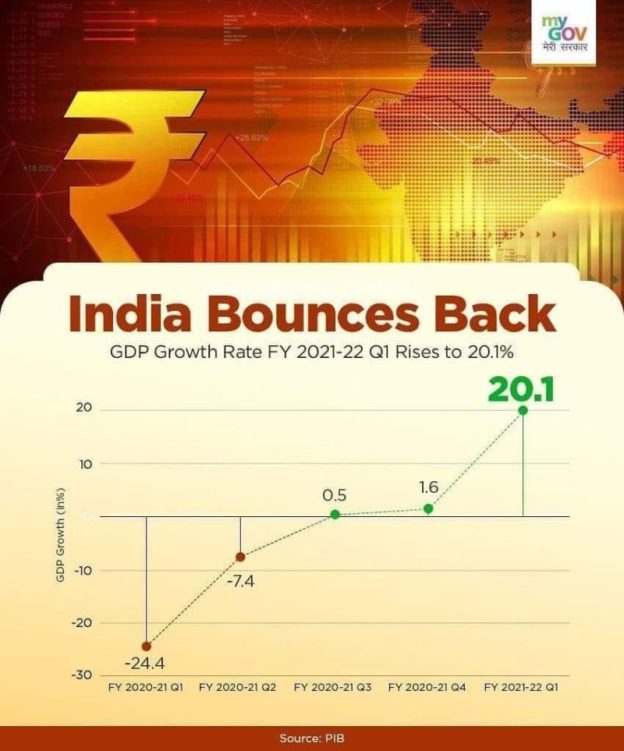

The 20.1% jump in Q1 GDP paves the way for higher growth in the coming quarters. Most management commentaries and a CEO poll indicate that firms are cautiously bullish for the next three quarters. However, inflation and supply-side constraints, especially chip shortage in the auto sector

As the economy makes a solid quarterly start to the fiscal by registering 20.1% GDP growth for the first quarter, India Inc is expecting a significant recovery in the corporate sector’s performance during the financial year 2021-22.

Order books are expanding, businesses are retaining optimistic growth projections, stock-building efforts are continuing and additional materials are being bought.

Management commentaries across the board indicate an improved demand environment post-June 2021, led by the easing of restrictions and a sharp reduction in active Covid cases. Moreover, companies that have reported towards the end of the earnings season have shown demand revival in July, August, according to Motilal Oswal Securities.

Inflation worries

Commodity cost inflation has impacted gross margins, partially offset by price hikes and the product mix during the quarter. However, the intensity is expected to plateau from 2HFY22. The semiconductor shortage continues to impact PV production, with the second quarter expected to be worse than the first. All of the two-wheeler firms are focused on their EV strategies going forward and expected launches.

According to a poll conducted among 117 senior CEOs at the recent meeting of the National Council of the Confederation of Indian Industry, about 79 per cent expected GDP growth to be more than 8 per cent.

What Moody‘s said

The economic activity in India is picking up with the gradual easing of COVID restrictions and there could be further upside to growth as economies around the world gradually reopen.

In its August update to ‘Global Macro Outlook 2021-22’, Moody’s retained India’s growth forecast for the 2021 calendar year at 9.6 per cent and 7 per cent for 2022.

The rating agency said it expects the Reserve Bank to maintain an accommodative policy stance until economic growth prospects “durably improve”.

The IT sector

The IT industry is seeing a big change, with technology emerging as the cornerstone for large enterprises. Two themes are driving growth in the industry: digital transformation and cost control through increased automation. Managements remain confident of achieving double-digit revenue growth in FY22 on the back of a strong deal pipeline around cloud, data analytics, cybersecurity, automation, and AI. While companies are adding employees at an unprecedented pace, attrition-led supply pressure on margins remains a key concern.

Capital goods

In capital goods, the managements have indicated that although the intensity of execution has been much higher vis-à-vis last year, most of the companies lost 3–4 weeks of productivity due to the second Covid wave disruption. The L&T management has indicated the order pipeline is up YoY, implying a positive outlook. While order inflows (OI) across most of the companies have been robust, Thermax’s management remains cautious; it attributes the higher OI to the pent-up demand effect post the lockdown. In Consumer Electricals, the managements of Havells and Crompton have indicated that eastern and southern India continue to witness muted demand, while northern and western India have rebounded.

Consumer firms

Managements have been optimistic on the back of consistent vaccination drives and gradual unlocks happening across the country. Sharp commodity inflation has impacted the gross margins of several companies, necessitating pricing actions and cost rationalization. While inflation has abated, to some extent, managements have guided for further price hikes if the inflation resumes.

Most banks’ managements have indicated a sharp recovery in momentum from July 2021; they expect loan growth to revive in the Retail/SME segment, assuming there is no adverse impact of a potential third Covid wave. Also, certain banks such as KMB have highlighted the opportunity to grow in the unsecured segment as well. Deposit growth remains healthy. On the asset quality front, most banks have reported higher slippage, driven by retail.

Retail

Retailers expect sales recovery by third, fourth quarters, led by demand from the festive season and weddings/functions. An increase in raw material prices would impact pricing and margins. On the digital front, retailers have significantly increased their investments to cater to demand from the online channel. Shoppers Stop plans to open 30 stores over the next two years.

What CEOs say

The CII CEOs poll was conducted among 117 Senior CEOs at the recent meeting of the CII National Council. Majority of the CEOs polled, about 79 per cent of them expected GDP growth to be more than 8 per cent.

On expected revenue growth of their respective companies, 46 per cent of the CEOs expected more than 10 per cent growth in the first half of the current fiscal when compared to the first half of the pre-pandemic year 2019-20.

Another 33 per cent of them said that their company’s revenue growth will be up to 10 per cent during the first half of the current fiscal when compared to the first half of pre-pandemic year 2019-20.

Sharing their expectations on net profit growth, 49 per cent of the senior industry leaders polled indicated more than 10 per cent net profit growth during the first half of the current fiscal when compared to the first half of the pre-pandemic year 2019-20. Yet another 32 per cent of them expected their companies to register up to 10 per cent growth in net profits for the first half of the current fiscal when compared to the pre-pandemic year, 2019-20.

https://cfo.economictimes.indiatimes.com/news/india-inc-eyes-a-buoyant-fy22-as-gdp-growth-makes-a-solid-start/85888351