-

Clean hydrogen has an important role to play in the energy transition, alongside renewables and carbon capture solutions.

-

Hydrogen and hydrogen-based fuels could help decarbonize hard-to-abate sectors like power generation, transport and some heavy industries.

-

While the market for clean hydrogen is growing, it is not increasing fast enough to meet the IEA’s Net Zero Emissions by 2050 Scenario.

You can’t see it or touch it, but it’s in everything you see and touch.

We’re talking about hydrogen – the most abundant element in the universe – and its potential as an energy transition fuel, which is generating a lot of excitement in the energy industry and beyond.

If you’re wondering why there’s so much talk about hydrogen lately, what it’s used for and its potential to help achieve climate goals, read on.

What is hydrogen and why is it important?

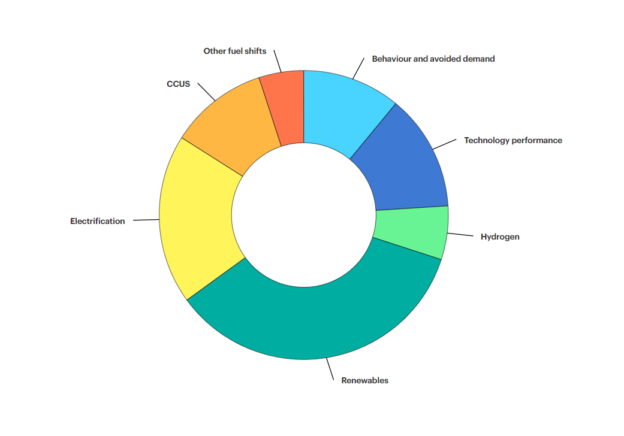

Operating at scale, clean hydrogen and hydrogen-based fuels could play a central role in efforts to decarbonize the global energy system, alongside technologies like renewables and carbon capture, utilization and storage solutions.

Clean hydrogen is increasing in importance as a way to help achieve net-zero ambitions. Image: IEA

As part of the Net Zero Emissions Scenario 2021-2050, hydrogen and hydrogen-based fuels could avoid up to 60 gigatonnes of CO2 emissions by mid-century – equivalent to 6% of total cumulative emissions reductions, according to the International Energy Agency (IEA).

Uses of hydrogen

So why is there so much buzz about the benefits of clean hydrogen as an energy transition fuel?

Part of the reason is hydrogen’s potential to help decarbonize sectors like power generation, transport and some heavy industries.

While the growth of wind, solar and other renewables is vital for the global energy transition, these clean energy sources suffer from intermittency: a lack of wind or sunshine that can leave a hole in electricity supplies. For this reason, a base-load fuel is needed to generate power on demand to compensate when output from renewable sources is low or to boost supply during periods of peak electricity demand. That’s where fuels like low- or no-carbon hydrogen come in.

Similarly, clean hydrogen could help decarbonize hard-to-electrify heavy transport sectors like shipping, railways and buses. The IEA’s Global Hydrogen Review 2022 notes positive signs of progress in this field recently, as the first fleet of trains powered by hydrogen fuel cells began operating in Germany, for example.

More than 100 pilot and demonstration projects are underway using hydrogen or its derivatives to fuel shipping.

Strong interest is being shown for these fuels, with several strategic partnerships in place within a shipping sector keen to curb its emissions in the face of ever-stricter regulatory restrictions imposed on fleet owners and operators by the International Maritime Organization (IMO).

Some heavy industries are also eager to embrace the decarbonizing potential of hydrogen. A year after the first experimental projects produced clean ‘green’ steel using renewable energy, a flurry of new steel projects have been announced that will use emissions-free hydrogen in the direct reduction of iron.

Clean hydrogen produced using renewable energy can help steelmakers produce emissions-free ‘green’ steel. Image: Reuters/Srdjan Zivulovic

The hydrogen rainbow

It’s important to note that not all types of hydrogen are created equally. Despite being a colorless gas, hydrogen is labelled in a rainbow of colors, each representing a different method of production with its own emissions footprint. However, these are the three main colors of hydrogen:

Grey – Hydrogen produced by combusting natural gas, which emits CO2 into the atmosphere. (This method emits less than black or brown hydrogen produced using different types of coal.)

Blue – Low-carbon hydrogen produced by combusting fossil fuels but with carbon capture, utlization and storage technology removing most CO2 emissions from flue gases.

Green – Emissions-free hydrogen produced using an electrolyzer powered by renewable energy.

The vast bulk of hydrogen in use today is generated using fossil fuels, which emits CO2 into the atmosphere and contributes to the climate crisis. In 2021, natural gas accounted for around 60% of total production with coal accounting for about 20%, the IEA notes.

Demand for hydrogen reached 94 million tonnes (Mt) in 2021, containing energy equivalent to about 2.5% of global final energy consumption. The production of low-emissions hydrogen accounted for less than 1 Mt.

Generating a clean hydrogen future

The good news is that the market for hydrogen is growing. Demand reached 94 million tonnes in 2021, containing energy equal to about 2.5% of global final energy consumption, up from a pre-pandemic total of 91 Mt in 2019, IEA figures show.

While most of the increase came from fossil fuels, there are signs of positive change on the horizon with a spike in low-carbon hydrogen projects being planned, including several at an advanced stage.

If all current projects are brought online, by 2030 low-carbon hydrogen capacity could reach 16-24 Mt annually, with green hydrogen from electrolyzers accounting for 9-14 Mt and blue hydrogen accounting for between 7-10 Mt.

However, in a sector characterized by a trinity of uncertainties about future hydrogen demand, inconsistent regulatory frameworks and a lack of available infrastructure to transport hydrogen to offtakers, just 4% of new projects are under construction or have made it to a final investment decision, the IEA Hydrogen Review 2022 shows.

In 2022, year-on-year annual electrolyzer capacity doubled to reach 8 gigawatts, helping combat climate change.

If all the new projects announced by industry are brought to life, this could reach 60 gigawatts annually by 2030. If this happens alongside the planned scale-up in manufacturing capacities, the cost of electrolyzers could fall by 70% by 2030, compared to 2022 prices – similar to the dramatic price falls that helped boost wind and solar power take-up.

Amid these signs of progress, there are also words of caution. Production of clean hydrogen is not growing fast enough to meet the IEA’s Net Zero Emissions by 2050 Scenario.

Urgent action is required to encourage greater investment and incentives to both scale up supply and create demand for premium-priced low-carbon hydrogen.

https://www.weforum.org/agenda/2022/11/hydrogen-clean-energy-transition/