The once-untouchable titans of Big Tech are losing market share to hungrier, more innovative startups

- Separate from the 2022 selloff, small-cap stocks have killed Big Tech.

- Meta and Netflix are seeing a novel drop in users. Amazon’s e-commerce sales growth has flipped into negative territory. Alphabet’s hypergrowth YouTube business is slowing for the very first time. Nvidia’s GPU performance lead is narrowing.

- The once untouchable tech giants are losing market share to hungrier, more innovative tech startups.

[Editor’s note: “Big Tech Are Falling Knives” was previously published in April 2022. It has since been updated to include the most relevant information available.]

I make a lot of bold claims. And one of my biggest, boldest, wildest of all time is that Big Tech is dead.

I first said that back in July 2021. No one listened at the time. In fact, everyone thought I was nuts.

It’s part of the nature of being a tech entrepreneur and an early-stage investor. Most people see the world as it is today. I see the world as it will be in five, 10, 15-plus years. That means I sound a bit out there sometimes. But that perception also helped me become the world’s No. 1 stock picker.

Indeed, look what’s happening now.

All the once-unstoppable Big Tech stocks are crashing. We saw a 65% drop in Netflix (NFLX) and a 60% decline in Meta (META) stocks. And Nvidia (NVDA) stock fell 60%, too.

It’s a bloodbath. And now everyone is asking: Is Big Tech dead?

In short, yes. Separate from the 2022 selloff, small-cap stocks killed them.

Competition Has Caught Up to Big Tech

Many think my rationale for believing Big Tech is dead hinges on government regulation, consumer boycotts over censorship, or even the turbulent macroeconomic environment.

But my rationale for claiming Big Tech is dead is much more fundamental in nature.

It’s dead because of competition.

In short, Big Tech became what it is by leveraging first-mover advantages in emerging tech industries. Amazon (AMZN) turned into a trillion-dollar company because it pioneered the e-commerce industry. Meta became a tech giant because it founded social media. And Netflix reached its height because it established TV streaming.

Now, though, those first-mover advantages are disappearing. We’re 10-plus years into the e-commerce, social media, and TV-streaming revolutions. Every retailer is selling online these days. Every website has an app, and every media company has a streaming platform.

The playing fields in the industries that Big Tech have dominated are “evening out.”

As they are, Big Tech is losing its edge.

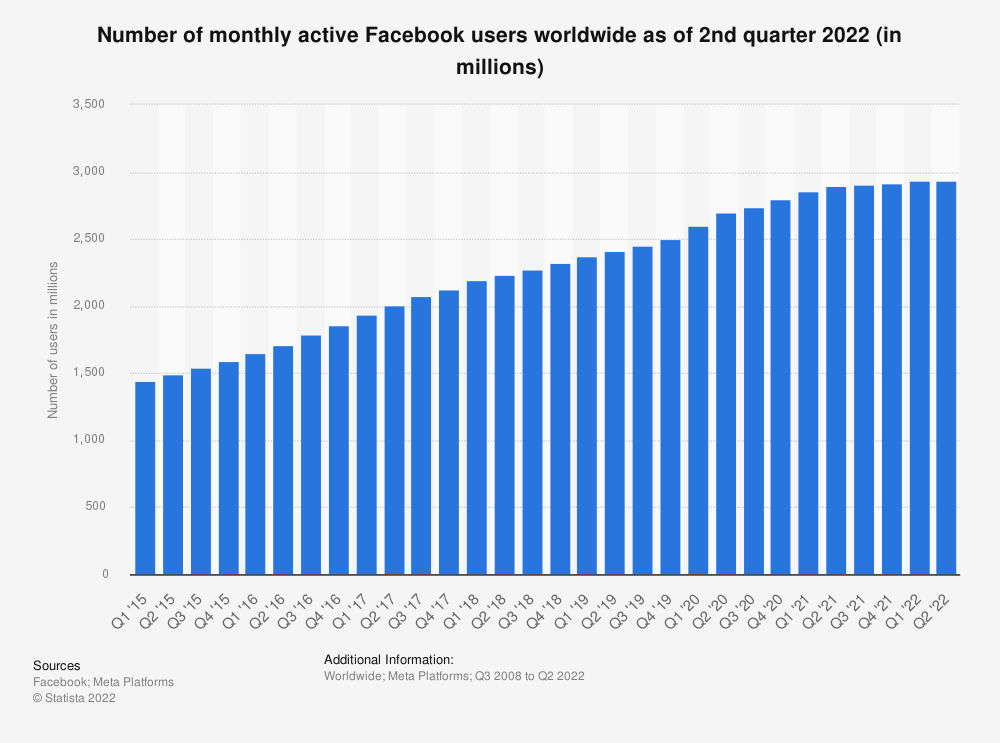

Meta and Netflix are seeing a novel drop in users. Amazon’s e-commerce sales growth has flipped into negative territory. Alphabet‘s (GOOGL) hypergrowth YouTube business is slowing for the very first time. Nvidia’s GPU performance lead is narrowing.

These examples aren’t just one-off phenomena. They are indicative of a broader trend, where small tech stocks are disrupting big tech stocks.