Global clean energy investment surged to new record levels in 2021, shaking off the effects of the Covid-19 pandemic to record more than A$1 trillion in investment for the first time.

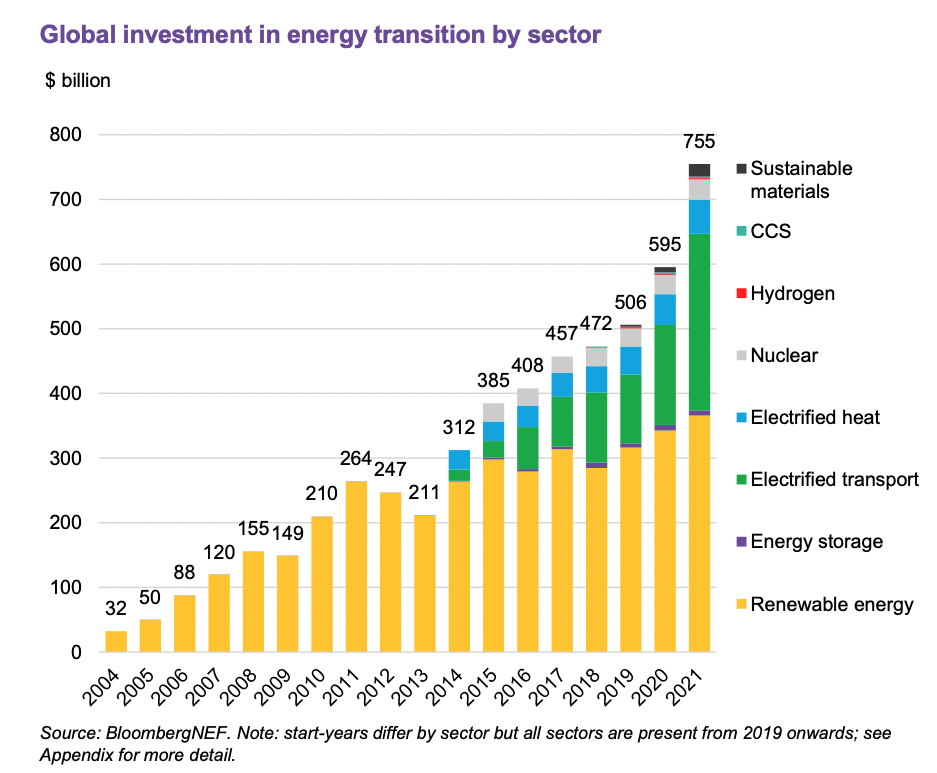

The latest Energy Transition Investment Trends report published by research group BloombergNEF says investment in low and zero emissions technologies topped US$755 billion (A$1.07 trillion) in 2021, recording an increase of 27 per cent from 2020 levels.

The analyst firm says the surge was underpinned by continued strong investment in the Asia Pacific region, which received almost half of all investment at $368 billion, as well as the continued rise of electric vehicles.

Investment in renewable energy capacity set a new record in 2021, with wind, solar and other renewables attracting US$366 billion in new finance, representing growth of 6.5 per cent from the previous year.

Meanwhile, investment in electric vehicles also continued to soar, reaching US$273 billion and achieving a massive 77 per cent increase over 2020 levels.

Carbon capture and storage was the only sector where BloombergNEF recorded a decline in investment – with investors preferring opportunities to invest directly in renewable energy production and the electrification of energy use. Just $2.3 billion was invested in new CCS projects in 2021.

A total of $731 billion was invested in energy production from renewables, nuclear power, energy storage, electric vehicles, and heat production. The remaining $24 billion was directed towards the production of hydrogen, CCS technologies and sustainable materials.

BloombergNEF suggested that the strong growth in the electric vehicle market has it on track to overtake investment in clean energy production as early as 2022.

” alt=”” aria-hidden=”true” />

The firm added continued growth across all clean energy sectors was a significant achievement given the challenging economic conditions in 2021.

“The global commodities crunch has created new challenges for the clean energy sector, raising input costs for key technologies like solar modules, wind turbines and battery packs,” BloombergNEF head of analysis, Albert Cheung, said.

“Against this backdrop, a 27 per cent increase in energy transition investment in 2021 is an encouraging sign that investors, governments and businesses are more committed than ever to the low-carbon transition, and see it as part of the solution for the current turmoil in energy markets.”

China continues to dominate the investment rankings recording US$266 billion in new investment last year. This was more than double the investment of the next largest country, the United States, which recorded $114 billion in new investment.

Asia Pacific countries now make up four of the top ten countries in terms of clean energy investment, with China, Japan, India and South Korea all making it into the top ten. Unfortunately, Australia did not make the cut.

” alt=”” aria-hidden=”true” />

Head of energy economics for BNEF, Matthias Kimmel, said that even with the record levels of investment flowing into zero and low carbon projects, governments still needed to work to accelerate the transition to cleaner energy sources to ensure global decarbonisation goals remained in reach.

“The world is rapidly running out of carbon budget to meet the goals of the Paris Agreement,” Kimmel said.

The energy transition is well underway, and moving faster than ever, but governments will need to mobilise much more finance in the next few years if we are to get on track for net zero by 2050.”

BloombergNEF’s New Energy Outlook report, released last year, estimated that clean energy investment levels needed to triple from current levels, to average US$2.1 trillion between 2022 and 2025, to put the world on track to keep global warming to within 1.75 degrees.

The amount of investment would need to double again for the remainder of the decade, to US$4.2 trillion, with electrified transport the only sector on a trajectory that could deliver the required level of investment.

Bloomberg’s head of technology and innovation, Claire Curry, said investors were responding to the growing demand for finance to support the development of new “climate-tech”, with the prospect of new clean energy technologies coming to the market.

BloombergNEF said an additional US$165 billion was invested in emerging ‘climate-tech’ companies that could culminate in new technologies.

“There has never been more capital available to companies tackling the hardest aspects of the climate challenge,” Curry said.

“It is true that we have solutions ready to deploy today, but there is still the need for continued innovation. All forms of corporate finance will play an important role in helping develop and scale climate-tech in the coming decade.”

https://reneweconomy.com.au/global-clean-energy-investment-topped-a-1-trillion-for-first-time-in-2021/amp/