India’s UHNWI population is expected to grow by 39% between 2021 and 2026, with 19,006 people expecting to have net assets of US$30m or more by 2026.

The number of ultra-high-net-worth-individuals (UHNWIs) has globally increased by 9.3% in 2021. Over 51,000 people have seen their net assets increased to US$30m or more. In India, the number of UHNWIs (net assets with US$ 30m or more) has grown by 11% YoY in 2021, the highest percentage growth in APAC, according to Knight Frank’s latest edition of The Wealth Report 2022.

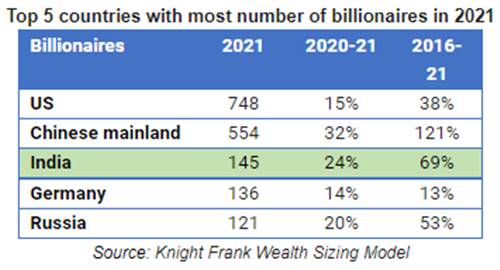

As per the report, equity markets and digital adoption have been key factors driving growth in the super rich category of India. Around 69% of the super wealthy individuals in India is expected to witness an increase of over 10% in their net worth in 2022. Asia continues to be the forerunner in the billionaires’ club contributing to 36% of the total billionaires in the world in 2021. India has ranked 3rd in terms of billionaires’ population in 2021, following the US and China.

Every region across the world saw an increase in the number of UHNWIs between 2020 and 2021 – Americas (+12.2%), Russia & CIS (+11.2%), Australasia (+9.8%), Middle East (+8.8%), Latin America (+7.6%), Europe (+7.4%) and Asia (+7.2%) – except for Africa, where the UHNWI population declined by 0.8%.

Amongst key Indian cities, Bengaluru witnessed the highest growth in the number of UHNWIs with 17.1% to 352 followed by Delhi with 12.4% to 210 and Mumbai with 9% to 1596 in 2021.

Commenting on the same, Shishir Baijal, Chairman and Managing Director, Knight Frank India, said, “Equity markets and digital adoption have been the key factors driving the growth of UHNWIs in India. The growth in younger, self-made UHNWIs has been incredible in India and we foresee them to drive new investment themes and innovation. With a healthy growth in the UHNWI and Billionaire population, India is expected to be one of the fastest growing countries amongst its global peers, further strengthening itself economically and emerging as a superpower in different sectors.”

What’s Next?

For the first time, Knight Frank has examined the size of the ‘next generation’ of the world’s UHNWI population and assesses what that could mean for the property markets. Globally, it is estimated that 135,192 UHNWIs are self-made and under the age of 40, accounting for around a fifth of the total UHNWI population. India has ranked 6th in percentage growth of the UHNWI population that is self-made and under the age of 40 years.

Over the next five years, Knight Frank forecasts that the global UHNWIs population will grow by a further 28%, with Asia and Australasia (+33% each) seeing the largest growth, followed by North America (+28%) and Latin America (+26%). The number of UHNWI population in India is expected to grow by 39% between 2021 and 2026, with 19,006 people expecting to have net assets of US$30m or more by 2026.

In the last 5 years for the major markets, Delhi has witnessed an increase of 101.2% followed by Mumbai (+42.6%) and Bengaluru (+22.7%). However, in the next 5 years, Bengaluru is projected to witness an increase of 89% of the UHNWI population and become home to 665 ultra-wealthy individuals by 2026.

https://www.financialexpress.com/money/india-ranks-3rd-in-billionaire-population-globally-knight-frank/2448068/