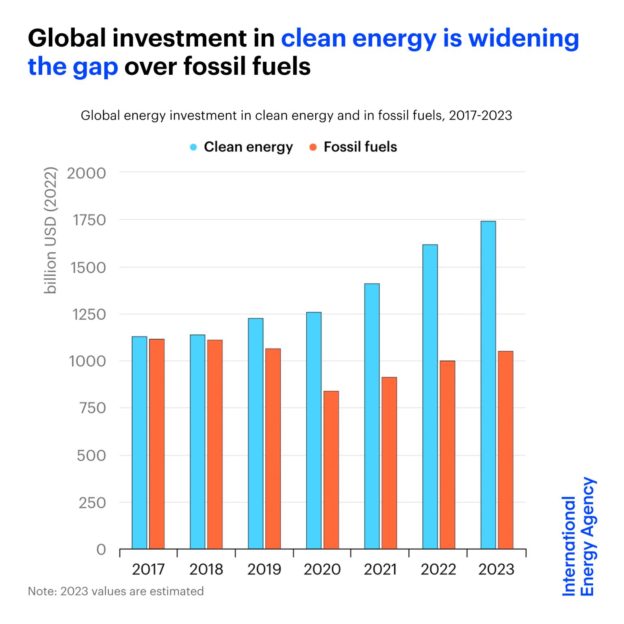

A major shift is taking place in global energy. 5 years ago, for $1 invested in fossil fuels, the same went to clean energy. But since then, a big gap has opened up. This year, for $1 invested in fossil fuels, $1.70 is going to clean energy.

The shining example of the growth in clean energy investment is solar, which in 2023 is set to attract more capital than global oil production for the first time ever. This reflects the changing tide in world energy.

The oil & gas industry benefited from an unprecedented cash windfall in 2022, but most of this has gone to dividends, share buybacks and paying back debt – rather than into energy investments.

Investment in clean energy technologies by the oil & gas industry is less than 5% of what it spends on exploration & production. The industry can do far more to scale up clean energy options like renewables, low-emissions fuels, hydrogen & carbon capture.

Renewables (led by solar) & electric cars are spearheading the expected increase in global clean energy investment this year. We need to see growth pick up further in other crucial areas such as efficiency, grids & batteries.

A major concern is the unevenness of growth in clean energy investment. More than 90% of the increase in recent years is in advanced economies & China. Mobilising greater financing for emerging & developing economies is critical to avoid new dividing lines in global energy.

The world needs to build on this strong momentum in clean energy investment. Governments, industry & investors all need to drive further progress on scaling up investment, particularly in emerging & developing economies. This is the key task for a secure & sustainable transition.

Investment in clean energy technologies is significantly outpacing spending on fossil fuels as affordability and security concerns triggered by the global energy crisis strengthen the momentum behind more sustainable options, according to a new IEA report.

About USD 2.8 trillion is set to be invested globally in energy in 2023, of which more than USD 1.7 trillion is expected to go to clean technologies – including renewables, electric vehicles, nuclear power, grids, storage, low-emissions fuels, efficiency improvements and heat pumps – according to the IEA’s latest World Energy Investment report. The remainder, slightly more than USD 1 trillion, is going to coal, gas and oil.

Annual clean energy investment is expected to rise by 24% between 2021 and 2023, driven by renewables and electric vehicles, compared with a 15% rise in fossil fuel investment over the same period. But more than 90% of this increase comes from advanced economies and China, presenting a serious risk of new dividing lines in global energy if clean energy transitions don’t pick up elsewhere.

“Clean energy is moving fast – faster than many people realise. This is clear in the investment trends, where clean technologies are pulling away from fossil fuels,” said IEA Executive Director Fatih Birol. “For every dollar invested in fossil fuels, about 1.7 dollars are now going into clean energy. Five years ago, this ratio was one-to-one. One shining example is investment in solar, which is set to overtake the amount of investment going into oil production for the first time.”

Led by solar, low-emissions electricity technologies are expected to account for almost 90% of investment in power generation. Consumers are also investing in more electrified end-uses. Global heat pump sales have seen double-digit annual growth since 2021. Electric vehicle sales are expected to leap by a third this year after already surging in 2022.

Clean energy investments have been boosted by a variety of factors in recent years, including periods of strong economic growth and volatile fossil fuel prices that raised concerns about energy security, especially following Russia’s invasion of Ukraine. Enhanced policy support through major actions like the US Inflation Reduction Act and initiatives in Europe, Japan, China and elsewhere have also played a role.

Spending on upstream oil and gas is expected to rise by 7% in 2023, taking it back to 2019 levels. The few oil companies that are investing more than before the Covid-19 pandemic are mostly large national oil companies in the Middle East. Many fossil fuel producers made record profits last year because of higher fuel prices, but the majority of this cash flow has gone to dividends, share buybacks and debt repayment – rather than back into traditional supply.

Nonetheless, the expected rebound in fossil fuel investment means it is set to rise in 2023 to more than double the levels needed in 2030 in the IEA’s Net Zero Emissions by 2050 Scenario. Global coal demand reached an all-time high in 2022, and coal investment this year is on course to reach nearly six times the levels envisaged in 2030 in the Net Zero Scenario.

The oil and gas industry’s capital spending on low-emissions alternatives such as clean electricity, clean fuels and carbon capture technologies was less than 5% of its upstream spending in 2022. That level was little changed from last year – though the share is higher for some of the larger European companies.

The biggest shortfalls in clean energy investment are in emerging and developing economies. There are some bright spots, such as dynamic investments in solar in India and in renewables in Brazil and parts of the Middle East. However, investment in many countries is being held back by factors including higher interest rates, unclear policy frameworks and market designs, weak grid infrastructure, financially strained utilities, and a high cost of capital. Much more needs to be done by the international community, especially to drive investment in lower-income economies, where the private sector has been reluctant to venture.

To help address this, the IEA and the IFC will on 22 June release a new special report on Scaling Up Private Finance for Clean Energy in Emerging and Developing Economies.

https://www.iea.org/news/clean-energy-investment-is-extending-its-lead-over-fossil-fuels-boosted-by-energy-security-strengths?utm_content=bufferb9b14&utm_medium=social&utm_source=linkedin-Birol&utm_campaign=buffer