India’s fintech sector is set for landmark Initial Public Offerings (IPOs) in the next five months as at least three startups – Paytm, Mobikwik, Policybazaar – are likely to raise up to Rs 28,000 crore ($3.7 billion) through public offers betting on favourable market dynamics where both institutional and retail investors are operating with abundance of liquidity.

According to industry experts, successful listings by these fintech companies could trigger a larger number of homegrown fintechs to make their debuts on Indian exchanges in the coming years mirroring the trends set by foreign counterparts listed on Nasdaq of the United States and China’s Shanghai Stock Exchange over the last two years.

However, these IPO-bound startups are set to face unique challenges, which include building public confidence around respective revenue models, diluting foreign ownership as well as working around tighter scrutiny by multiple regulators in the financial sector ahead of their highly-anticipated public offerings, the experts said.

Challenges and Opportunities

“While Zomato’s successful and historic public offer has set the tone for other IPO-bound startups this year, a bumper Rs 1 lakh crore Life Insurance Corp of India (LIC) offer could test the depth of Indian market where startups listing around the same time could struggle to garner anticipated traction,” an investment banker working with an IPO-bound startup said highlighting one such near term challenge.

While Paytm and Mobikwik have filed their draft red herring prospectus (DRHP) with capital market regulator Securities and Exchange Board of India (Sebi) for Rs 16,600 crore and Rs 1,900 crore IPOs respectively, Policybazaar’s DRHP is imminent following its board approving an offer to raise Rs 6,500 crore last week. These IPOs are likely to be launched between October and December this year.

As per the banker cited above, an IPO for fintech startups not only offers greater legitimacy for these companies in the eyes of the regulators while applying for new licenses, it also presents an acceptable exit window for the foreign investors in these startups. In fact, Chinese investors of both Paytm and Policybazaar are likely to offload stakes during the proposed IPO as per our sources.

Also Read: How Zomato executed its IPO plan

“For Indian fintech with Chinese funding, it is becoming exceedingly hard to raise private capital after the government’s fresh FDI rules last year post Indo-Sino border skirmish,” said an industry insider.

Scope for growth

Even with these constraints, across the startup ecosystem the consensus is that India’s underpenetrated, yet high potential consumer, internet market means that loss-making fintech startups are commanding high valuation premiums, especially from global investors eyeing to diversify from more saturated western markets.

“The year 2020 saw a rapid acceleration of the total addressable market for Indian fintech startups as the pandemic brought about a near-permanent shift in consumer behaviour towards digital modes, which in turn helped these companies command higher growth and valuations,” said Pranav Pai, the founding partner, 3one4 Capital, an early-stage venture capital firm.

“As this ecosystem expands both in terms of users and talent, we are likely to see increased participation from global investors. Already, 2020 and 2021 have been record years for Foreign Direct Investments (FDI) in India among the emerging markets economies,” said Pai. “For many investors, the eventual exit strategy tends towards IPOs; the only question then is when to do the IPO?”

A Year for IPO: 2021

For Indian fintechs, 2021 has therefore presented the opportune moment for public listing driven as well by global sentiment among institutional backers for the sector in public markets elsewhere.

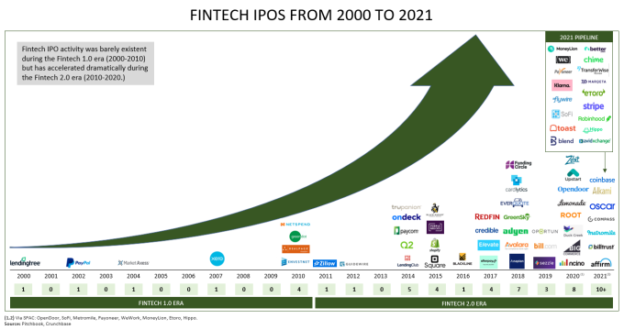

For instance, while 2020 saw a record eight US-based fintechs make stock exchange debuts, 2021 has already surpassed this number with high profile listings by the likes of SoFi, Coinbase, Billnext and Affirm among others.

“This could be the ‘coming of age’ for Indian fintech sector as well as Indian stock exchanges with a new wave of startups making debuts on domestic exchanges and considering Indian Exchanges favourable for listing against other exchanges like Nasdaq,” said Navin Surya, the chairman of Fintech Convergence Council, an industry group.

“These IPOs can influence the Indian indices much like how tech and the internet companies in the US moved the NASDAQ in the 2010s and also position Indian stock exchanges as attractive options for listing of foreign companies,” said Surya.

According to Dinesh Arora. Partner, Deals, PwC India, 2021 could be the year for Indian fintech startups just like 2008 for microfinance institutions making public offers.

“With better availability of information as well as low costs of transaction, fintech companies have opened a new layer of market which is untapped, which in turn helps these players command a higher valuation premium in the public market,” said Arora.

Another factor driving Indian listing is lack of clarity on foreign listing rules, said a founder of a fintech startup eyeing global listing. “The government was supposed to issue guidelines on direct global listing in March, but this has been delayed.”

“Most fintech startups, which were eyeing US-listing, are now reconsidering for a viable domestic alternative as there is pressure to maintain consistent capital flow and retain talent through employee stock programs,” the founder said. Fintech startups such as Pine Labs, Groww, Razorpay, PhonePe are all among those reportedly eyeing global listings.

https://m-economictimes-com.cdn.ampproject.org/c/s/m.economictimes.com/tech/startups/indias-fintech-sector-is-set-for-landmark-ipos/amp_articleshow/84771256.cms