How the Indian government is gearing up to achieve jet engine manufacturing capabilities which are fundamentally all about highly complex core elements, including advanced materials? Take a deeper look at the highly complex world of jet-engine and solutions through global collaboration with Safran and GE.

With the rocketing success of the Indian space programme—as advanced among the world’s top 4 space entities—which is driven by Indian Space Research Organisation (ISRO), the question is often being raised in comparison to military aerospace projects. Straight away, the questions hint at the development of fighter jets and to be specific the jet engine. While the LCA Tejas did succeed with 4+ generation capabilities, it failed to develop a viable and functional jet engine, beginning with the Kaveri engine.

In fact, it is the jet engine that is still defined as the most complex technological feat in the era of artificial intelligence and machine learning.

That is now set to change as the government strived to fill that technological void. The radical approach and importance that the government adopted, led to two leading global engine makers joining hands with India.

The recent talks with world-leading original engine manufacturers (OEM) Safran is a defining moment which actually lays the foundation of a new jet engine with best of class thrust ratio to power next-generation (5+) fighter jets.

However, it is important to understand what is actually needed to develop a jet engine which could power India’s highly ambitious programmes like Advanced Medium Combat Aircraft (AMCA), Multi-Role Fighter Aircraft (MRFA) and possibly Tejas Mk2.

The technological gaps are well understood now as India learnt during the development stage of the Kaveri engine, which was sanctioned in 1989 for LCA Tejas.

Propulsion technologies

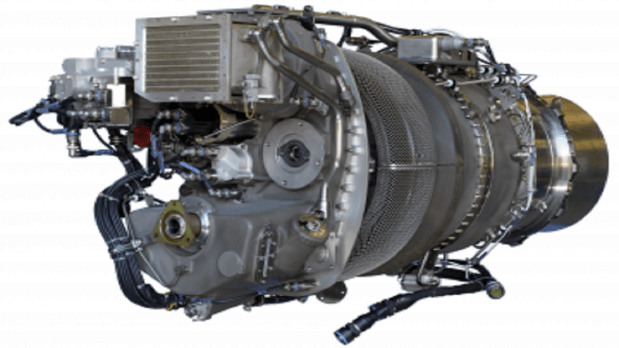

The jet engine is fundamentally all about the three highly complex core elements – advanced materials and process technology, combustion technology and Computational Fluid Dynamics (CFD) in engine design procedures.

Worldwide, all gas turbine engines have now improved turbine inlet temperature and compressor pressure ratio. The core functional aspect of the turbine has been transformed with a greater bypass ratio and nacelle performance which also boosts emissions.

The Kaveri turbofan engine faced thrust deficit performance at high altitudes, excessive weight and a “mysterious noise”. The noise that emanates from the excessive heat in the core could not be rectified but that corresponded to the material within.

The material in question is the superalloys which can withstand combustion heat beyond 1,800°C. To generate 110-kN wet and 75-kN dry thrust aimed at new engines for Indian fighter jets, the higher heat- resistance materials were needed. And that is about finding high-temperature materials-mix and technology to process it for jet engine. Mostly, silicon carbide (SiC) and ceramic matrix composite systems are the proven ones for jet engines which India lacked. Besides, ceramic matrix composite materials are a choice for aerospace structural parts, which are largely utilized by the world’s leading global engine manufacturers, Safran and GE among others.

Despite the challenges, ISRO has successfully used such complex materials, especially Carbon-carbon composites for aerospace structures in the parts of gas turbine engines such as flaps, vanes, seals and liners. That remains for India’s ingenious plan for jet engine.

That is where the recent development and foreign collaborations matter where India needs to address the ceramic matrix composites (CMCs) for engine, especially the core.

Both global leaders of the jet engine — Safran Aircraft Engines and GE – can resolve the materials issues. In fact, jointly, Safran and GE have established an entity which is known as CFM Materials for their existing and futuristic jet engine.

