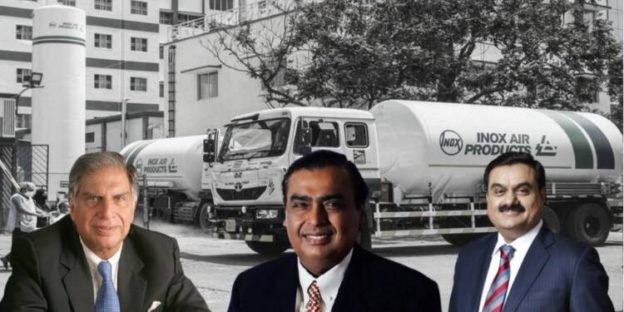

The masters of execution and their mega bets

- The groups plan to spend at least $215 billion to become future-ready over the next five years

- For now, five Tata companies, two Adani firms and Reliance Industries are part of NSE 50. This should change in the coming years

2022 just put the entire argument in the bin as the country’s three largest conglomerates, led by Reliance, Tata and Adani, started their biggest-ever capital expenditure exercise. The three groups plan to spend at least $215 billion in making themselves future-ready over the next five years, according to a review of the commentary made by the management of the three conglomerates.

One impact of the rise of the three conglomerates would be its impact on the Index. For now, five Tata companies (TCS, Titan, Tata Consumer, Tata Steel and Tata Motors), two Adani firms (Adani Enterprises and Adani Ports and Special Economic Zone) and Reliance Industries are part of NSE 50. This should change in the coming years as some of the businesses of these conglomerates become larger and are demerged and listed.

Take the example of Reliance.

Reliance pulled off the biggest surprise when it announced in October that its financial services business would be the first to get listed. Up until now, it was believed that the conglomerate would demerge and list its telecoms or retail businesses. Mukesh Ambani has entrusted K.V. Kamath, the doyen of the country’s private sector banking, as the chair of Jio Financial Services although for now, the group has not set a date by when it intends to make the financial services company a separate listed entity.

But the most ambitious bet from the oil-to-gas-focused group is its foray into energy projects encompassing batteries, hydrogen and solar power. After making the group debt-free recently, Reliance has once again set to splurge, as it intends to spend $75 billion on these new-age bets.

It was an equally busy year for Tata Sons chairman, Natarajan Chandrasekaran, who got a second five-year term. The year started with the group bagging Air India, the loss-making flag carrier. By the end of the year, Tata had started work on merging its other air carrier, Vistara with Air India. Tata merged seven listed steel businesses with Tata Steel.

Tata is also looking to spend the most among all companies: $90 billion over the next five years, according to The Economist. This includes Tata Power’s plan to spend over $10 billion over the next five years in renewable energy, a $5 billion project to build Giga factories and its bets in tech and electronics. Tata intends to make 5G telecoms gear and is also beefing up its play in the semiconductor space.

Two more group companies, Tata Play and Tata Technologies, will go public in the coming years.

Earlier this year, Adani Wilmar became the seventh group company to go public. Then, in the summer, Asia’s richest businessman Gautam Adani agreed to buy Ambuja Cements and ACC from Holcim, the Swiss building-materials giant, for $10.5 billion. The Ahmedabad-headquartered group intends to spend $50 billion, in making among other things, green hydrogen.

For now, much of the business built by homegrown conglomerates is with an eye on the domestic market. This is bound to see the three groups slugging it out between themselves for supremacy. In August, Adani was a surprise bidder at the government’s auction of 5G bandwidth. Many believe it could be a prelude to competing with Reliance in telecoms.

Adani buying nearly 65% of NDTV implies that ten companies owned by Gautam Adani are public.

For the new ventures, capital raising will be a challenge, in a high interest rate regime. Perhaps, that explains why Adani Enterprises is seeking to raise ₹20,000 crore through a follow-on public offer.

Reliance and Tata group have been increasingly buying out startups—from spending on hyperlocal delivery startups to drones —as they look to scale up their digital online business.

The other challenge is for all the bets to succeed. Ambani, Adani and Chandrasekaran are masters of execution. But some of these large bets would require these leaders to better their historical records.

Can they deliver on their promise? The jury is out.

https://www-livemint-com.cdn.ampproject.org/c/s/www.livemint.com/economy/the-masters-of-execution-and-their-mega-bets/amp-11672159571102.html