With China’s tech crackdown forcing global risk investors to look elsewhere, it seems the funding tap for Indian startups isn’t going to run dry anytime soon.

It’s been a landmark year for Indian tech startups, which have already raised a record $20.76 billion from investors since January. Now, with China’s crackdown on its technology sector forcing risk investors to look elsewhere, it seems the funding tap isn’t going to run dry anytime soon.

Also in this letter:

- Milkbasket cofounder resigns, RIL execs join board

- Infosys fixes I-T portal after CEO is summoned

- Cognizant Technology faces US visa trial

Indian startups will benefit from China’s tech crackdown

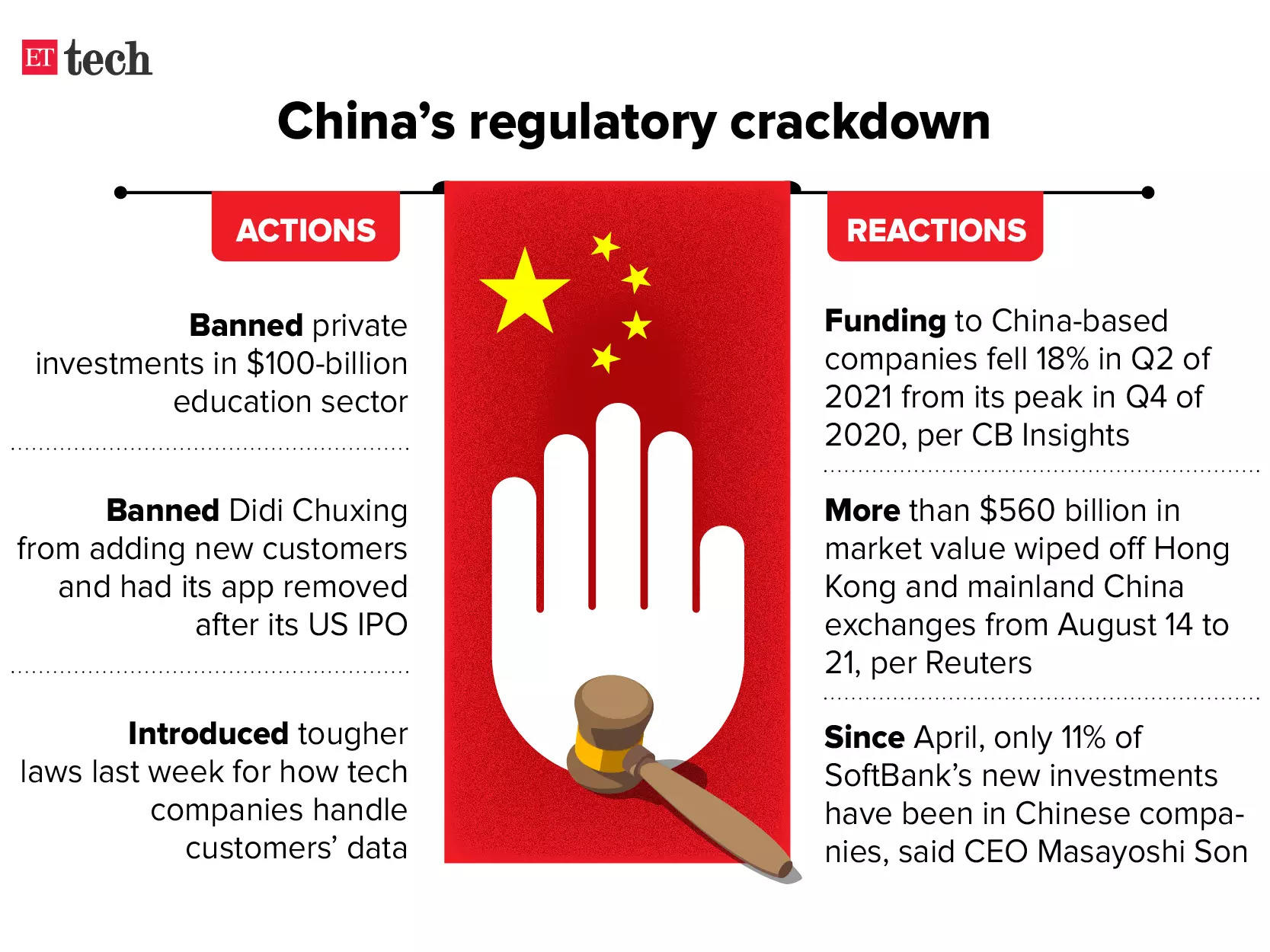

China’s crackdown on its tech sector is expected to further boost investments in India’s tech startups, which have already been raking in record sums from private equity and venture capital firms this year. That’s according to several founders and investors we spoke with.

They also said China’s continued crackdown on Big Tech firms could also trigger long-term changes in the way large internet companies are regulated globally.

Case in point: Earlier this month, education platform Eruditus saw its valuation jump 4x to $3.2 billion after it raised $650 million from SoftBank, Accel US and others.

Ashwin Damera, its cofounder and CEO, said, “China gets more venture capital than India. Now, if the Chinese funnel is getting choked, it will [have to] go somewhere. Emerging markets such as India will get that allocation.”

SoftBank leads the way: Chinese startups account for 23% of SoftBank’s portfolios in terms of fair value. But CEO Masayoshi Son said that since April, only 11% of new investments have been in Chinese companies.

Earlier this month, Son said he was being ‘cautious’ on China investments and that it may take up to two years for the situation there to stabilise.

SoftBank has a sizable India portfolio and has invested large sums in Meesho, Swiggy, Mindtickle, OfBusiness and others this year.

Third-largest market: India is the third-largest startup market for investors. So far this year, 25 new unicorns—startups valued over $ 1 billion—have been minted here.

India’s startups have raised $20.76 billion in 583 deals this year (as of August 20), according to data from Venture Intelligence. In comparison, they raised $11.1 billion in all of 2020, with 12 turning unicorns.

Fallout goes beyond money: China’s crackdown on its tech sector wiped more than half a trillion dollars off Chinese tech stocks in a week, including those of Alibaba Group, Kuaishou Technology and Tencent Holdings.

But the impact of the country’s new rules will be felt in other ways, too.

Varun Dua, founder of Acko, an insurance tech startup, said China’s clampdown may have long-term, global impact, “especially on labour rules for gig workers, data privacy and usage, corporate structures, and more regulations for fintech”.

India and other countries may adopt portions or versions of these rules as internet companies become larger and more powerful, he added. “While the underlying reasons [for framing rules] might be different, it’s a sign of things to come across the globe. These changes could take businesses years to adjust to,” he said.

https://cfo.economictimes.indiatimes.com/news/chinas-crackdown-to-boost-desi-startups/85552082