Inflation continues to rattle the worldwide economic system, forcing financial authorities to strengthen efforts to extinguish it.

Consumer costs within the US elevated final month by greater than forecast, which can probably prod the Federal Reserve to lift rates of interest by 75 foundation factors for a third-straight assembly this coming week.

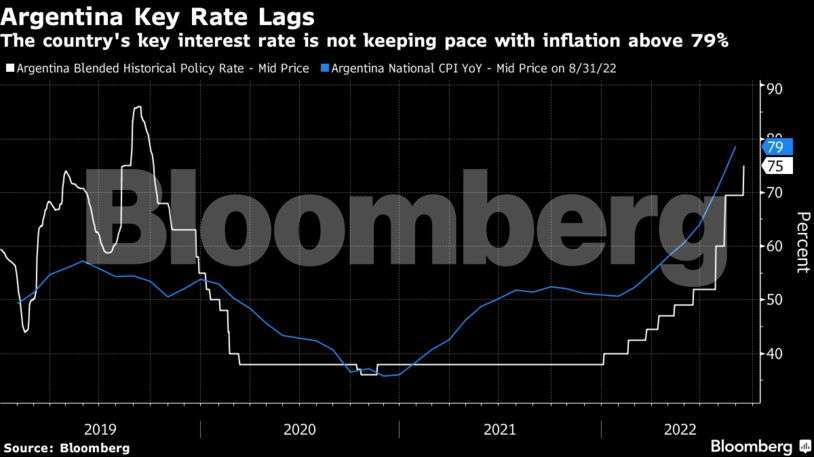

UK inflation remained near a four-decade excessive and the economic system barely expanded as industrial manufacturing and building weakened. In Argentina, inflation shot up essentially the most in three many years and prompted the central financial institution to lift its benchmark charge to a whopping 75% in an effort to prop up its forex.

Here are a few of the charts that appeared on Bloomberg this week on the newest developments within the world economic system:

US

US client costs had been resurgent final month, dashing hopes of a nascent slowdown and certain assuring one other traditionally massive interest-rate hike from the Fed. Against a backdrop of sturdy labor market situations that’s pushed up wages, odds favor the central financial institution changing into that rather more aggressive to take extra wind out of the economic system’s sails with the aim of bringing inflation down.

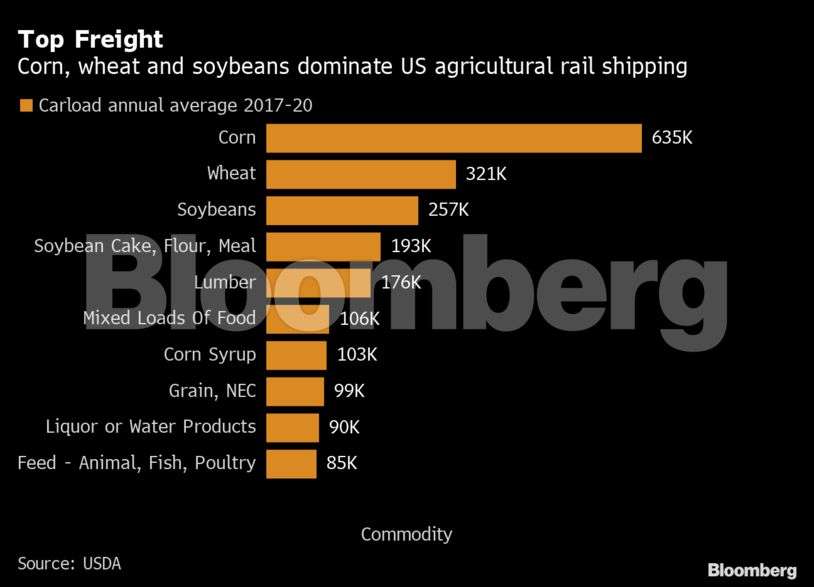

President Joe Biden hailed a tentative railway labor settlement, one which he helped dealer and that averted an economically perilous nationwide work stoppage lower than two months forward of the November midterm elections. The stoppage would have been the most important of its form since 1992 and threatened to price the world’s largest economic system greater than $2 billion a day.

Europe

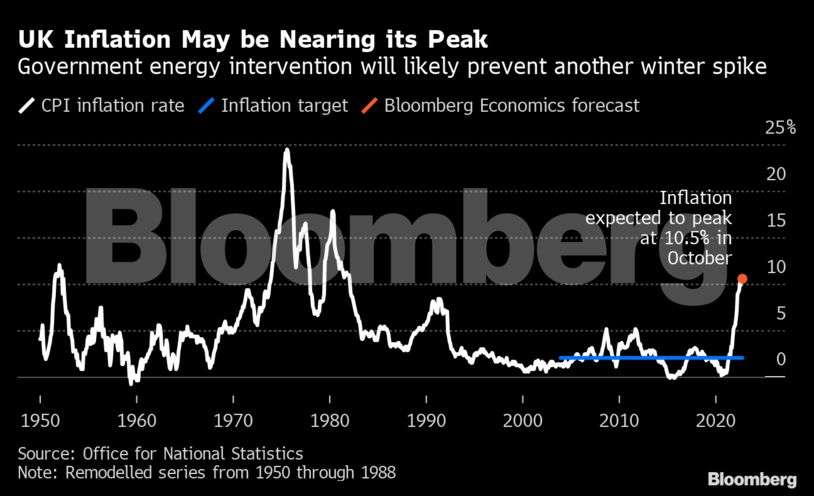

Britain’s inflation eased from its highest charge in 4 many years after petrol declined, nonetheless leaving the tempo of worth will increase uncomfortably excessive for the Bank of England. The Consumer Prices Index rose 9.9% in August from a 12 months in the past, in contrast with 10.1% in July.

