For a country that’s adding billionaires at the world’s fastest pace, China doesn’t have many businesses that specialize in serving ultra-high-net-worth individuals.

The nation’s newly wealthy are distrustful of outsiders and clans frequently prefer turning to executives within the family business to run their investments. Still, succession is beginning to loom large for thousands of families as the next generation comes of age.

A new breed of professionals is rising to the challenge. They offer the usual suite of services, advice on taxes, alternative investments and charitable giving with a high level of discretion and personalization. Many go a step further to win trust, with the more experienced offering sometimes unconventional ways to deepen the relationship.

Alvin Syh, president of Anrich Capital, is among them. He helped set up an entire supply-chain company to help one client’s U.K.-educated child gain more business experience on the ground. He secured a former Alibaba Group Holding Ltd. veteran as adviser, found a CEO and hired around 20 employees.

After attending board meetings for four months as a director to keep an eye on things, Syh ceased his involvement. Now, he said, he’s coaching a handful of young people for several clients while also managing their family money.

Every rich family in China gets approached by lots of people, Syh said. “If you don’t have a family’s trust, you can only sell products” like a wealth management firm would, he said.

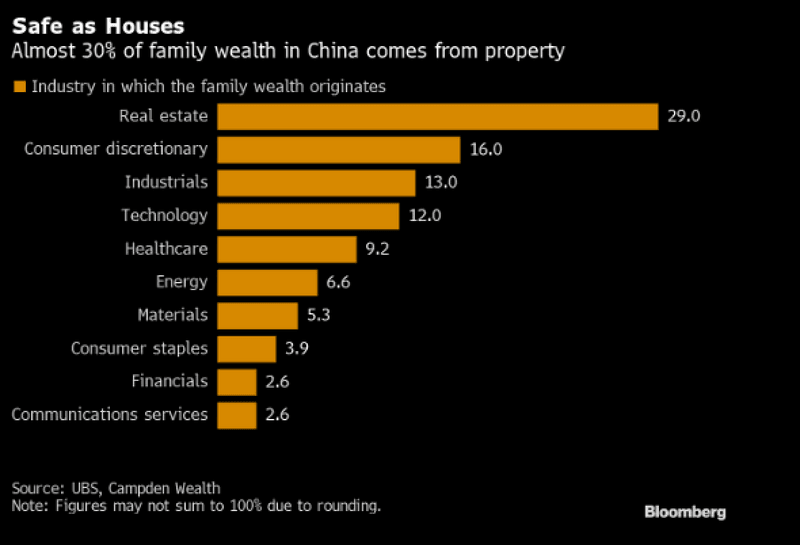

The concept of a family office in China is nascent, according to UBS Group AG. The lines between family business entities and ultra-high-net-worth individuals are often blurry. Rules governing family offices and trusts are only beginning to be developed.

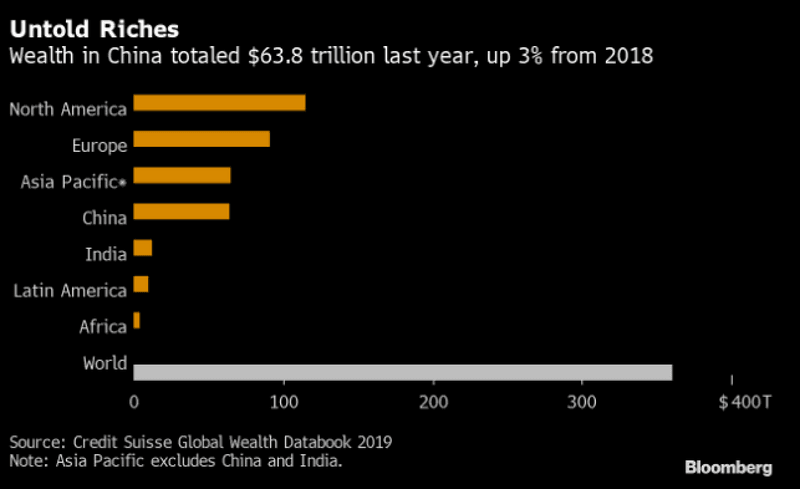

Yet China has fantastic wealth – $64 trillion of it, or almost 20% of the global total. The number of millionaires increased to 4.4 million last year, more than in Japan and second only to the U.S., a Credit Suisse Group AG report published in October showed. China also has 61,587 individuals worth more than $30 million, according to a Knight Frank LLP study released earlier this month.

Some of China’s mega-rich have elected to locate their family office outside of China. Blue Pool Capital Ltd., which manages part of the fortunes of Alibaba Group Holding Ltd. co-founders Joe Tsai and Jack Ma, is based in Hong Kong, for example. Singapore, with its favorable tax breaks, is another popular location.

