Berkshire Hathaway is one of the largest and best-managed insurance and investment company in the world. Lead by famous Warren Buffett and Charlie Munger, the old investment foxes were able to consistently beat S&P 500 index by a large margin for decades. The success of Berkshire Hathaway has in my opinion several reasons:

- incredible honest, humble management with integrity that is focused on bringing more value to shareholders

- great capital allocation strategy

- consistent long-term vision, investment horizon and time for compounding

- the 4 pillars strategy and the snowball effect

There are only a few other companies that meet these criteria. Today I would like to present ideas, which make Berkshire a company that will be here for a long time. The ideas are so powerful that a lot of active investors can be inspired by them and use them in their portfolio building. They are not only great for your stocks but also for building your own company, life or managing your relationships with others.

Honest Management

Are the people that lead the company honest to the shareholders? This is one of the hardest questions to ask as investors. You can see the financial information and balance sheet on yahoo finance or from SEC. However, how do we really know that the management of the company is with us? My answer is the long-term track, real actions and personality traits of these people.

If Warren Buffett wants to get more stocks from Berkshire, he would get to his broker and buy them by himself. They don’t need to do shady stock compensation or stock splits to pump the value of their company.

“It takes 20 years to build a reputation and five minutes to ruin it. If you think about that, you’ll do things differently.” Warren Buffett

Buffett and Munger know that building a good reputation is very hard and long work. They also know that it is much easier to lose all reputation. When they are hiring people they are looking for honesty and integrity. It is a much better prediction of success than intelligence. They know that if they hire people with integrity, there is a higher probability that the company will behave well in the future. Honesty and integrity are powerful traits that attract other people. Any reputation damage will cause damage to the whole company.

For example, with Berkshire management, there are no shady stock compensations or undervaluing of other shareholders of the company. If anyone from the management team wants to get the stock, then they are free to purchase it through the market like everybody else.

Right now the integrity gap is widening more and more because of the two lives that we are living. One is real and one is virtual. We need to be careful about both of them. If our real life is aligned to the virtual one then we have integrity across these two dimensions and we don’t need to lie on Instagram something that in reality we are not.

“A lot of people with high IQ are terrible investors because they have terrible temperaments.” Charlie Munger

Great Capital allocation

Honesty to yourself will make you a better investor. You will not chase something that you don’t understand. This is described also as the circle of competence. Stock picking is hard and we shouldn’t invest in companies outside of our circle. In my case, I don’t understand the biotech industry. This is just too complex, and often there are many regulations that are causing a lot of trouble. I’m not sure which newly developed drug will be successful and the entire process of drug acceptance is lengthy and expensive. That is why I don’t try to find any biotech company.

The father of value investing Ben Graham says that price is what are investors willing to pay and value is what they get. It is a good reminder to us that, when investing in stock we should know what and for how much. The famous first rule of investing is never to lose money, and people from Berkshire are very good at it. When they are considering a new opportunity, they pick a company that is undervalued currently or will be in the future.

One of the great advantages that individual investors have is investing in micro-cap and small-cap companies. Berkshire Hathaway is so big that they can take only large fish that everybody knows. These companies are great but often overpriced. Luckily micro-cap and small-cap companies are overlooked. There are good reasons for that, but often some of them are the best investment opportunities of a lifetime. Micro-cap and small-cap companies can compound much faster the large-cap companies. The opportunity for growth is better for small companies. Of course, there comes a risk with small-cap companies.

Longterm vision

Buying companies with fair value is not enough. We need to have a long-term vision and constantly fight our doubts. Mr Market is every weekday telling us a new price for our security, however, this doesn’t matter at all if we know the intrinsic value of the business that we own. Time is the best weapon for individual investors, and if we are holding a good company then we don’t need to react to Mr Market’s messages. All the managers of active funds don’t have this advantage on their side, because they are forced to report their quarter and year performance. There is a big pressure on them because of it and are forced to sell a good company at a loss, just to invest in a different one which will give them few percentages for some small period of time. This is not an optimal strategy at all. Time is your best weapon!

The best performers in the market are the people who forget about their broker accounts.

The 4 Pillars

Berkshire Hathaway is standing on four pillars, and each of these pillars is able to provide a substantial cash flow. This is able to boost further capital allocation. Investing more each year more & more money and getting overtime better and better results are caused by the snowball effect. It’s called the snowball effect because the falling snowball is getting overtime more & more snow.

Simply said, four pillars are four companies that Berkshire is owning:

- Technology company

- Utility/Energy company

- Railway company

- Insurance company

Warren and Charlie are against the large diversification and investing in a large number of companies. They are often calling it a “divorsification”. Of course, Berkshire right now is so big that it is owning a lot of companies. However, these four companies (pillars) are Berkshire’s largest positions and provide an incredible defensive moat. Whatever will happen to one of the pillars, there will still be probably another three that will be able to safely navigate Berkshire through dark times. These four companies make great diversification, each of them focusing on a totally different part of the sector.

Apple — A technology company

Bought by Mr Buffett between 2016 and 2018 for more than 36 billion USD, this is right now the largest position valuing more than 150 billion. The myth is that Warren bought Apple after hearing about his upset friend losing his iPhone. In a few years, Apple was almost 5–6 bagger. The company is creating beautiful technology products and consumer devices that love people all over the world.

