- Paytm could launch its ₹21,000 crore ($3 billion) initial public offering (IPO) later this year.

- If successful, this will be the biggest IPO for a company in India, beating the ₹10,000 crore Coal India IPO from 2010.

- The 10-year old startup is backed by Softbank, Alibaba Group, Ant Financial, among others.

Paytm, one of the leading digital payments providers in India, is eyeing a bumper ₹21,000 crore ($3 billion) initial public offering (IPO) this year. If it goes through, this would be the largest market debut of an Indian company, so far. Two people familiar with the matter confirmed the development to Business Insider.

Bloomberg was the first publication to report on the IPO plan for the 10-year old startup backed by Softbank, Alibaba Group, Ant Financial and SAIF Partners. The report says that One97 Communications is going for the IPO.

Business Insider has written to Paytm seeking comments. We will be updating the story if and when we receive a response.

A year ago, in April 2020, Paytm founder Vijay Shekhar Sharma told Business Insider that an IPO was likely in the next three years. Paytm might not get listed but the subsidiaries or affiliate companies might get listed. Bank, commerce, gaming are all spinouts of Paytm. Our banking business which is incidentally profitable by design, after a certain amount of net worth it has an obligation to get listed,” he had said then.

Listing individual units instead of Paytm itself would be a win-win for investors as well as Sharma, said Sumit Agrawal, Founder, Regstreet Law Advisors and a former SEBI official.

If Paytm’s IPO is successful, it will beat Coal India’s public offering which raised INR 15,000 crore from the public in 2010.

Devendra Agrawal, founder of investment bank Dexter Capital, believes a successful Paytm IPO augurs well for other fintech players in the country.

“A successful listing for Paytm would pave the way for multiple other fintech startups to tap Indian capital markets as a fundraising option for further growth. The pandemic has led to a digital shift in consumer behaviour when it comes to availing financial services and we may see more IPOs emerging from the fintech space,” he told Business Insider.

The scale of Paytm’s reach is evidenced by the number of transactions it processes every month. According to its recent blog post, the company revealed that it has crossed 1.4 billion monthly transactions across both merchants and customers.

It said that it has over 20 million merchant partners as well, allowing them to accept payments via the Paytm platform that supports wallet, bank accounts, cards as well UPI (Unified Payments Interface).

However, digital payments is a crowded market and Paytm has plenty of catching up to do with the market leaders – PhonePe and Google Pay.

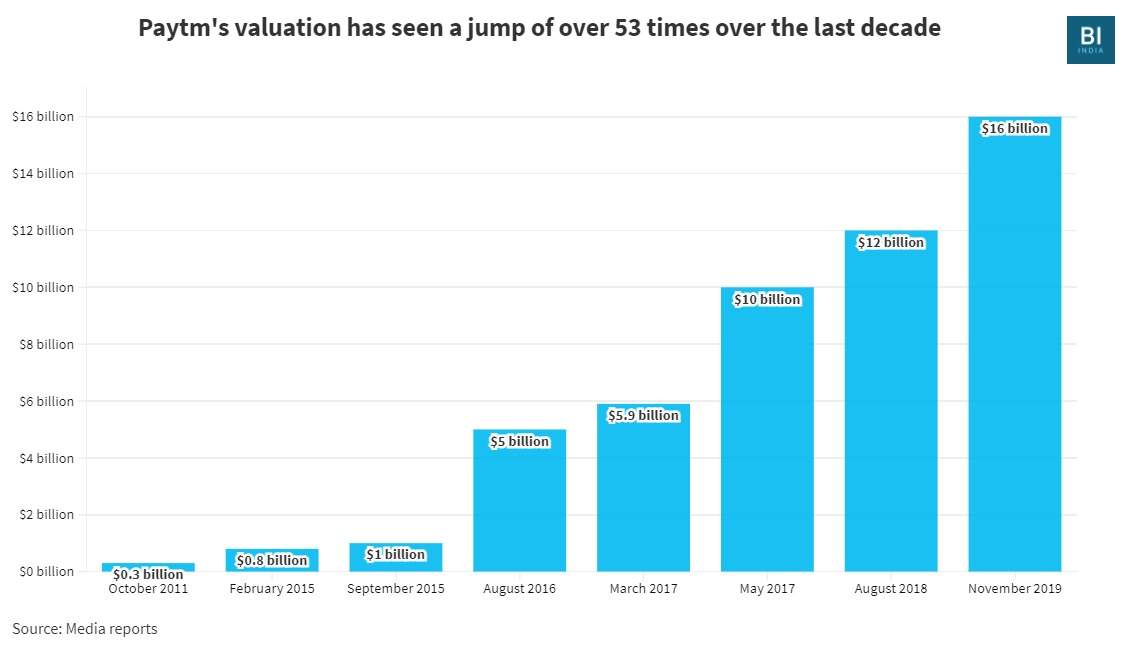

Over the last 10 years, Paytm’s valuation has seen a multi-fold surge, going from just $300 million in 2011 to over $16 billion at the end of 2019.