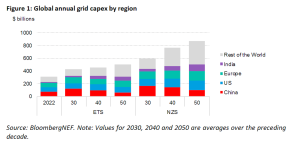

New York and London, March 2, 2023 – Electricity grids are the backbone of the energy transition, yet the networks we have today are not ready for the future. At least $21.4 trillion needs to be invested in the electricity grid by 2050 to support a net-zero trajectory for the world, according to a new report from BloombergNEF (BNEF). The New Energy Outlook: Grids report, published today, provides a more detailed breakdown of the grid analysis presented in BNEF’s New Energy Outlook 2022 Net Zero Scenario.

The total investment comprises $4.1 trillion to sustain the existing grid and $17.3 trillion to expand the grid for new electricity consumption and production. Annual investment triples from $274 billion in 2022 to $871 billion per year in the decade preceding 2050. Significant policy intervention is required to realize this scale of investment in the grid. This includes streamlining the permitting processes to reduce the number of permits required for a project, consolidate the review process among different agencies, and establish clear time frames for approval. To ensure grid modernization can accelerate, reforms are needed to create right incentives for utilities to pursue digitalization and grid flexibility.

Annual expenditure on distribution networks more than triples to about $533 billion by 2050, from $147 billion today. As renewables expand, grid expenditure leans towards building greater redundancy in the distribution grid, enabling bi-directional flow, and enhancing remote monitoring. Transmission lines continue to play an important role to connect markets, balance power between distribution grids, improve system reliability and carry electricity from remote generators across the network.

Power lines expand tremendously. BNEF estimates 80 million kilometers in grid growth between 2022-50, more than enough to replace the global electricity grid today. This breaks down to about 68 million kilometers of above-ground lines, 12 million kilometers of underground cables and 0.2 million kilometers of submarine cables.

“We must effectively double the size of the global electricity grid by 2050. This future grid needs to be smart, flexible and responsive, enabling us to harness the full potential of renewable energy rather than be bogged down by it.” said Sanjeet Sanghera, Head of Grids & Utilities at BloombergNEF and lead author of the report.

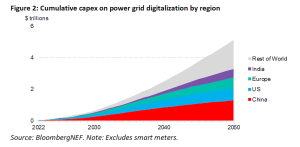

Digitalization, which helps improve and extend the utilization of the grid infrastructure, represents 24%, or $5.1 trillion, of total investment to 2050. Most of this goes toward implementing automation and control of the power system or to increasing monitoring and situation awareness. Digital deployments also help extend the lifetime of aging assets, avoid costly new power lines and affordably maintain reliability for both demand and generation connections – thereby cutting across all the drivers of grid investment.

“The legacy grid was built for the industrial revolution and outperformed our wildest expectations,” said Sanghera. “But the project ahead is to decarbonize the global economy by connecting terawatts of renewables and electrifying as much as possible of the end-use economy. The technologies, policies and strategies utilities will need to accomplish this goal are different from those that made the grid so successful in the past.”

The expansion of the electricity grid will strain supply chains. Copper demand from grids reaches 13 million tons by 2030, up from 5 million tons today, and then continues growing towards 23 million tons in 2050. Power grids will be the top consumer of copper among energy transition technologies in 2022-50 under the net zero scenario.

This research forms part of a series of reports diving deeper into country and sector results from BloombergNEF’s New Energy Outlook. As part of this series, BloombergNEF today also published a separate report New Energy Outlook: Industry, focusing on the key technologies needed to decarbonize industrial sectors. A link to the press release can be found here.

BloombergNEF will publish New Energy Outlook reports for the US, Europe, China, Japan, India, and Australia over the coming months.

https://about.bnef.com/blog/global-net-zero-will-require-21-trillion-investment-in-power-grids/