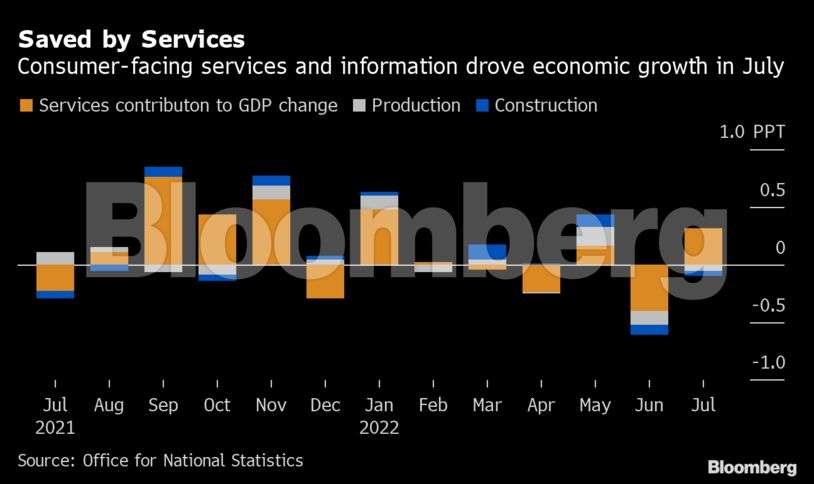

The UK economic system recovered extra slowly than anticipated from a hunch triggered by an additional public vacation in June, with industrial manufacturing and building each shrinking.

Asia

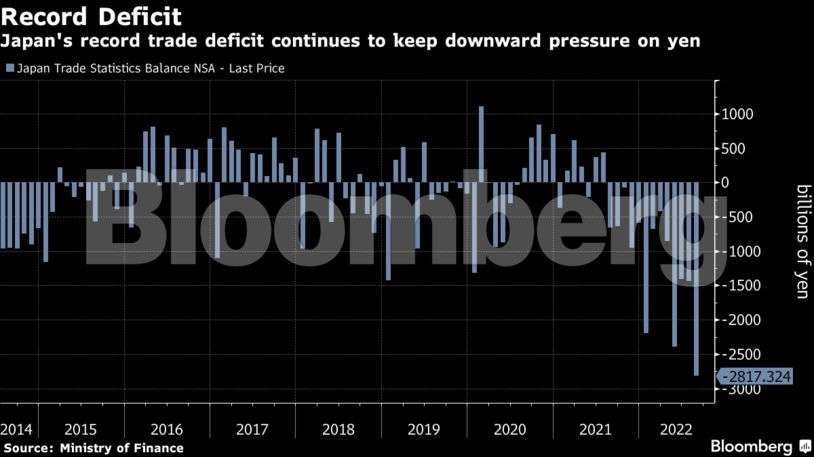

Japan’s commerce deficit ballooned to a report in August that highlights the growing ache of the weak yen as import prices spiral upwards, including to stress on the nation’s financial restoration.

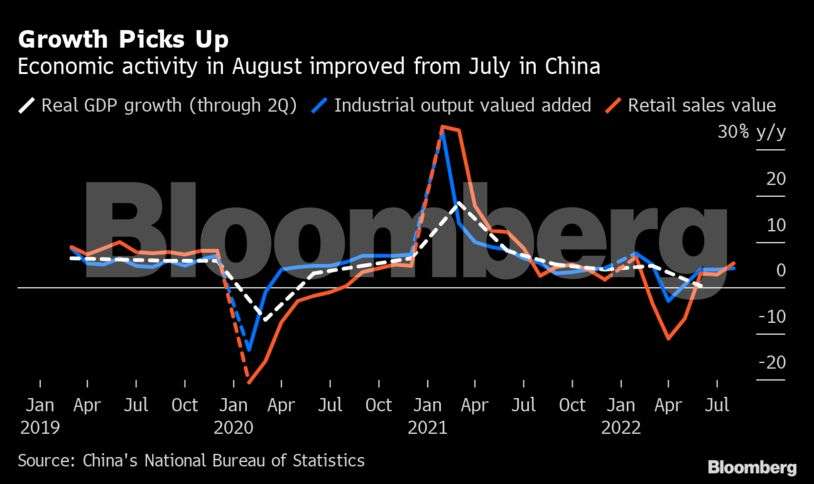

China’s economic system confirmed indicators of restoration in August as Beijing rolled out stimulus measures to counter a slowdown, though a property market hunch and Covid outbreaks proceed to weigh on the outlook. Industrial manufacturing, retail gross sales and fixed-asset funding all grew extra final month than economists anticipated.

