ESG Investing: The Top Five Drivers

Today, environmental, social and governance (ESG) investing has never been more popular, surpassing record levels seen in 2020, according to Google Trends.

By 2025, ESG investing is projected to reach $53 trillion in assets globally—roughly equal to a third of all investment assets under management. It raises an important question: why are people choosing to use an ESG strategy?

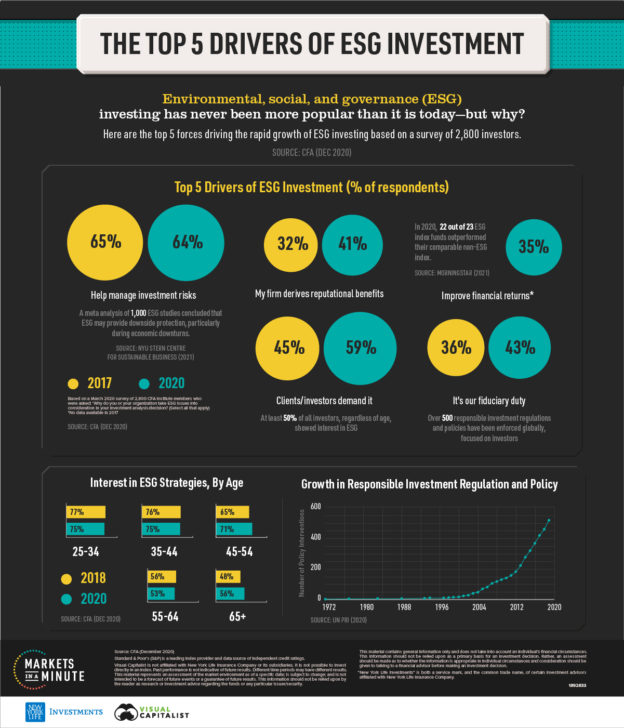

To answer this question, the above Markets in a Minute chart from New York Life Investments looks at the top drivers behind ESG investing, based on a survey of 2,800 Chartered Financial Analyst (CFA) investment professionals.

What is ESG Investing?

ESG investing refers to assets that are selected according to their environmental, social, and governance factors.

These include everything from carbon intensity and gender representation, to executive pay. Often, these variables are analyzed through sources such as sustainability reports or government data, among others.

Broadly speaking, ESG investing strategies can fall into four main categories:

- Values & Screening: Determines sectors, companies, and activities that are included or excluded from investment such as fossil fuels. This can also be based on investors’ values.

- Integration: Identifies the risks and opportunities of ESG factors on companies. Typically more complex than screening approaches.

- Thematic: Focuses on structural themes in ESG such as women’s leadership or smart cities.

- Impact: Specific goals are designed to be met, such as companies that are working towards the UN Sustainable Development Goals.

Given its rapid rise, here are the most influential reasons why investors—retail and institutional alike—are paying attention to this trend.

The Top 5 Drivers of ESG Investing

Simply put, risk management and client demand were the most prominent factors behind ESG investing in 2020.

| Driver of ESG Investing | 2017 | 2020 |

|---|---|---|

| To help manage investment risks | 65% | 64% |

| Clients/investors demand it | 45% | 59% |

| It’s our fiduciary duty | 36% | 43% |

| My firm derives reputational benefits | 32% | 41% |

| To improve financial returns | N/A* | 35% |

Based on a March 2020 survey of 2,800 CFA institute members who were asked: ‘Why do you or your organization take ESG issues into consideration in your investment analysis/decision? (Select all that apply)

*No data available in 2017

Fiduciary duty ranked third highest, impacting the decisions of 43% of investment professionals.

Here, fiduciary duty is when an investment professional acts in the best interest of a client. From Brazil to the U.S., over 500 socially responsible regulations have been enforced globally, including corporate disclosures and pension fund regulations.

Additionally, improving financial returns was a primary reason for 35% of the respondents. In 2020, for example, 22 out of 23 ESG index funds outperformed their comparable non-ESG index.

ESG Investing: Age is Just a Number

Who is investing in ESG?

Across age groups, people were motivated by higher risk-adjusted returns and values to varying degrees. For instance, 42% of investors between 25-34 expected higher risk-adjusted returns from ESG compared to 16% of investors aged 55-64.

At the same time, 47% of investors across all age groups wanted to invest in ESG to express their personal values or focus on companies that were making a positive contribution to society and the climate.

| Reason for Investing in ESG | 25-34 | 35-44 | 45-54 | 55-64 | 65+ |

|---|---|---|---|---|---|

| To realize higher risk-adjusted returns | 42% | 39% | 18% | 16% | 14% |

| To express personal values or invest in companies with a positive societal/environmental impact | 44% | 41% | 54% | 50% | 50% |

| Both | 14% | 19% | 28% | 34% | 35% |

Source: CFA (Apr, 2020)

Meanwhile, roughly a quarter of investors said that both higher risk-adjusted returns and sustainable impact underscore their interest in ESG.

| Reason for Investing in ESG | Overall |

|---|---|

| To realize higher risk-adjusted returns | 29% |

| To express personal values or invest in companies with a positive societal/environmental impact | 47% |

| Both | 24% |

Source: CFA (Apr, 2020)

In 2020, 10% of retail investors invested in ESG. By comparison, interest in ESG is much higher. Almost 70% of individual investors expressed interest in these strategies.

| Investment in ESG | Retail Investors | Institutional Investors |

|---|---|---|

| Currently invest in ESG | 10% | 19% |

| Show interest in ESG | 69% | 76% |

Source: CFA (Apr, 2020)

Perhaps one of the most interesting takeaways from this study, however, is the wide gap between interest and investment in ESG. One factor behind this gap could be due to the fact that just 41% of advisors have spoken to clients about ESG investing, research shows.

However, underlying perspectives on performance, demand, and personal preferences show that ESG may further cement its way into not only the investment dialogue, but investors’ portfolios.

https://advisor.visualcapitalist.com/esg-investing-the-top-5-drivers/