Buy these 3 hypergrowth stocks to play the hydrogen economy’s $11 TRILLION breakout

- Technological advancements and falling renewable energy costs have led to a new era of scalable “Green Hydrogen” production.

- Thanks to its unmatched energy density, hydrogen outplays battery electricity when it comes to range, recharging times and emissions.

- Hypergrowth investors should take a good hard look at these emerging hydrogen stocks.

[Editor’s note: “3 Hydrogen Stocks to Buy for the $11 Trillion Breakout” was previously published in December 2020. It has since been updated to include the most relevant information available.]

Today, electric vehicles are all the rage. They’re at the epicenter of the world’s shift to cut carbon emissions dramatically and rapidly for a cleaner future. But EVs weren’t always at the forefront of the Clean Energy Revolution. Indeed, back in 2003, it was all about hydrogen.

In his 2003 State of the Union address, then-President George W. Bush said, “the first car driven by a child born today could be powered by hydrogen and [be] pollution-free.”

He was half-right. There are a lot of pollution-free cars out there today. And many children born back in 2003 are driving them. But for the most part, they’re powered by electric batteries, not hydrogen fuel cells.

Where did it go wrong?

In the words of Matthew Blieske, Shell’s (NYSE:SHEL) global hydrogen product manager, “… there was always something missing.”

The History of Hydrogen

In the early 2000s, hydrogen fuel cells were hyped up for their ability to reduce energy dependence. That was at a time when crude oil prices were north of $50 and rising. But falling oil prices in the late 2000s and early 2010s sapped some of this hype. And it dramatically slowed the Clean Energy Revolution.

Then the world started getting serious about decarbonization again in the back half of the 2010s. And hydrogen was but one of many zero-emission energy sources out there, alongside solar, wind, and electric batteries.

And relative to those other energy sources, hydrogen has proven to be less efficient and more expensive.

That’s because hydrogen, while the most abundant element in the universe, doesn’t exist in its pure form on Earth. So, producing it requires a complex, multi-step process. And that results in significant electricity loss and requires tons of added infrastructure – and dollars.

Not to mention, to offset these extra costs, most companies have turned to producing hydrogen from cheap natural gas. That means that most isn’t zero-emissions at all.

Net net, hydrogen has gone from being the epicenter of the Clean Energy Revolution to just a niche afterthought.

But that’s all about to change.

The Hydrogen Economy is on the cusp of an enormous tipping point.

For the first time in its choppy history, the time has come for this clean energy source to reign.

The Drivers Have Arrived

As every country works toward a net-zero emissions target, the global political stage is set for mass decarbonization.

Economies of scale have led to the cost of hydrogen fuel cells dropping 60% over the past decade. Deloitte expects those costs to drop below electric battery and combustion engine costs within just a few years…

Technological advancements and falling renewable energy costs have led to a new era of scalable “Green Hydrogen” production. And now it can be cost-effectively produced from renewable energy sources, like solar and wind.

In other words, all the drivers have finally shown up to the party at the same time.

In the words of Blieske: “[In the past] there was a policy missing, or the technology wasn’t quite ready, or people were not so serious about decarbonization. We don’t see those barriers anymore.”

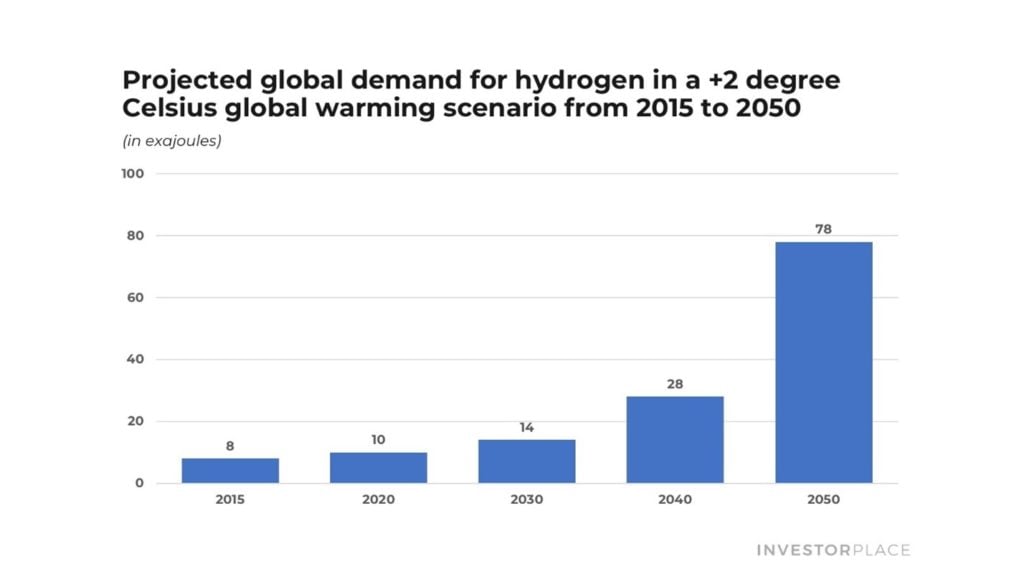

With those barriers removed, the Hydrogen Economy will tip into its long overdue renaissance in the 2020s. And that will create what Morgan Stanley (NYSE:MS) sees as an $11 trillion market in the coming decades.

Where will all this hypergrowth come from?

We’ll see it in high-usage and long-range energy and transportation markets. That’s where hydrogen’s advantages over electric batteries shine brightest.

The Final Word on Hydrogen Stocks

You see, when it comes to cost, efficiency, safety, and public roads infrastructure, battery electricity wins out. To that extent, battery electricity will likely be the dominant clean energy source for passenger cars and last-mile delivery vans.

But thanks to its unmatched energy density, hydrogen outplays battery electricity when it comes to range, recharging times, and emissions. So, in heavy-usage and long-range situations, hydrogen is best in class. Therefore, those fuel cells will likely be the dominant clean energy source for industry, stationary and cross-country haul.

Think forklifts in warehouses, trucks that travel across the country, and ships that sail across oceans. And what about data centers that have to be “always on”?

Indeed, hydrogen fuel cells are on the cusp of disrupting those industries over the next decade.

Who is at the forefront of this multi-trillion-dollar disruption?

Plug Power (Nasdaq:PLUG) is. The company started out supplying hydrogen fuel cells for forklifts to warehouse operators like Walmart (NYSE:WMT) and Amazon (Nasdaq:AMZN). Now Plug Power is morphing into an all-in-one, vertically integrated powerhouse at the epicenter of the Hydrogen Economy.

Needless to say, Plug Power stock is a long-term winner.

But other names are also piquing interest in this hypergrowth space…

Like Ballard Power (Nasdaq:BLDP), who’s making hydrogen fuel cells for buses, trucks, and trains. And Bloom Energy (NYSE:BE) is creating energy “boxes” powered by green hydrogen to help replace grid power.

With these hypergrowth stocks, you have three of the highest-quality plays on the multi-trillion-dollar Hydrogen Revolution. And they’re three stocks that could easily rise several hundred percent in the 2020s.

Hypergrowth investors should take a good hard look at these emerging hydrogen stocks.

On the date of publication, Luke Lango did not have (either directly or indirectly) any positions in the securities mentioned in this article.

https://investorplace.com/hypergrowthinvesting/2022/07/3-hydrogen-stocks-to-buy-for-the-11-trillion-breakout/