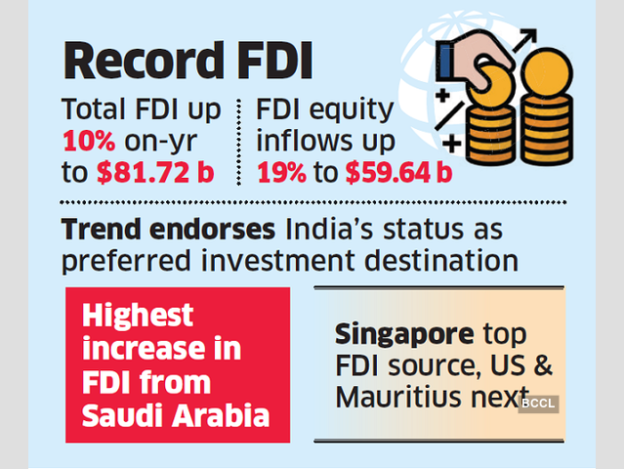

India attracted the highest-ever total foreign direct investment (FDI) inflow of $81.72 billion in FY21, 10% higher than 2019-20, the government said. The total FDI comprises equity inflows, reinvested earnings and other capital.

FDI equity inflows rose 19% over the previous fiscal, led by Singapore and followed by the US and Mauritius. However, the highest increase in FDI came from Saudi Arabia which invested $2.81 billion in FY21 compared to $89.93 million in the previous financial year.

“Out of top 10 countries, Saudi Arabia is the top investor in terms of percentage increase during 2020-21,” the government said.

Equity inflows in FY21 were $59.64 billion compared to $49.98 billion in the previous fiscal.

“Measures taken by the government on the fronts of FDI policy reforms, investment facilitation and ease of doing business have resulted in increased FDI inflows into the country,” the commerce and industry ministry said in a statement.

It said that a 227% and 44% increase was recorded in FDI equity inflow from the US and the UK, respectively.

Computer Software and hardware emerged as the top sector during with around 44% share of the total FDI Equity inflow followed by Construction (Infrastructure) Activities (13%) and Services Sector (8%), respectively, according to the statement.

Under the sector Computer Software & Hardware, the major recipient states are Gujarat, Karnataka and Delhi.

As per the statement, the major sectors, namely Construction (Infrastructure) Activities, Computer Software & Hardware, Rubber Goods, Retail Trading, Drugs & Pharmaceuticals and Electrical Equipment have recorded more than 100% jump in equity during 2020-21 as compared to the previous year.

Gujarat is the top recipient state during the year with 37% share of the total FDI Equity inflows followed by Maharashtra (27%) and Karnataka (13%).

https://m.economictimes.com/news/economy/finance/fy21-fdi-inflows-up-10-highest-jump-in-investments-from-saudi-arabia/amp_articleshow/82910518.cms