- The AI computing market may shift in 2025, opening opportunities for smaller companies.

- Nvidia dominates AI computing. Evolving workloads could benefit competitors.

- Companies like Groq, Positron, and SambaNova focus on inference to challenge Nvidia’s market hold.

In 2025, the tides may turn for companies hoping to compete with the $3 trillion gorilla in AI computing.

Nvidia holds an estimated 90% of the market share for AI computing. Still, as the use of AI grows, workloads are expected to change, and this evolution may give companies with competitive hardware an opening.

In 2024, the majority of AI compute spend shifted to inference, Thomas Sohmers, CEO of chip startup Positron AI, told BI. This will “continue to grow on what looks like an exponential curve,” he added.

In AI, inference is the computation needed to produce the response to a user’s query or request. The computing required to teach the model the knowledge needed to answer is called “training.” Creating OpenAI’s image generation platform Sora, for example, represents training. Each user who instructs it to create an image represents an inference workload.

OpenAI’s other models have Sohmers and others excited about the growth in computing needs in 2025.

OpenAI’s o1 and o3, Google’s Gemini 2.0 Flash Thinking, and a handful of other AI models use more compute-intensive strategies to improve results after training. These strategies are often called inference-time computing, chain-of-thought, chain-of-reasoning, or reasoning models.

Simply put, if the models think more before they answer, the responses are better. That thinking comes at a cost of time and money.

The startups vying for some of Nvidia’s market share are attempting to optimize one or both.

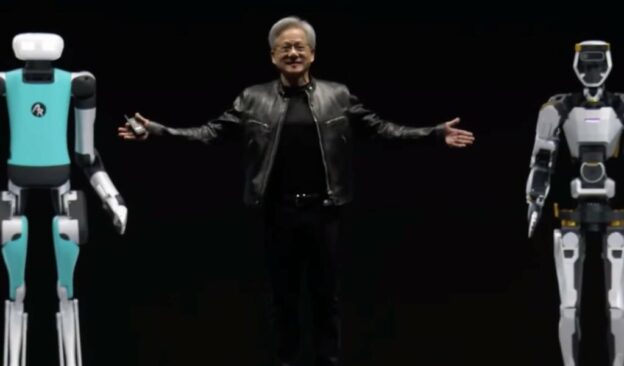

Nvidia already benefits from these innovations, CEO Jensen Huang said on the company’s November earnings call. Huang’s wannabe competitors are betting that in 2025, new post-training strategies for AI will benefit all purveyors of inference chips.

Business Insider spoke to three challengers about their hopes and expectations for 2025. Here are their New Year’s resolutions.

What’s one thing within your control that could make 2025 a big year for alternative chips?

Mark Heaps, chief technology evangelist, Groq:

“Execution, execution, execution. Right now, everybody at Groq has decided not to take a holiday break this year. Everyone is executing and building the systems. We are all making sure that we deliver to the opportunity that we’ve got because that is in our control.

I tell everyone our funnel right now is carbonated and bubbling over. It’s unbelievable, the amount of customer interest. We have to build more systems, and we have to stand up those systems so we can serve the demand that we’ve got. We want to serve all those customers. We want to increase rate limits for everybody.”

Rodrigo Liang, CEO, SambaNova Systems:

“For SambaNova, the most critical factor is executing on the shift from training to inference. The industry is moving rapidly toward real-time applications, and inference workloads are becoming the lion’s share of AI demand. Our focus is on ensuring our technology enables enterprises to scale efficiently and sustainably.”

https://www.businessinsider.com/chip-startups-nvidia-market-share-2025-2024-12