Warren Buffett’s 6 investment principles emphasize long-term value, investing in productive assets, staying within your expertise, seizing big opportunities, and continuously improving yourself.

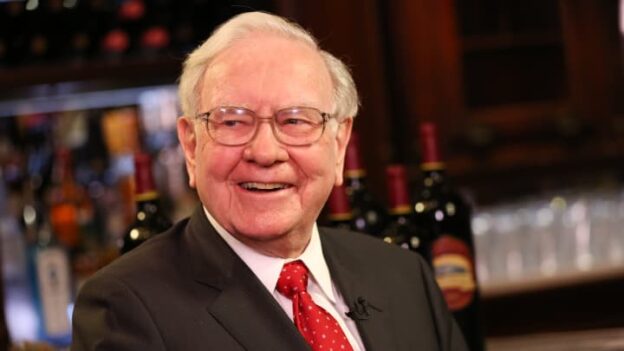

Warren Buffett is widely regarded as one of the most successful investors of the 20th century. Over the years, Buffett, now 94, has shared a wealth of knowledge about the principles that have guided his remarkable success. So, how did he achieve such impressive results and become one of the richest people in the world? It was by investing in businesses and following a set of core principles that have consistently served him well.

Here are six of his key investment rules:

- Cash is Never a Good Investment

This principle reflects Buffett’s broader investment philosophy: get out of cash and invest in assets, because the value of cash will likely decrease over time.

As Buffett famously said, “When people say cash is king, I mean, that’s crazy. Cash doesn’t produce anything, and it’s sure to lose value over time.”

While it’s important to have enough cash for your immediate needs — like oxygen for survival — holding too much cash is inefficient. “We always want to have enough cash around, but anytime we have surplus cash, I’m unhappy. I would much rather own good businesses than hold cash,” Buffett explains.

- Invest in Productive Assets

Buffett contrasts owning physical commodities like gold with investing in productive assets. “You could own all the gold in the world and have a cube 67 or 68 feet on each side. You could climb on top of it and think you’re king of the world, but it doesn’t do anything. It doesn’t produce anything,” he states.

Instead, Buffett advocates for investing in assets that deliver returns over time. “You buy a farm because you expect it to produce a certain amount of corn, soybeans, or cotton every year. You decide how much you’ll pay for it based on what you think it will deliver,” he explains.

When investing in a business, Buffett thinks long term and ignore short-term fluctuations in stock prices.

Also read: Retirement Planning: 4 simple tips to save your money from inflation

- Stay in Your Circle of Competence

One of Buffett’s core principles is knowing your strengths and sticking to them. “Defining your circle of competence is the most important aspect of investing. It’s not how large your circle is; it’s knowing where the perimeter is, and staying inside it,” says Buffett.

He often references Tom Watson, the founder of IBM, who said, “I’m no genius, but I’m smart in the spots I stay around. If I understand a few things and stick to them, I’ll do okay.”

Buffett believes that getting caught up in things you don’t understand is a recipe for failure. “If I don’t understand something, I don’t get excited about it just because my neighbors are talking about it or because everyone else seems to be making money. I stick to what I know,” he adds.

- Evaluate Companies First

Buffett’s approach to investing is rooted in value. He doesn’t focus on market prices; instead, he evaluates the intrinsic value of the company first. “We don’t think about the price first. We think about what the company is worth. When we bought it at $35 billion, I felt the company was probably worth at least $100 billion,” he recalls.

Buffett advises that investors should “look at the business first, figure out what it’s worth, and then look at the price. If the price is way lower than what I think the company is worth, that’s when I’ll buy it.”

- Play Big and Don’t Waste Opportunities

Buffett emphasizes that taking advantage of big opportunities is crucial to building wealth. “Omission is a much bigger mistake than commission. You need to seize big opportunities when they come. If you play it safe and only make small bets, you’ll miss the chance to make a real difference,” he explains.

He also believes in taking bold actions when necessary. “When you get a chance to do something right and big, you have to do it. Doing it on a small scale is almost as big a mistake as not doing it at all.” Buffett reflects that life doesn’t offer endless opportunities, so you have to grab the big ones when they come.

- Invest in Yourself

Finally, Buffett underscores the importance of investing in your own skills and knowledge. “The best investment you can make is in yourself. No one can take it away from you—neither inflation nor taxes,” he says.

He advises young people to develop good habits, continuously improve, and build their abilities. “You’re a million-dollar asset. If you can improve your communication skills, whether verbal or written, you could increase your value,” Buffett says.

Summing up:

These six rules have been the cornerstone of Warren Buffett’s investment philosophy. By avoiding cash, investing in productive assets, staying within his circle of competence, focusing on company fundamentals, seizing big opportunities, and constantly improving himself, Buffett has built one of the most successful investment careers in history.

https://www.financialexpress.com/money/how-to-invest-like-warren-buffett-6-rules-of-investing-to-become-ultra-rich-3660304/?ref=money_hp