On Thursday, India’s market capitalisation stood at Rs 263 lakh crore or $3.55 trillion, ahead of France’s $3.4 trillion and within touching distance of fifth-placed UK, which has a market cap of $3.7 trillion.

Key Highlights

- India’s market capitalisation is now at striking distance from fifth placed UK, which has a market cap of $3.7 trillion.

- The top four slots in this league table are occupied by US ($51tn), China ($12.4tn), Japan ($7.4tn) and Hong Kong ($6.4tn).

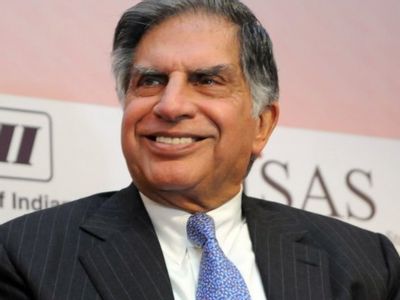

- India’s oldest corporate house Tata group have added nearly Rs 7 lakh crore to its market value.

New Delhi: With the BSE Sensex crossing 59,000 mark for the first time on Thursday, India has become the sixth most valued equity market in the world putting behind France. On Thursday, India’s market capitalisation stood at Rs 263 lakh crore or $3.55 trillion, ahead of France’s $3.4 trillion and within touching distance of fifth-placed UK, which has a market cap of $3.7 trillion, according to Bloomberg data. The top four slots in this league table are occupied by US ($51tn), China ($12.4tn), Japan ($7.4tn) and Hong Kong ($6.4tn).

In the last one month itself, India’s market cap has risen by about $300 billion or about Rs 22 lakh crore.

The Times of India citing official data mentioned in a report that the Tata group has contributed the most to India’s market cap so far this year. The salt-software conglomerate and India’s oldest corporate house have added nearly Rs 7 lakh crore to its market value. Tata group’s crown jewel TCS, which has rallied nearly 35% this year so far has alone added over Rs 5 lakh crore to the group’s market cap.

Gujarat-headquartered Adani group added Rs 4.8 lakh crore and the Pune-based Bajaj Group, added Rs 2.9 lakh crore to their market value. Mukesh Ambani-led Reliance Industries has seen its market value growing by Rs 2.8 lakh crore or nearly 22% year till date.

Indian equity markets extended their gaining streak on Friday as well led by banks and Reliance Industries. As of 11:35 am, the Sensex was up 348 points at 59,489, after hitting an all-time high of 59,737.32 during intraday trade.

The publication citing S Ranganathan, head of research, LKP Securities mentioned, it’s generally observed that when an underperformer stock or a sector rallies, that creates a feel-good effect on others. Ahead of the government’s announcement of the details about the operations of the proposed bad bank that will handle large bad loans of the sector, “banking stocks provided the much needed ammunition to the bulls to notch up record highs of 59k on the sensex”, he wrote in a post-market note.

https://www.timesnownews.com/amp/business-economy/markets/article/india-pips-france-becomes-6th-most-valued-equity-market-globally-tata-group-creates-maximum-value/813190