Parekh said the Prime Minister Awas Yojana, under which an estimated 11.3 million home loans have been sanctioned, has been a game changer for the housing sector as the ultimate objective is to build a more inclusive and a property-owning democracy.

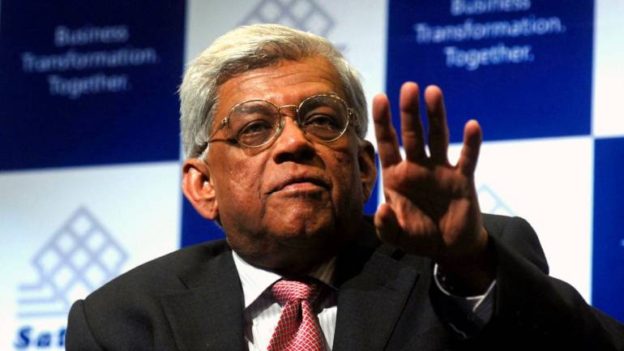

The demand for housing in India remains a combination of purchases by first-time homebuyers, customers moving up the property ladder by shifting to larger homes or acquiring a second home in another location. It is structural in nature and unlikely to dissipate soon, Housing Development Finance Corporation (HDFC) chairman Deepak Parekh said on Thursday.

With the work from home (WFH) option increasingly available, the proximity to one’s workplace has become a less compelling consideration. As a result, there are wider options in terms of locations when buying a home. “I firmly believe that the demand for housing is not pent up. It is structural demand and that is here to stay,” Parekh said, speaking at a digital property tech summit organised by Brigade REAP and HDFC Capital.

The strong demand seen in recent times has been a surprise on the upside. Growth in home loans has been aided by low interest rates, softer or stable property prices and continued fiscal benefits on home loans. Technology has enabled developers to virtually showcase their property and home loan providers to leverage their digital platforms to continue to serve new and existing customers, he said.

Parekh said the Prime Minister Awas Yojana, under which an estimated 11.3 million home loans have been sanctioned, has been a game changer for the housing sector as the ultimate objective is to build a more inclusive and a property-owning democracy. “One cannot talk about sustainability if the benefits accrue to only a small privileged segment of society. Sustainability and inclusion are closely linked,” he said.

The HDFC chairman harped on the need to move the liquidity sloshing around across the world in real assets, saying that governments across the world are conscious about preventing the build-up of asset bubbles. “Building infrastructure is one way to ensure a sustained recovery without spiralling inflation. Building infrastructure also creates a massive number of jobs and has a multiplier effect on the economy,” Parekh said.

The construction industry is one of the least digitised sectors in the world, Parekh said, citing estimates that the real estate sector spends less than 1.5% of its revenue on technology. Capitalising on technology for the real estate sector will improve governance and one way of doing this would be to make real time data on real estate available. “For instance, progress of projects can be monitored through digital dashboards, with data driving key decisions. Funding for projects based on achieving construction milestones can be better monitored online. This will bring in much needed transparency and accountability and improve cost efficiencies also in this sector,” Parekh said.

https://www.financialexpress.com/industry/housing-demand-is-here-to-stay-hdfc-chairman-deepak-parekh/2238511/