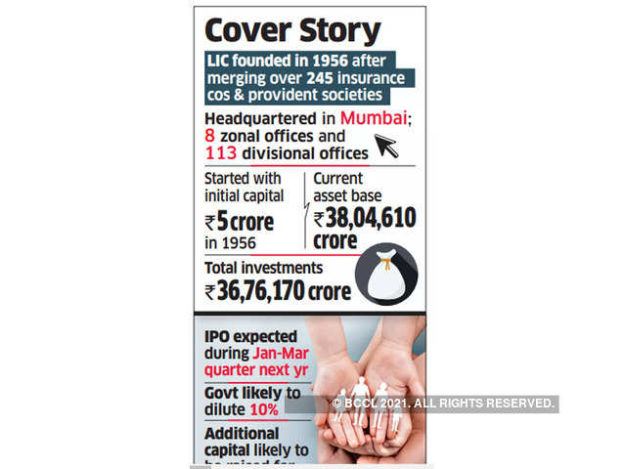

The Department of Investment and Public Asset Management (DIPAM) expects to launch the LIC IPO in the January-March quarter.

“On LIC IPO, we are working very hard. For the capital market, it will be a very big event in the first quarter of 2022,” DIPAM secretary Tuhin Kanta Pandey said earlier this month. The IPO is considered crucial to meet the government’s disinvestment target of Rs 1.75 lakh crore for FY22.

Starting with an initial capital of Rs 5 crore in 1956, LIC’s asset base crossed Rs 38 lakh crore with total investments of Rs 36.8 lakh crore and a life fund of Rs 34.4 lakh crore at the end of March, it said two months ago. In the year ended March 2020, total assets were at just under Rs 32 lakh crore, total investments at Rs 30.7 lakh crore and its life fund at Rs 31.1 lakh crore.

“There is also a portion (of the IPO) which will be kept for policyholders,” chairman MR Kumar had told ET in November. “For the first time, customers will also have a part of shares reserved for them. There are 60 million demat accounts in the country and we have 250 million customers. So the LIC IPO has the potential to expand the entire capital market – if three-four new customers come and open a demat just for the LIC IPO, he will not stop at only LIC.”

Emkay Global head of investment banking Yatin Singh said, “LIC is a contra investor-their profitability in the past two years is excellent. It will be an attractive bet with a rational pricing.”

https://m.economictimes.com/markets/ipos/fpos/global-investors-queue-up-for-lic-ipo-anchor-book/amp_articleshow/87920290.cms