Ah, the sweet sound of six figures.

Respected investment and money management experts agree that amassing your first $100,000 is a critical early milestone on the path to long-term wealth.

Don’t miss

- You could be the landlord of Walmart, Whole Foods and CVS (and collect fat grocery store-anchored income on a quarterly basis)

- UBS says 61% of millionaire collectors allocate up to 30% of their overall portfolio to this exclusive asset class

- ‘So much money out there’: This millionaire YouTube star says earning $200K should be easy if you’re ‘smart about it’ — here’s 1 easy way to boost your income while you sleep

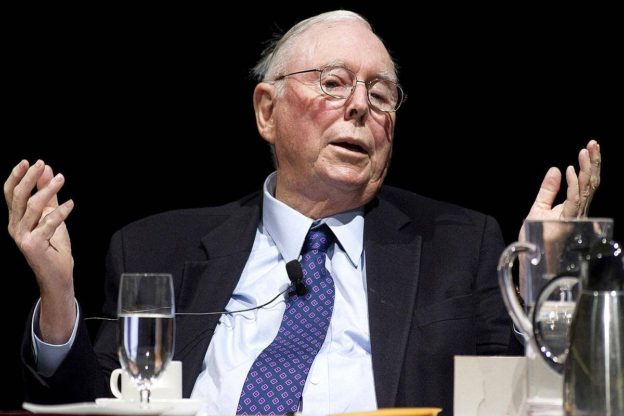

Billionaire investor Charlie Munger may be the most famous advocate for the theory, based on his colorful advice offered more than two decades ago to an audience member at an annual meeting of Berkshire Hathaway shareholders.

“It’s a b—-, but you gotta do it,” Munger said. “I don’t care what you have to do — if it means walking everywhere and not eating anything that wasn’t purchased with a coupon, find a way to get your hands on $100,000. After that, you can ease off the gas a little bit.”

Why $100K matters so much

Why is that figure so important — especially when you consider that for many investors and savers, the goal is often much higher?

After all, $100,000 back in 2002 now amounts to roughly $166,000 in today’s dollars. And with inflation in the U.S. still high, that sum doesn’t go as far as when Munger delivered his cheeky take.

Then again, Munger didn’t elaborate on just how much that first $100,000 could grow over time, even if left alone. Invested at a modest 5% return, you wouldn’t have needed to add a single penny over 21 years to see that stash grow to $278,596, per compound interest calculators like this one.

The lesson? What comes before — and after — that first $100,000 makes all the difference.

Consider this example: Debbie, a young worker who diligently saves and invests $10,000 a year through her employer’s 401(k) plan and nets an annual return of 7%, would need slightly less than eight years to reach a net worth of $100,000.

This is where things get interesting: The same annual investment, at the same rate of return, would produce Debbie’s next $100,000 in only about five years. Reaching the next uptick on that sixth digit would take even less time.

As a result, Debbie learns that consistent saving — fueled by compound interest — can get you to that $100,000 level and rocket your net worth if you stay the course.

It’s fair to wonder: What’s so important about $100,000 versus, say, $90,000 or $95,000? Besides the literal extra $5,000 or $10,000, there’s plenty of hustle and psychology at play.

Here’s what Munger and others stress.

Read more: Rich young Americans have lost confidence in the stock market — and are betting on these 3 assets instead. Get in now for strong long-term tailwinds

Working for it

People love round numbers; maybe you do, too. Of course there’s no tangible trigger at which $100,000 becomes a more meaningful driver of wealth than $99,999. But there’s also no denying the satisfying psychological metric of $100,000. It’s six figures versus five, making it a desired milestone for salary or other accumulations of monetary worth.

Getting to $100,000, especially in one’s younger years, isn’t easy. Most of us can’t get there quickly from a standstill. Reaching it usually means earning promotions and salary bumps at work; significantly underspending your income; or good old-fashioned side hustling like driving for a ride-hailing service or taking on freelance assignments.

But if wealth accumulation begins with more income and less expenses, compound interest does the heavy, heavy lifting.

Then not working for it

The earlier you start to save and invest, the more time you’ll have to grow your money. It’s much like a garden, where you don’t have to hover obsessively over a grapevine to let time do its work. Invested money can earn interest, dividends and capital gains. That’s why Debbie’s time between her first $100,000 and $200,000 is far less than when she went from zero to $100,000.

Earning your first $100,000 can provide financial stability to help you weather unexpected financial storms. But there’s more: It can also give you confidence to take calculated chances with your investments by allowing for more high-risk, high-reward opportunities.

By no means is $100,000 a license for recklessness. And that number, let’s face it, can feel a bit intoxicating, a temptation to spend big. But viewed properly, $100,000 can provide a goal to shoot for, a foundation for wealth building, and the opening chapter of your incredible financial success story.

What to read next

- Hold onto your money’: Jeff Bezos issued a financial warning, says you might want to rethink buying a ‘new automobile, refrigerator, or whatever’ — here are 3 better recession-proof buys

- Americans are paying nearly 40% more on home insurance compared to 12 years ago — here’s how to spend less on peace of mind

- Here are 3 easy alternatives to grow your hard-earned cash without the shaky stock market

This article provides information only and should not be construed as advice. It is provided without warranty of any kind.

https://finance.yahoo.com/news/b-gotta-charlie-munger-says-140000516.html