The industry is slowly also beginning to take root on the mainland.

One of the biggest is Beijing-based Wu Capital, which manages money for the family of real-estate tycoon Wu Yajun, the chairwoman and largest shareholder of Longfor Properties Co. Wu has a net wealth of $12.7 billion, according to the Bloomberg Billionaires Index.

Wu Capital has a 20-strong team that invests globally in everything from hedge funds to private equity. One of its latest deals involved Akouos Inc., a precision genetic medicine company, and it’s also invested alongside Renaissance Technologies LLC and Hillhouse Capital Management Ltd.

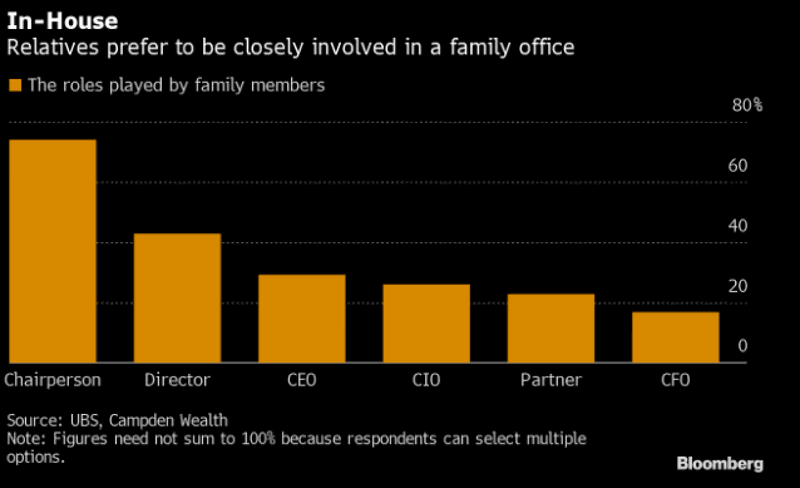

That’s much grander than most family offices in China. According to a report published by UBS, AVIC Trust Co. and consultancies Campden Wealth and FOTT in January, the average staff size is nine, including two family members who generally take up the key roles of chairman or director.

“There aren’t enough mature independent multi-family offices in China,” said Jun Mao, the founder of Viva Ventures, which manages around $500 million, mostly Mao’s family money.

Mao’s family set up Viva in part to avoid the high expense of investing through private funds, most of which she said barely beat inflation anyway.

With turmoil sweeping global markets amid the coronavirus outbreak, Mao sees investing through a family office as allowing the wealthy to take the long view.

She’s looking for “rare entry points,” she said. “When valuations of your target industries and companies drop and become reasonable, opportunities present themselves.”

One reason there aren’t more family offices in China stems from cultural differences. As one survey respondent told Campden Wealth and FOTT: “Reservations about discussing wealth are deep-rooted in Chinese history.”

The UBS, Campden Wealth and FOTT study canvassed families with an average wealth of 6.5 billion yuan ($926 million). More than half said the preferred way to choose an adviser was recommendations from family and friends. Trust, confidentiality and reputation were by far the most important considerations.

Hopson Huang sees opportunities for service specialists to capitalize on that. Based in Europe, Huang works for Hoca Capital NV, which manages money for a wealthy Belgium family. He’s their Greater China head, and travels to the mainland frequently, visiting both big and small cities, to source investment opportunities.

To bridge the yawning trust gap, Huang said external managers need to deepen ties by sharing risks, like being willing to convert performance fees into equity in a family’s business, if that’s what’s desired.

It’s also useful to be able to help develop young scions to a point they’re ready to take the reins – according to a PricewaterhouseCoopers survey in 2018, just 21% of wealthy families in China had a succession plan, compared to 49% globally.

“There’s greater value in cultivating people than investing money,” Huang said.

Preparing children to enter the family business in China can be more intense versus elsewhere. In Asia, family values are often deeply ingrained and there’s a stronger sense of obligation toward one’s parents.

“One family member has been preparing since she was young – 13 or 14-years-old,” an interviewee recounted to FOTT and Campden Wealth. “After school or during the holidays, her father took her to meetings. Over time, she came to understand the basic structure of investments.”

Viva’s Mao said “good parents” won’t let others school their children on the world of business in China. That makes it hard for family offices to turn hand-rearing children into a truly sustainable business, she said.

Regardless, Syh is confident change can happen.

“A good family office needs a strategy for the future of the entire family, something that can sustain a clan through wartime, tumult and illness,” he said. Prosperity for the industry “can be expected in the next 10 years.”

https://www.bloomberg.com/professional/blog/family-offices-chasing-64-trillion-making-inroads-in-china/