Despite the expectations of past science fiction writers, robots are still far from common in our everyday lives, notes the venture capitalist community. More than a fifth of the 21st century has now passed, and the worlds of The Jetsons and Lost in Space still feel like projections of a distant future.

However, away from the domestic lives that most of us inhabit daily, robots have suddenly become pervasive in some industries. Self-driving cars are moving from research labs to the road, Boston Dynamics continues to release incredible video demos — and many investors are starting to take notice.

What has changed to drive this acceleration in both the technological capability and deployment of robotics? Venture capitalists see three key factors:

- Labor costs continue to rise and are now 45% above 2000 levels.

- The cost of robotics components has dropped, so innovators can piece together existing platforms and spend more time focusing on the truly groundbreaking elements of their technology. For example, the cost of a robotic arm has fallen 90% since 2000. In business speak, this means nobody has to “reinvent the wheel” every time they want to build a new robotics solution.

- Software has advanced to the point that it can support robotics technology with complex tasks, buoyed by a 400% increase in AI investment over the past five years.

Where the money is flowing

The robotics space changes rapidly, with constantly rotating “hot sectors,” tweaks to business models, and shifting investment and exit dynamics. To better understand the industry landscape, F-Prime Capital recently completed a comprehensive analysis of more than 1,250 robotics companies that raised funding over the past five years.

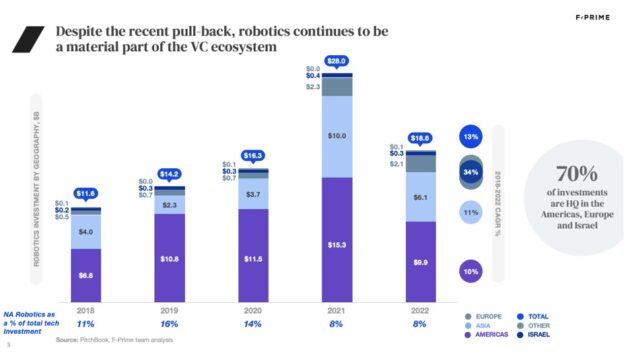

In the resulting report, we found that $90 billion worth of funding had gone to the robotics industry since 2018, representing roughly 10% of overall investments in tech.

We identified three main categories for robotics investment:

- Autonomous vehicles — public roads only

- Vertical robotics — use-case specific and mostly focused on industrial settings

- Enabling systems — hardware and software components that others can use to build complete solutions

Autonomous vehicles (AVs) accounted for more than 50% of robotics funding in most years. However, as investors began to question the paths to commercialization for many companies in the sector, AVs saw a stark decline in 2022.

Vertical robotics companies now take the majority of venture funding available for robotics technology. Within this, logistics, defense, medical, and manufacturing applications tend to attract the most investment capital.

However, as we’ll discuss below, the fall in investment that began in 2022 is on track to continue through 2023.

Another way to trace this shift in focus from AV to vertical robotics is to observe the types of unicorns that have emerged in the space. The 2018 and 2019 crops of robotics unicorns clustered in the AV and enabling lidar space — several of which have since shut down — while the 2021 and 2022 crops tend to center around vertical robotics.

This year has been challenging for startup fundraising, and robotics is no different. The first half of 2023 saw investments decline more than 50% relative to 2022, which itself was down 30% from the heights of 2021.

Fortunately, the second half of 2023 is looking more promising, with several high-profile funding rounds for companies like Anduril, Aurora, and Stack AV.

A deeper dive into the funding environment, however, shows a wide range of behavior by stage. Early-stage deals have shown a relatively modest decline in 2023, whereas mid- and late-stage deals have been far more challenging. This is largely attributable to overvalued earlier-stage companies that raised at the height of the market, which are now facing valuation expectation mismatches when they re-engage investors for their next round of funding.

The exit environment has also created challenges for robotics startups. IPOs and SPACs have ground to a halt in the past 18 months, while mergers and acquisitions are down 50% since 2021.

However, even in the best of times, the vast majority of M&A deals since 2018 have been worth less than $250 million, with only a handful of notable exits. Among them:

- Auris’ $5.75 billion acquisition by Johnson & Johnson in 2019

- Uber ATG’s acquisition by Aurora for $4 billion in 2020

Public market performance has also been mixed, with robotics companies that have built scaled, high-growth businesses faring best — Symbotic, AutoStore, PROCEPT Biorobotics, and Hesai Technology are the standouts here. For others, valuations have significantly reset.

What’s next for venture capital and robotics?

The boom in autonomous vehicle investment catalyzed a new generation of robotics entrepreneurs and engineers. They are now using that know-how to build startups that solve real customer pain points.

As venture capitalists, we believe the industry remains in its early innings. Indeed, the exit environment is still maturing, and hardware businesses still face an additional layer of complexity compared to pure software businesses.

But for those with experience in the industry — and who understand its unique metrics and business models — it is clear that opportunity is growing at an accelerated rate.

Founders should be aware the era of exiting a business based on little more than “promising technology” is over — you must eventually build a real business. Tech demos do not equal commercial success, and investors have wised up to the fact that production deployments delivering measurable ROI trump pilot customers who are “excited by the technology” every time.

As demonstrated by the data outlined above, it’s also important to note that, for now, capital remains scarce. Founders must build capital-efficient businesses to entice investors. For many, capital efficiency, or a lack thereof, can make or break a founder’s pitch.

Today’s robotics founders have several tailwinds at their back: technological acceleration, labor shortages, stagnant productivity gains, and a cadre of investors who are increasingly interested in the category. Those who can learn the hard-fought lessons of the past five years — including the experience of AV companies and the macro rise and fall in tech investment dollars — are well-placed to find success in this unique category.