The August 2021 allocation of special drawing rights supported countries amid recovery from the pandemic—and continues to offer benefits

In a world shaken by multiple shocks affecting many countries—pandemics, wars, food and energy crises, and climate disasters—the international community has a responsibility to stand together and support the global economy and all its citizens.

One example of such international cooperation has been the IMF’s largest-ever allocation of special drawing rights in August 2021, which injected $650 billion of liquidity into countries to help turn the pandemic crisis toward recovery.

SDRs are unconditional reserve assets issued to member countries at times of stress to safeguard global stability. SDRs can be saved as international reserves, providing a cushion against shocks. These assets can also be exchanged for other currencies and spent, including on vaccines or social assistance for families.

Two years after this historic allocation, our new study shows that it met its objectives by giving member countries a boost and helping the global economy avoid worse outcomes.

Most importantly, the benefits are poised to continue. More than $100 billion of SDRs in pledges announced by the G20 are being channeled from stronger members to vulnerable low-and middle-income countries, amplifying the direct benefits of the allocation.

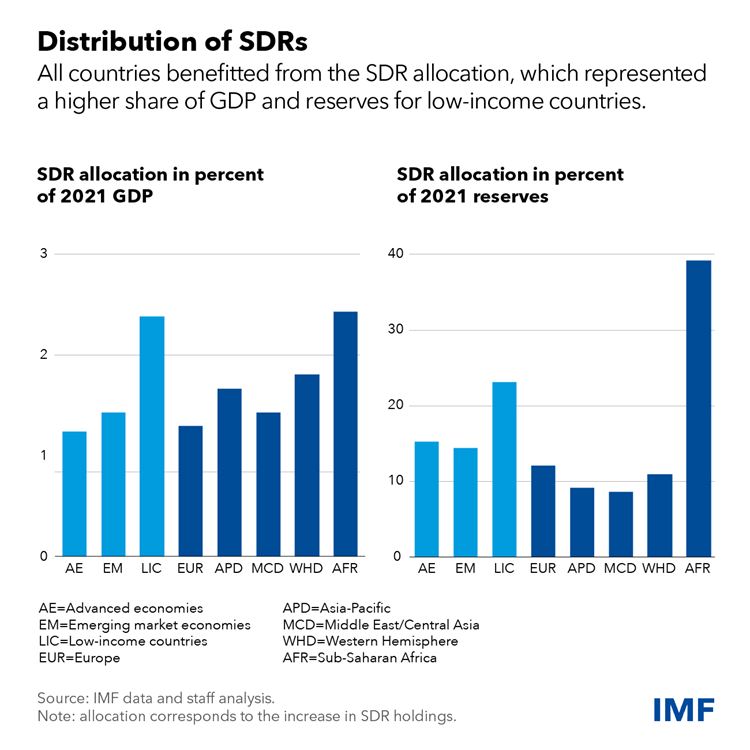

Our report shows that the SDR allocation benefitted all IMF members, especially low-income countries. Although advanced economies received the bulk of the allocation ($376 billion), when measured in relation to the size of their economies, low-income countries received on average almost double the allocation compared to advanced economies. And low-income countries continue to benefit from the rechanneling of SDRs.

International reserves of low-income countries were bolstered by 23 percent on average (up to 40 percent for sub-Saharan African countries). Some of these countries also used the space provided by the allocation (about 2.4 percent of their annual economic output on average) for crisis-related spending.

Our report also shows that SDRs were used to protect people’s livelihoods and well-being.