Berkshire Hathaway Energy — Utility company

Berkshire Hathaway Energy division consists of several companies like MidAmerican Energy, Nevada Energy and PacifiCorp. According to Semper Augustus, BHE produces more than 34,000 megawatts of power per year. The future and importance of this division are growing with rising energy prices across the world. It is also one of the first companies in the world that have a chance to build the next generation of safe nuclear energy.

BNSF — Railway company

This railroad company is the backbone of American industry. Berkshire had a great opportunity in 2010 and bought the whole Burlington Northern and Santa Fe. It is generating more than 6 billion USD per year now, which can be further reinvested and compounded. If you have never seen BNSF train then you probably cannot imagine how important are they for delivering goods across America. This is a solid business to own for the next 100 years. No electric truck can compare in effectiveness with the massive scale of these trains.

Berkshire Insurance — Insurance companies

Berkshire owns several insurance companies like GEICO, General Re, Aleghany and more. The head of insurance operations is Ajit Jain, a person that will probably replace Warren Buffett one day. The insurance companies provide another substantial cash flow for Berkshire.

These are four pillars that are making Berkshire an incredible defensive company. All of them have a great moat and are able to compound their capital for many years to come. Of course, Berkshire owns also part of Coca-Cola, Sees candy and many other businesses but these four are critical for Berkshire.

Shameless Cloner Strategy

And here comes another great idea that I steal from famous investor Monish Pabrai. And it is cloning. I will probably never be an as good investor as Mr Buffett or Mr Munger. Simply said, my intelligence and more importantly personal traits are incomparable to the best investors in the world. If I would invest just with my knowledge, I would get only average or poor results. However, we are able to clone ideas of the best investors and increase the likelihood of getting very good results instead.

So what about the cloning of the idea of 4 Pillars, investing in your 4 Pillars that will be a large part of your portfolio and then returns from these 4 Pillars in form of dividends will be invested in other companies. In this way, you will be able to create your own snowball that will compound over the years. These 4 Pillars don’t need to be the companies from the same sectors as Berkshire owns. These 4 Pillars don’t need to be even a company, it can be some project or your own application or even a blog about some topic, maybe an investment of your time in learning a new foreign language. All of it can bring you a lot of value in future if you are thinking in long term.

Now maybe you are thinking about “how many years do I need to do this?”. And here comes a little bit of math. The compounding effect depends heavily on the percentage of interest. With a lower percentage, you need to compound for a longer time.

Diversification can be great and bad. If you want to be independent then income diversification will be something that you are probably looking for. However, too much diversification brings down your attention to things that matter in your life.

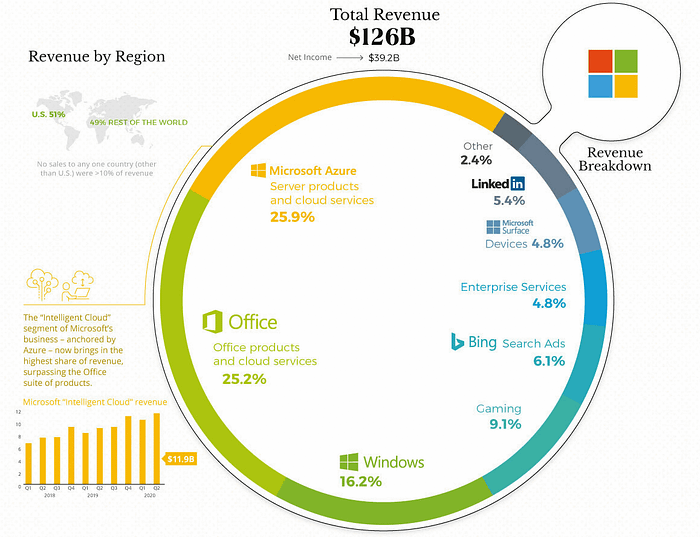

Do you have your own startup? Or are you individual investor? Maybe it is time to create your four pillars. Look at Microsoft, right now this mega-tech corporation doesn’t have only one income stream (Windows) as it was in 90s. Microsoft is a shameless cloner of other projects and right now the 4 largest divisions (pillars) are Azure, Office, Windows and Gaming. All of these divisions were cloned. Just think about it Azure is cloned AWS, their Xbox is cloned Playstation, before Windows there was os with a graphical user interface from Apple and Xerox…

If we look at Bill and Melinda gates foundation at dataroma, we can see that they built their own 4 pillars. We can see that the richest people are using this idea again and again. The top 4 companies in Gates portfolio consists of:

- Berkshire Hathaway

- Waste Management

- Canadian National Railway

- Caterpillar

This portfolio is concentrated and in the same time diversified. Contains corporations that will be here for long time and are necessery for day to day lives of all people.

What we can get from all of this?

In a sum up, cloning is one of the most powerful ideas in the business and investing. We should find our values and be honest to ouserveles, think longterm and don’t overpay for businesses. If we want to be successful in our lives then we must be a consistent.

My strategy for capital allocation is simple, build 4 pillars from large cap corporations which will generate cash flow from dividend that I would be able to invest in small-cap companies. For picking stock I use the cloning strategy proposed by Monish Pabrai.

It is not greed that drives the world, but envy. Warren Buffet

If you would like to read more articles like this in future then follow me 🙂

https://medium.com/the-investors-handbook/the-four-pillars-of-berkshire-hathaway-6bd185db0d24