In volatile times, do not sell equity investments. Stick to your asset allocation plan and use the correction to buy quality stocks for long-term

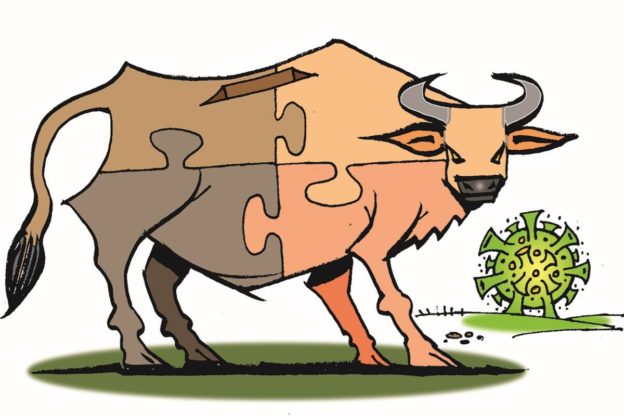

As the 30-share BSE Sensex has dropped over 4,000 points from the February 15 peak of 52,154, many equity investors would be reminded of March last year when the index fell 23% in the month due to the outbreak of the Covid-19 pandemic and the nation-wide lockdown. As the second wave of the pandemic has hit the country, investors should look at ways to safeguard their portfolio against a downturn.

Most individual investors sell in panic when the markets are volatile. While it is quite natural for investors to sell in times of uncertainty to avoid the risk of further loss, it is often counter-productive when the market sees a sharp rally as was seen last year. Experts suggest that investors stick to their asset allocation plan, remain focused on the long-term goals, diversify their portfolio, and stay away from panic in the markets.

Hold on to your stocks

By selling stocks when the markets are falling an individual will not only upset his asset allocation by selling, but will lose out on benefiting from a market upturn. A sharp rebound in the market post-redemption will lead to unnecessarily booking notional losses and severely impacting your financial goals. Experts suggest that market downturns almost always open up new opportunities in areas of the market that were overlooked or overvalued before the downturn. So, instead of a complete exit, one can look at selling those stocks which are fundamentally weak and investing in those stocks that have the potential to rebound fast.

In a note to clients, Jitendra Gohil, head, India Equity Research, Credit Suisse Wealth Management, India, says the equity market could see some further profit booking in coming weeks. “We expect this correction to be very sharp and to not last long. Hence, we recommend investors use this correction as a buying opportunity from a six to nine-month perspective. We continue to prefer cyclicals and mid-caps,” he says.

Similarly, Vinod Nair, head of Research at Geojit Financial Services says the market has been going through a correction phase following increasing Covid cases, in spite of the optimism due to vaccination drives. “Though earnings outcome is expected to have stock-specific movements in the coming days, broader movement in the market will depend on fall in Covid cases,” he says.

Rebalance your portfolio

As different asset classes move in different directions, it is always advisable to review your asset allocation at regular intervals. So, if equity allocation rises due to an increase in stock prices, it should be brought down to its original levels by booking partial profits. Experts suggest booking profits when equity valuations are rising will help an investor to invest again at lower levels. For instance, one can redeem equity units accumulated over four years which have yielded returns of 15% per annum and park the redeemed amount in shorter duration funds. This approach will help to reduce risk in the portfolio.

Stick to your SIPs

Investors must continue their systematic investment plans (SIP) unless there is a crash crunch. In fact, SIPs allow an investor to buy units on a given date each month and he does not have to time the market. While SIP collections have increased over the years, they declined to Rs 96,080 crore in FY21 as compared to Rs 1,00,084 crore in FY20 because of income uncertainty. From an all-time inflow of Rs 8641 crore in March last year, SIP inflows dropped every month till February this year, and touched a record high of Rs 9,182 crore in March. While many investors stopped or paused their SIP because of income uncertainty and cash crush, a lot of investors booked profits because of the sharp rally in the markets.

Investors must understand that more units are purchased when a scheme’s net asset value (NAV) is low and fewer units when the NAV is high. As a result, the cost is averaged out and, and the longer the time-frame of the investment, the larger will be the benefits of averaging. In volatile market conditions, individual investors can stagger investments through STPs by investing a lump sum in debt, which could be a liquid or ultra short term fund, and then transfer a fixed amount either monthly or quarterly into an equity fund.

https://www.financialexpress.com/money/equity-investing-safeguard-your-portfolio-against-a-downturn/2239276/