- Venture capitalists are more like rash gamblers than prudent investors, Charlie Munger said.

- Warren Buffett’s business partner said many VCs get rich while founders and backers lose out.

- Munger contrasted the VC approach with Berkshire’s hands-off, long-term ownership of businesses.

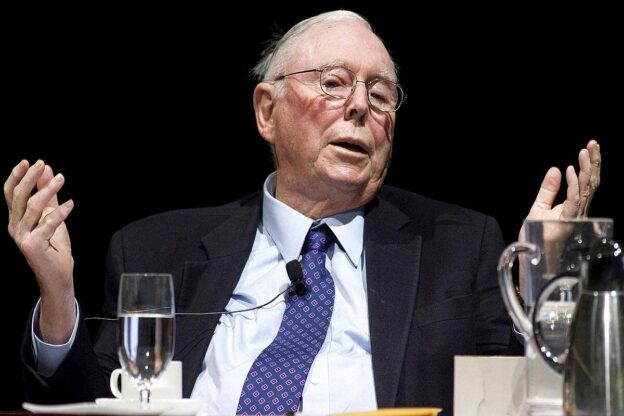

Charlie Munger has delivered a scathing critique of venture capitalists, blasting them as closer to gamblers than investors, and slamming them for getting rich at others’ expense.

“It’s very difficult to invest money well, and I think it’s all but impossible to do time after time after time in venture capital,” Warren Buffett’s business partner told the Acquired podcast in a rare, hour-long interview released this week. “Some of the deals get so hot, and you have to decide so quickly, that you’re all just sort of gambling.”

“The people who make the most money out of venture capital are a lot like investment bankers, deciding which hot new area they’re going to get in,” Munger noted. “They’re not great investors or great at anything.”

The billionaire investor and Berkshire Hathaway vice-chairman said America’s VC industry as a whole is doing a terrible job of supporting founders of early-stage companies.

“More often than not, they hate the venture capitalist, they don’t feel they’re their partner trying to help them — they’re only taking care of themselves,” he said.

Munger, 99, also railed against VCs for being greedy and taking advantage of their backers, which include institutions like university endowments.

“You don’t want to make money by screwing your investors, and that’s what a lot of venture capitalists do,” he said. “They happen to make very handsome livings for themselves, but the endowments are not getting a good return.”

“They feel had, misled, irritated,” he continued. “They’ve looked foolish to their own trustees.”

Munger contrasted the typical VC to Berkshire. Buffett and his team typically buy businesses for the long term, and believe in “delegation just short of abdication” — they aim to invest in great companies run by quality managers and just leave them to it.

Berkshire’s hands-off approach appeals to founders who want to cash out but would prefer an owner who won’t seize control, dismantle what they’ve built, or sell them on in a few years’ time.

“Our people, they know we’re not trying to discard them to the highest bid,” Munger said. “If some asshole investment banker offers us 20 times earnings for some lousy business, we don’t sell.”

“If it’s a problem business we’ve never been able to fix, we’ll sell it,” he continued. “But if it’s a halfway decent business, we never sell anything, and that gives us this reputation of staying with things, which helps us.”

Munger went as far as including VCs among the groups he personally avoids, along with bankers and consultants.

“The point of getting rich is you don’t have to need other people, you don’t have to get along with other people,” he said.

It’s worth pointing out that Buffett’s right-hand man doesn’t universally dislike VCs. Munger has previously hailed Sequoia Capital — an early backer of Apple, Google, and Airbnb — as “the most remarkable investment firm in America,” and said the firm would “run rings” around him if they competed in the startup game.

https://finance.yahoo.com/news/charlie-munger-rips-vcs-saying-222858334.html