“With these silver linings, India appears to be well placed to ride through an uncertain global economic environment,” he said.

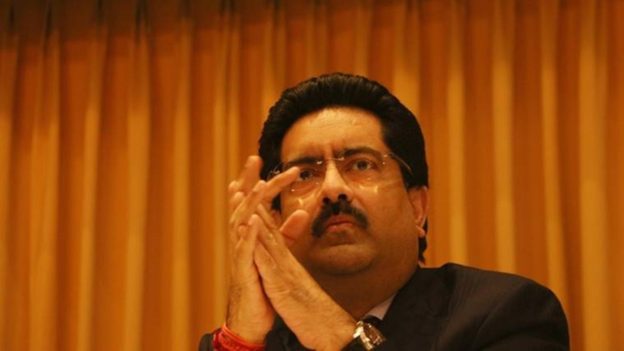

India appears to be well placed to ride through an uncertain global economic environment brought by various disruptions, which now feel like ‘business as usual’, UltraTech Cement Ltd Chairman Kumar Mangalam Birla said on Wednesday.

In his virtual address to shareholders at the cement maker’s annual general meeting, Birla said one can expect the medium-term growth recovery to remain on track even though businesses would need to remain on guard regarding financial market volatility and cost pressures this year.

“The turn of the decade felt like a moment of departure. The COVID-19 pandemic made 2020 an unprecedented year. And then the supply chain whiplash made 2021 feel unprecedented. And now, the Russia-Ukraine war and global stagflation are making 2022 feel unprecedented. Disruption now feels like ‘business as usual’,” he said.

Birla noted that the Indian economy has not remained unscathed by these global developments.

India has also witnessed upward pressures on inflation, rate hikes by the RBI and a widening trade deficit, he said, adding that “nevertheless, there are also bright spots in India’s overall economic narrative — which are bolstering our resilience through the broader global economic turmoil.” He pointed out that the economic recovery cycle in India remains firmly in place thanks to the significant progress on vaccination and the upswing in public capital expenditure (capex).

Moreover, while India’s inflation rate has been above the RBI’s tolerance range for some time, the overshoot has not been as severe as in many other countries, he said.

Monetary and fiscal authorities have taken steps to dilute the inflationary pressures, and a normal monsoon this year will help soften these pressures further.

Although the trade deficit is rising, Birla said India’s external indicators remain supported — with foreign exchange reserves equivalent to more than nine months of imports despite some decline in recent months.

“With these silver linings, India appears to be well placed to ride through an uncertain global economic environment,” he said.

Birla further said factors such as the government’s pragmatic policies such as production linked incentives and robust pipeline of infrastructure projects have been helpful.

Dynamism in India’s digital ecosystem, diversification of global supply chains away from China and the greater emphasis of investors on sustainable finance also offer new opportunities for India, he added.

“Thus, while businesses will need to remain on guard regarding financial market volatility and cost pressures this year, one could expect the medium-term growth recovery to remain on track,” Birla said.

While the global economies recovered from the pandemic shock in 2022 on the back of supportive fiscal and monetary policies and mass vaccination programs, Birla said in recent months, the war in Ukraine and looming fears of a global recession have posed macro headwinds.

The resultant tightness in energy markets, concerns around energy security of some regions and elevated fuel prices have spurred a chain reaction, fuelling the existing inflationary impulses, he added.

Birla also pointed out that in order to fight inflation, central banks have normalised monetary “policy faster than anticipated, denting consumer confidence and dampening risk sentiment in the financial markets.” Also, he said the global supply chain disruptions due to pandemic-induced lockdowns have been replaced by new disruptions due to the war in Ukraine and the lockdowns imposed in China last quarter.

On UltraTech, Birla said the new capacities from the fresh capex of Rs 12,886 crore towards increasing capacity by 22.6 MTPA with a mix of brownfield and greenfield expansion, are expected to go on stream in a phased manner by FY25.

“Upon completion of the latest round of expansion, your company’s capacity will grow to 159.25 MTPA, reinforcing its position as the third largest cement company in the world, outside of China,” he added.

https://www.financialexpress.com/economy/disruption-now-feels-like-business-as-usual-kumar-mangalam-birla/2633659/