Indian e-waste recycling companies are at the forefront of sustainability, with their active innovation and expansion plans to meet the country’s lofty green targets

India averages over three million tonne of e-waste annually out of the global figure hovering at 50 million tonne, as per Global E-Waste Monitor, a programme supported by United Nations Univeristy, United Nations Institute for Training and Research and International Telecommunication Union. It further states the global e-waste in 2021 could reach 57.4 million tonne.

In India, as of 2019, there were 312 formal authorised recyclers to process this e-waste. However, this number constitutes less than 5% of the overall e-waste recyclers in the country. Around 95% of the sector is still unorganised and this leaves over 75% of the e-waste generated unprocessed.

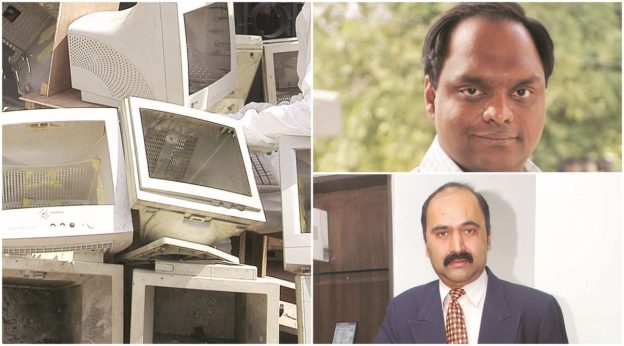

A few Indian companies are now organising the sector and making the best use of the opportunity to generate revenue from waste while feeding back recycled materials into the country’s supply chains. Cerebra Integrated Technologies, one of the oldest and the biggest players in the e-waste recycling space in the country, has been an early adopter of Extended Producer’s Responsibility (EPR) programme, wherein it partners with electrical and electronic brands and IT/ITeS players to extract metals from the e-waste generated by them and put it back into the industry for new use.

“EPR is one of the several revenue streams associated with the business. The other stream with respect to procurement from corporations who are large consumers of electronics, is directly sending a quote to them to procure e-waste on a unit weight basis and give destruction certificate to the procurement. We then extract everything, including plastic, leaving nothing out to the environment,” says V Ranganathan, MD, Cerebra Integrated Technologies.

Cerebra also refurbishes e-waste that need not be destroyed. It has 33 experience centres to sell the refurbished products. Then, the company partners and converts the waste pickers as collection agents and procures e-waste via them. “This is also recognised by the city corporations across India currently but we need more participation from the government,” he says.

Further, Cerebra partners with manufacturers to get only the reusable parts. “Apple, for the first time, is working with us on a couple of products from their line to implement this plan,” says Ranganathan. The publicly listed recycler also sends back metals to core engineering industries to make wires and sheets.

In line with this, the company has been expanding its Karnataka plant with a country-wide collection network. “While we are aiming to diversify our waste pickup points, ultimately directly getting e-waste from the general public, we are also planning to set up plants in Mumbai and Delhi which will reduce pollution due to logistics,” says Ranganathan. “With our software, we can trace exactly where an e-waste item was picked up and where it will be sent after recycling,” says Ranganathan.

Cerebra processes around 96,000 tonne of e-waste, the largest in the country, with aims to expand to other countries.

What e-waste recyclers essentially do is urban mining, most importantly of rare earth elements. Attero, a Noida-based recycler has been able to contribute to India’s Cobalt needs, preventing new imports and fresh mining. It boasts of being the only company in India to recycle lithium ion batteries to extract 99% cobalt and lithium carbonate of pharmaceutical grade and give it back to the supply chain in addition to other metals and compounds, reducing the dependence on imports. The company has been granted 20 patents in the US and Europe on the lithium ion battery recycling technologies.

“India is also a major importer of tin ingots. Just by recycling electronic waste, we will make India a net exporter of tin ingots in 2021,” says Nitin Gupta, CEO and co-founder, Attero Recycling. It has garnered investor attention, raising $30 million to fund its operation and set up its plant.

The waste recycling industry, however, faces several challenges. “First, there is a huge gap between the volume of e-waste generated and that recycled. Then, we need strong enforcement of existing laws and guidelines,” says Ranganathan.

With most of the general public not being aware of the consequences of improper e-waste disposal, there is a strong need for a nationwide programme to educate consumers of electronics. “The problem of awareness, the behavioural change is as difficult as organising the unorganised workers in the sector. There is technology, talent and investment but not enough awareness,” says Ranganathan.

https://www.financialexpress.com/industry/technology/e-waste-recycling-mountains-of-e-waste-mountains-of-opportunities/2399293/