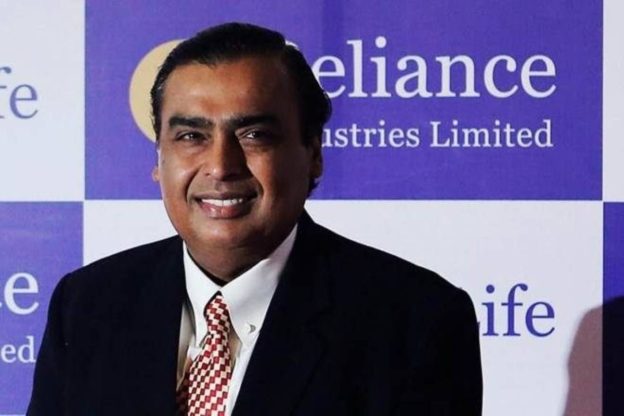

(Bloomberg) — Billionaire Mukesh Ambani’s Reliance Industries Ltd. is weighing a bid for Deutsche Telekom AG’s Netherlands subsidiary, according to people familiar with the matter.

The Indian conglomerate is working with an adviser to evaluate an offer for T-Mobile Netherlands BV, the people said, asking not to be identified discussing confidential information. Deutsche Telekom is seeking about 5 billion euros ($5.9 billion) in any sale, the people said.

Deliberations are ongoing, no final decision has been made and there’s no certainty Reliance will decide to proceed with a formal offer, according to the people. Deutsche Telekom declined to comment. A representative for Reliance could not immediately comment.

Deutsche Telekom is working with Morgan Stanley on the sale of the business, which has attracted interest from private equity firms including Apax Partners, Apollo Global Management Inc., BC Partners, Providence Equity Partners and Warburg Pincus, Bloomberg News reported last month.

Buyout firms are drawn to such assets as they can gain control of underlying infrastructure, which offers steady long-term returns. In May, the Dutch telecom group Royal KPN NV said it had rejected an “unsolicited high-level approach” from investment firms EQT AB and Stonepeak Infrastructure Partners.

KPN shares dropped as much as 4.7% in Amsterdam Tuesday to a three-week low on the news Reliance was considering a bid for its competitor.

Global Expansion

Reliance is India’s largest company by market value, with a business that spans oil refining, petrochemicals, retail and telecommunications. A deal for T-Mobile Netherlands would represent a rare purchase in Europe and come as Ambani tries to transform Reliance from an old-economy conglomerate into a technology and e-commerce titan.

Ambani has said previously that he eventually wants to expand Reliance’s digital unit, Jio Platforms Ltd., overseas and last year secured more than $20 billion of backing from investors including Facebook Inc.

“This could be one step forward for that direction, in addition to leveraging natural synergies to Jio,” said Kranthi Bathini, a strategist at Mumbai-based consultancy WealthMills Securities Pvt. “This could also serve as the beginning of aggressive acquisitions in this space and deploying funds in different geographies after Jio Platforms raised record money last year.”

Shares in Reliance have risen 5.2% this year, giving it a market value of 13.7 trillion rupees ($184 billion). The stock rose as much as 1.7% Tuesday, before giving up some of these gains.

Deutsche Telekom entered the Dutch mobile-phone market in 2000, acquiring a stake in a venture with Belgacom SA and Tele Danmark. The business was renamed T-Mobile Netherlands in 2003 after the German carrier bought the remainder.

It considered a sale of the unit in 2015 to raise funds to buy wireless frequencies in the U.S., before deciding to keep the business. In 2019, T-Mobile Netherlands merged with Tele2 AB’s operations in the country to create one of the biggest local carriers.

Speaking at an investor day in May, Tele2’s Chief Executive Officer Kjell Johnsen confirmed the company planned to sell its 25% holding in T-Mobile Netherlands and focus on its core markets in the Nordics and Baltics.

(Updates with detail on Ambani plans, analyst quote under ‘Global Expansion’ subhead.)

More stories like this are available on bloomberg.com

Subscribe now to stay ahead with the most trusted business news source.

©2021 Bloomberg L.P.

https://finance.yahoo.com/news/ambani-reliance-said-weigh-bid-063845570.html