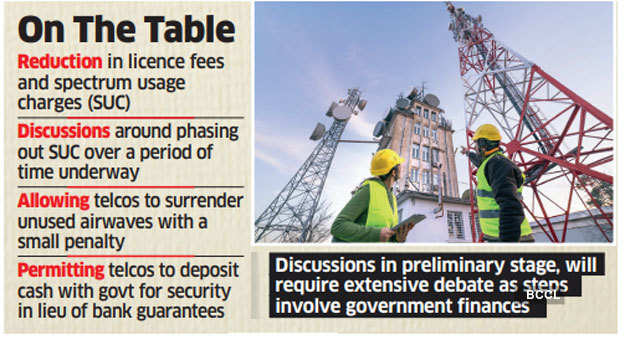

New Delhi: The government is considering a slew of long-term measures to improve the health of the debt-laden telecom sector, which includes prospectively redefining adjusted gross revenue (AGR) to exclude ‘non-telecom’ items and allowing telcos to surrender unused spectrum for a small penalty.

Other measures being discussed with the Department of Telecommunications (DoT) include reduction in licence fees (LF) and spectrum usage charges (SUC) and phasing out bank guarantees, senior government officials say.

“The government is looking at ways to improve the financial health of the sector, not just of one company (Vodafone Idea),” said one of the officials. “If the sector is nursed back to health, Vodafone Idea too will benefit.” The officials though cautioned that the measures would require extensive consultation with the finance ministry owing to the revenue implications of some of them, including reducing the annual LF and SUC.

A critical step is a relook at the definition of AGR to exclude non-telecom items. This has been a long-standing battle between the government and telcos, which the DoT won in September 2019 in the Supreme Court.

Trai recommendation

The court then backed the government and widened the definition of AGR to include non-telecom items. But this left India’s older telcos – Bharti Airtel and Vodafone Idea – facing a combined Rs 1.02 lakh crore in AGR-related licence fees and SUC dues, pushing already struggling Vodafone Idea further towards a possibly fatal financial crisis, say analysts.

“So, a fresh definition for AGR excluding all non-telecom revenue could actually help clear all the doubts and grey areas which have been a bone of contention between the telcos and the government,” another senior official told ET.

Licence fees and SUC are paid on the basis of AGR; so lower the AGR, lower the related levies.

Besides, there is already a recommendation by the telecom regulator to reduce licence fees and phase out SUC over time. “Discussions around phasing SUC out over a period of time and reducing LF to a token percentage are underway,” the second official said.

Another major reform under consideration is a provision to allow telcos to surrender airwaves to the government with a small penalty in case any amount is lying unused with them.

“At present, telcos can only trade/ share airwaves with each other. Suppose a telecom operator wants to return airwaves to the government as none of the other telcos want to buy, then it cannot do so and is saddled with unused spectrum,” the second official explained.

“In such a scenario a telco isn’t forced to keep paying instalments to the government for the entire 20-year period and will make a telco more agile and speedy in making profitable decisions,” the official told ET.

According to some industry estimates, Vodafone Idea is currently not using almost a third of its spectrum for which it has to pay instalments to the government.

The official added that giving a one-year payment moratorium – as requested by loss-making Vodafone Idea — will not be sufficient for the cast-strapped telco to survive. The telco has a debt of Rs 1.8 lakh crore, of which Rs 1.5 lakh crore is government debt towards AGR and spectrum payments. Its cash balance at the end of March was Rs 350 crore.

“Vodafone’s board approved close to Rs 25,000 crore mix of debt and equity but it seems as though the company needs about Rs 50,000 crore,” the first official said. “The company needs to put its own house in order which means first raising tariffs and then achieving operational efficiencies.”

Earlier this month, Vodafone Idea asked the government to grant it a one-year moratorium over spectrum instalment worth over Rs 8,200 crore due in April 2022, saying it won’t have enough funds after meeting AGR payment obligation due in March 2022.

The telcos have also been asking the DoT to scrap bank guarantees which companies need to furnish as security for their statutory dues which include LF, SUC and deferred spectrum payment instalments. DoT can encash the guarantees in case of any default on part of the telcos.

“If the LF and SUC are indeed reduced/ phased out, then automatically it will impact the bank guarantees which telcos have to furnish,” the first official said. Currently Airtel and Vodafone Idea furnish bank guarantees in the range of Rs 6,000- 6,500 crore annually.

Officials say Airtel recently reached out to the DoT requesting that telcos be allowed to deposit cash with the DoT instead of bank guarantees which places a heavy interest burden on telcos.

“The company has cited examples of GST and income tax, saying that the government doesn’t place the demand for bank guarantees on the industry for timely payment of those dues but imposes a hefty penalty for delay or non-payment,” the second official said.

Airtel has submitted 347 bank guarantees to the tune of Rs 13,578 crore from 16 banks to the government so far.

“A long history of extracting as much as possible from the sector has left a legacy of repeated business failures – including the largest bankruptcy in Indian corporate history, Reliance Communications. That is likely to be trumped by Vi…” Deutsche Bank said in a report.

“For all the talk of the Indian government wanting three private players, there has been insufficient action to take that claim very seriously,” it added.

https://telecom.economictimes.indiatimes.com/amp/news/government-mulling-long-term-measures-to-boost-health-of-stressed-telecom-sector/84812647