Additionally, the CMCs are also being tested with CentrAl reinforced aluminium (CentrAl) which can drastically improve performance and reduce the cost of aircraft manufacturing. CentrAl has proved to be 25% more tensile strength than high-strength aluminium alloys, with high fatigue resistance and high damage tolerance. For example, CentrAI has made a massive difference in CFM LEAP high-bypass turbofan engines which reduced fuel consumption by 16%.

Another key area that is being addressed, focuses on the CFD for jet engine solutions in the areas such as aerodynamics (Fluid Analysis), structure-fluid interface analysis, and heat transfer analysis. Besides, the CFD will provide tech capability for components managing heat in avionics systems, electrical and electronics systems, landing gear wheels, air-conditioning units, fuselage and cockpit pressurization units. The CFD will be crucial for fluid analysis, and aerodynamic analysis in aircraft comprising pressure, velocity, lift, drag, etc.

The other areas which need to be highlighted are single crystal blade technology, integrated rotor disk and blades. These are again highly dependent on the advanced materials mix.

Safran-HAL co-development

Once we cross the materials issue, the next stage is about developing capabilities for the supply chain of components & ancillaries in India for the next-generation 110 KN engine for AMCA and MRFA.

Safran is already heavily investing in 6th generation fighter aircraft with afterburner thrust of 125 kN. That if it is well negotiated, will design & develop a 110kN engine with India without any hiccups and clauses which is prevalent in the inner world of elusive jet technology.

Here, the collaboration will enable critical cast components of Titanium and Super Alloys. India can not only leverage Safran’s M88 engines which power Rafale fighter jets but the new -engine for military aircraft engine and other critical applications.

Collaboration is a much better option for India as it tests our real ambitions & efforts for such high tech. DRDO’s Gas Turbine Research Engine (GTRE) has achieved some good fundamental success in single crystal blades where the French giant Safran will play an immense role which includes the core material, computational fluid dynamics & heat management etc.

In fact, Safran has proposed a better engine core than M-88 which powers Rafale.

Besides, Safran Helicopter Engines and HAL are already in the process of setting up their new joint venture company in Bengaluru, which will be dedicated to the design, development, production and support of helicopter engines for the 13-ton Indian Multi-Role Helicopters (IMRH) and its naval version, the Deck Based Multi-Role Helicopter (DBMRH).

In fact, elaborating on the proposed collaboration, Cedric Goubet, CEO of Safran Helicopter Engines, explained: “We at Safran Helicopter Engines are truly elated to partner with HAL and India to craft this new turboshaft engine joint venture set to address the Indian market and also future export opportunities.”

Safran’s Ardiden 1H1 engine with Hindustan Aeronautics (HAL) as later called Shakti, is one of the most successful high-tech military projects which powers India’s all indigenous helicopters, including the Advanced Light Helicopter (ALH) Dhruv, ALH Rudra and Light Combat Helicopter (LCH) Prachand.

Here, the scope of tech-collaboration has touched the engine manufacturing process in its entirety, including the two-stage centrifugal compressor, single-stage gas generator turbine, reverse flow combustion chamber, two-stage free power turbine, gear box unit and Dual channel FADEC (Full Authority Digital Engine Control). HAL will further leverage the compact modular design of Shakti 1H1 for IMRH and high-altitude sustained capabilities in extreme conditions.

Along, the civil space is witnessing unprecedented demand and transactions. The LEAP and its predecessor, CFM56, which power over 330 Airbus A320/A320neo and Boeing 737/737 MAX aeroplanes are hovering in the Indian sub-continent.

With 1,500 LEAP engines currently on order and with the proposed Maintenance, Repairs and overhaul (MRO), Safran is also geared to build parts.

According to a recent study, the aero-engine market is expected to grow from $54.7 billion in 2022 to $112.6 billion in 2029 at a CAGR of approximately 11%. India is expected to order 500 military aircraft over the years. Broadly, taking account of services requirement, there will be demand for 2,700 turbine engines for fighter aircraft, including those for replacement and trainers, and over 5,000 helicopter engines of various classes.

https://www.financialexpress.com/business/defence-fighter-jet-engine-how-india-is-filling-gaps-in-critical-materials-core-technology-3174356/