Emerging Markets

Argentina’s central financial institution raised its benchmark rate of interest for the ninth time this 12 months to 75% in a bid to shore up its forex and curb inflation nearing 100%. Central bankers made incremental charge will increase early within the 12 months however over the previous three months they’ve ramped up hikes, with a mixed 23 share level improve since July.

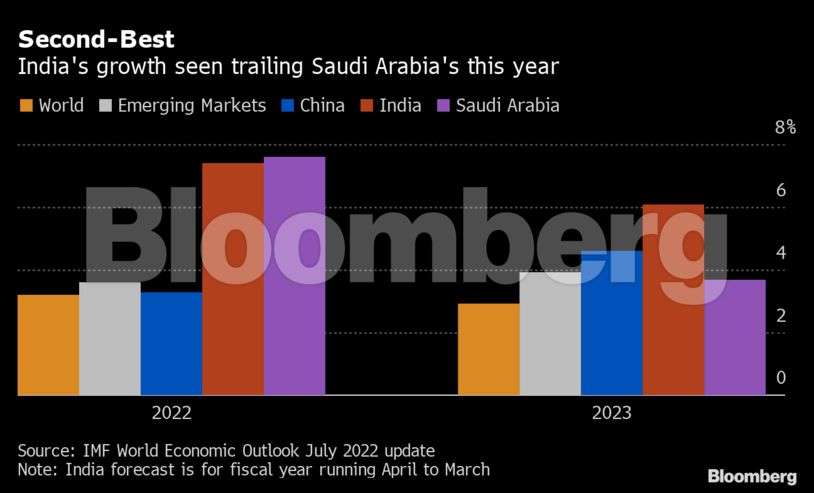

India’s central financial institution, which final month vowed to do “whatever it takes” to battle inflation, is predicted to refocus efforts towards its personal model of a gentle touchdown the place it tackles worth beneficial properties whereas attempting to make sure progress stays among the many world’s quickest.

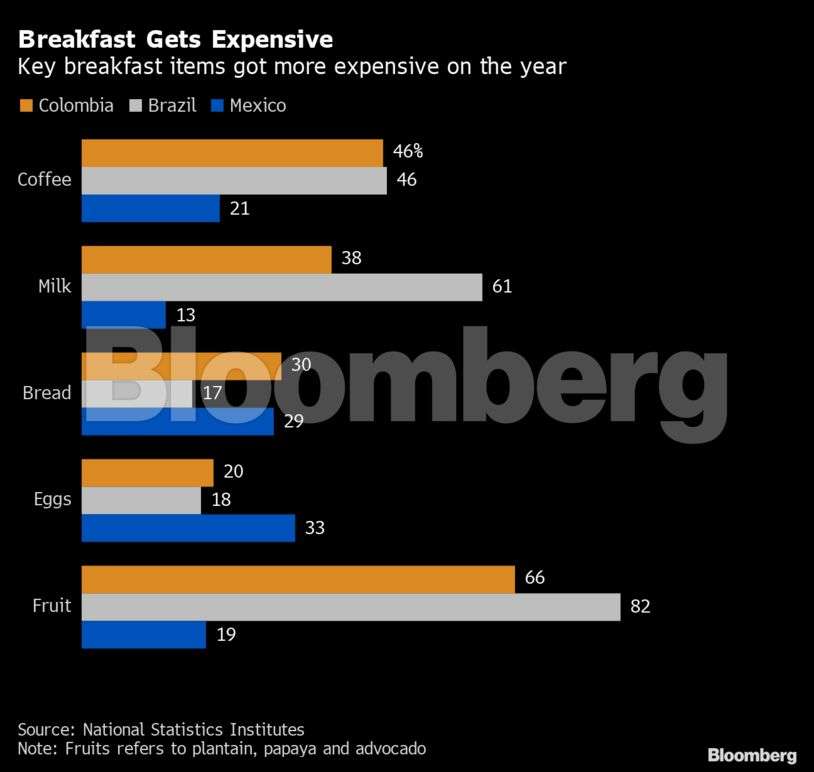

From Mexico to Brazil, persistently excessive inflation is widening the hole between wealthy and poor in what’s already the world’s most unequal area. It’s stoking political upheaval that might be a foretaste of what lies forward as coverage makers the world over wrestle to satisfy calls for to extend social spending.

World

Around the world, hovering borrowing prices are squeezing homebuyers and property house owners alike. From Sydney to Stockholm to Seattle, patrons are pulling again as central banks increase rates of interest on the quickest tempo in many years, sending home costs falling.

https://cfo.economictimes.indiatimes.com/news/charting-the-global-economy-indias-growth-seen-trailing-saudi-arabias-this-year/94279367?action=profile_completion&utm_source=Mailer&utm_medium=newsletter&utm_campaign=etcfo_news_2022-09-19&dt=2022-09-19&em=cGFua2FqLnByYW1hbmlrQGdtYWlsLmNvbQ==