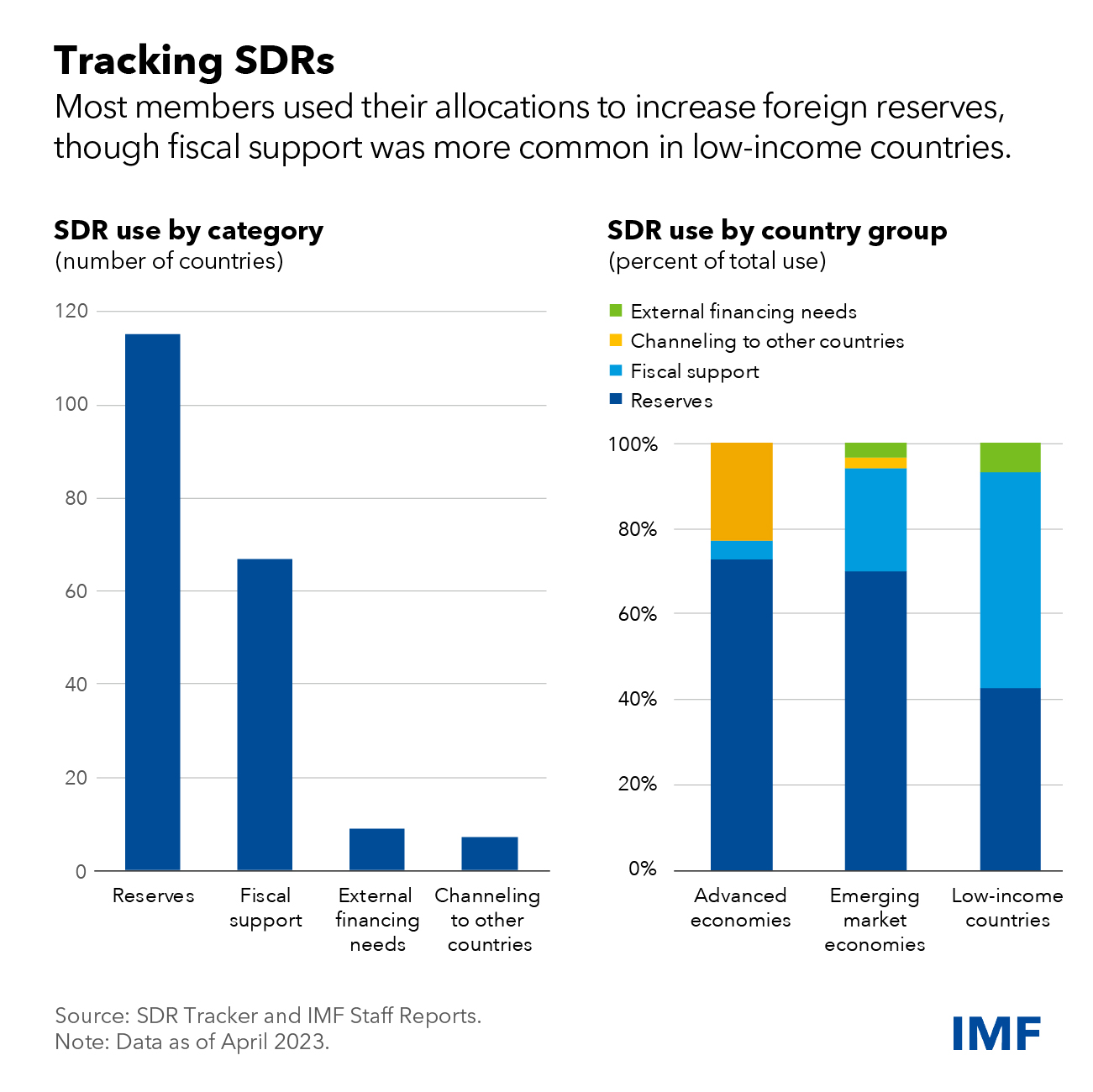

Countries generally used SDRs to increase their reserve buffers. As a result, they saw lower borrowing costs. This helped amplify the beneficial effects of the allocation by allowing emerging and developing countries to borrow from markets at lower cost to help meet the urgent needs of their populations.

A number of emerging market economies and low-income countries also used SDRs to finance pressing fiscal needs, including those related to the pandemic, according to the IMF’s SDR Tracker, which collects information on how countries used the resources.

For example, The Gambia dedicated some of its funding to a new ultra-cold storage facility for COVID-19 vaccines, while Senegal used SDRs to support domestic vaccine production and invest in hospitals. North Macedonia used its entire allocation to provide subsidies to vulnerable households and those hit by the pandemic, boost spending on health, vaccines, and finance capital projects. And Paraguay funded its pandemic emergency plan.

Our report suggests that governments generally pursued responsible policies, saving SDRs to protect against future shocks, spending them on critical needs, while not delaying needed adjustment and reforms. They also generally reported transparently on their use of SDRs. Only in some cases were reforms postponed, and the reporting of SDR use by fiscal authorities faced challenges.

While countries that spent SDRs now face higher interest costs, they are still lower than alternative market financing. With higher global interest rates, the total long-term expected costs of using SDRs have more than tripled for the median country since August 2021. Still, interest costs due on the SDR allocation remain significantly below alternative market financing, and should be manageable with sound macroeconomic policies, even if interest rates stay higher for longer.

SDR channeling benefits

Countries with strong balance of payments positions—generally advanced and large emerging market countries—have demonstrated responsibility toward the global community by pledging part of their allocation to support more vulnerable members and standing ready to provide currencies in exchange for SDRs through voluntary trading operations.

As part of the broader channeling effort to support countries since the pandemic, the international community has mobilized pledges of $45 billion for the IMF’s Poverty Reduction and Growth Trust and $42 billion for the Resilience and Sustainability Trust, which are helping low- and middle-income countries address balance-of-payments needs and longer-term structural challenges, such as climate change.

This is essential so that the Fund can continue to provide affordable financing to its poor and vulnerable members. Efforts are also being made to further channel SDRs through multilateral development banks for the benefit of low- and middle-income countries.

Collective responsibility

Responsibility does not stop here. With close to $1 trillion in SDRs allocated to date, the international community has a collective responsibility to evaluate carefully any future decisions to issue SDRs and ensure transparency in the use of such global reserve assets. In particular, at the current juncture, members need to take into account the environment of higher interest and inflation rates, which is making the use of SDRs more costly. Countries must also be prudent, accountable, and transparent in their actions and use of SDRs to help their people.

Stronger economies must continue to amplify the effects of the 2021 allocation by translating their pledges into actual contributions and, as feasible, increasing the ambition of voluntary SDR channeling. This is critical to adequately resource the global financial safety net and support vulnerable countries facing multiple shocks and challenging transitions.

In sum, while an SDR allocation is a very useful and important mechanism to build confidence and strengthen global economic and financial resilience, it is not a silver bullet. It has to be seen as part of a broader range of support measures. This includes those measures that the IMF has deployed and will continue to deploy to support our membership in this shock-prone world, such as our policy advice to countries, financial support, including our contingency facilities, and technical assistance.

https://www.imf.org/en/Blogs/Articles/2023/08/29/historic-650-billion-liquidity-boost-continues-to-benefit-the-global-economy