The only thing that has changed in effect is that these enterprises are no longer under the direct administrative control of the Department of Defence Production (DDP)

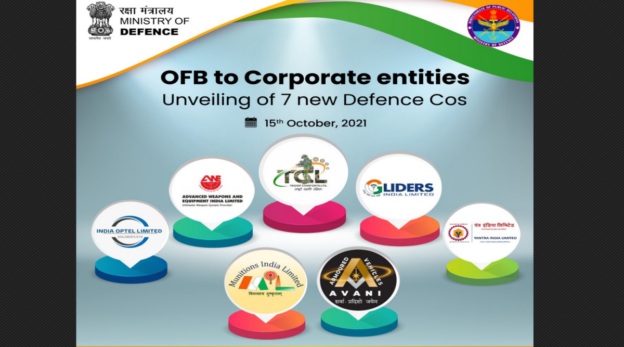

Very little is known of the performance of the 41-odd ordnance factories managed by the erstwhile Ordnance Factory Board (OFBs), some 18 months after it was dissolved by a government fiat and the factories were reconstituted into seven autonomous state-run Defence Public Sector Undertakings (DPSUs) in October 2021, in addition to the nine already existing enterprises.

The new DPSUs that emerged after the OFB’s corporatisation include Advanced Weapons and Equipment India Limited (AWE), Armoured Vehicles Nigam Limited (AVANI), Gliders India Limited (GIL), India Optel Limited (IOL), Munitions India Limited (MIL), Troop Comforts Limited (TCL), and Yantra India Limited (YIL). Expectedly, these are staffed and managed largely by the erstwhile OFB officers, experienced in running their respective units dotted across the country.

The only thing that has changed in effect is that these enterprises are no longer under the direct administrative control of the Department of Defence Production (DDP), under whose careful watch the OFB was roundly vilified by the armed forces for the putative sub-standard performance.

The OFB’s corporatisation had previously been recommended by several committees headed by senior officials like former civil servants TKA Nair and Vijay Kelkar and one by Vice Admiral Raman Puri (retd), but no blueprint for this transition and subsequent functioning of the emergent DPSUs was in place when it actually occurred.

To address this problem, an Empowered Group of Ministers (EGoM) headed by Defence Minister Rajnath Singh was established in September 2021 to ‘oversee and guide the entire process, including transition support and redeployment plan for employees, while safeguarding their wages and retirement benefits’. The EGoM also included the union Home and Finance ministers.

Not much is known of how the EGoM has been steering the transition to ensure that the new enterprises become commercially profitable, but prima facie some ticklish issues affecting the functioning of the new enterprises remain unaddressed.

For instance, therespective Board of Directors of these new enterprises do not seem to be adequately empowered to take commercial decisions, especially with regard to capital expenditure (capex) on modernising the assorted plants and machinery. This is a sine qua non, or essential pre-condition, for these new companies to become competitive in the acutely restricted and highly competitive defence market in India and abroad.

It is no secret that the DDP’s administrative and financial stranglehold debilitated the OFB, as did its complex procedures. These problems endure even after the ordnance factories have transmogrified into DPSUs. And whilethe procedures can be customised by each DPSU within the broad framework of the General Financial Rules, the issue concerning financial autonomy is tricky.

All Indian PSUs, including the DPSUs, operate in accordance with the instructions and guidelines issued by the Department of Public Enterprises (DPE). According to the DPE’s 1997 and 2005 directives, each individual PSU’s Board of Directors is authorised, without prior government approval, to approve capex of up to Rs. 150 crore or equal to 50% of the net worth of the enterprise, whichever is less, but this delegation of power is not unfettered.

These powers can be exercised by only those PSUs whose balance sheet shows profit in each of the three preceding accounting years and a ‘positive’ net worth of not less than Rs 500 crore, including the fixed assets and capital works in progress. The financial powers exercisable by the DPSUs which do not meet either of these two conditions are quite low, as low as Rs 10 crore if the net worth is less than Rs 100 crore. These low net worth companies are required to approach the government for approval of the investment proposals. This is a time consuming exercise.

This could be problematic for the new DPSUs. While each, or all, of them would probably have net worth exceeding Rs 500 crore, their balance sheet cannot show profit for the preceding three years, as they were incorporated only in late 2021. Consequently, these DPSUs must approach the DDP for approval of even very small value investment proposals, exceeding Rs 10-20 crore depending on the net worth of the DPSU seeking the approval. This restriction on the exercise of capex powers can affect the new enterprises’ ability to take quick investment decisions.

As a part of the capital outlay for the defence services, the government has been allocating funds to the newly created DPSUs under two budget heads: ‘Emergency Authorisation for the newly created DPSUs’ and ‘Investment in Public Enterprises’.

Under the former category, Rs 2,500 crore was allocated in the current financial year (FY), in addition to an equal amount in the previous FY 2021-22. These allocations were intended to service all ‘committed liabilities’ or making payments for previously concluded contracts. But since no such allocation has been made for the upcoming FY 2023-24, it can be presumed that the new DPSUs have squared up all their previous liabilities.

However, it’s the investment in the new projects and programmes which poses a problem. For one thing, the financial limit of Rs 150 crore up to which these powers can be invoked without prior government approval is outmoded, having been fixed over 17 years ago.For another, even these powers cannot be exercised by the Board of Directors of the new enterprises on their own without the DDP’s prior approval as none of them can meet the condition relating to the net profit in the preceding three years.

In the FY 2021-22, the government had collectively invested Rs 1,643 crore in all DPSUs, but thereafter in the FY 2022-23 this allocation dropped to Rs 1,310 crore. An equivalent sum has been allocated for the FY 2023-24 and the same level of funding is anticipated for the upcoming two or three years.With limited financial powers to sanction capital projects, the new DPSUs could come under pressure to utilise these funds. In fact, the very purpose of providing funds for capex to the new DPSUs can get defeated by the restricted delegation of financial powers.

Having to depend on clearance of capex proposals by the DDP is not conducive to efficient financial management of commercial organisations like the DPSUs. Persisting with the financial powers delegated 17 years back also indicates a lack of trust in the Board of Directors which comprises senior and experienced professionals, including a representative of the ministry, to take commercially sound investment decisions.

What purpose is served by restraining the powers of the Board of Directors, and what contribution is made by the DDP when an investment proposal is referred to it, remain shrouded in mystery. If anything, delegation of emergency procurement powers to the armed forces up to Rs 500 crore is a tacit admission of the fact that it takes a long time for the ministry to take a decision on the proposals referred to it.

The Board of Directors of the new enterprises -the new ones at any rate- must be similarly trusted as the armed forces with higher delegation of financial powers, for eventually they are the ones responsible for running the DPSUs, efficiently and profitably. The EGoM must step up to the plate to ensure that the new DPSUs quickly stabilise as commercially vibrant enterprises and contribute to the cherished goal of self-reliance in defence production.

https://www.financialexpress.com/defence/financial-stranglehold-on-new-dpsus-can-undermine-their-commercial-growth/2994076/