Factors such as increasing workforce, migration to urban centers and dearth of good bachelor living options serve as major demand drivers for the organized modern co-living model.

Driven by reopening of offices, record vaccination and reopening of colleges in a phased manner, the shared economy or popularly known as the co-living segment in the country is expected to see a recovery in 2022.

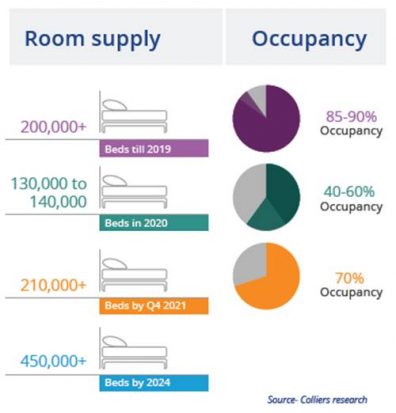

Though the pandemic marred the growth story of the co-living sector in 2020, it has already witnessed a sharp recovery in 2021. The co-living segment is expected to have 4,50,000 beds mainly driven by organized players by 2024 as opposed to 2,10,000 beds by the end of 2021, according to a Colliers report, titled ‘Future of Co-living in India.’

While there are various factors that contribute to the demand for co-living spaces, factors such as increasing workforce, migration to urban centers and dearth of good bachelor living options serve as major demand drivers for the organized modern co-living model.

Nearly 10 million youth join the workforce every year and this further results in an increased demand for affordable living options near the Central Business Districts (CBDs). Furthermore, with migration in India touching the 9 million mark during 2011-2016, the market has seen a consequent increase in requirement of residential stock in urban centers across the country.

“With the situation improving rapidly, the sector has recovered substantially and is looking more optimistic. The primary contributor to the recovery is the growing rate of vaccination. The unemployment rate is down to 7% in November 2021, a gradual dip from 11.84% in May 2021. Also, amidst the pandemic, hiring by IT companies has gathered pace followed by robust performance of the sector which will only add on to the demand for the Co-Living in coming quarters,” said Ramesh Nair, CEO, India, and Managing Director, Market Development, Asia, Colliers.

The concept of ‘Shared Economy’ got severely tested during the peak of the pandemic. Factors such as uncertain economic conditions resulting in loss of jobs, work from home and the shift of migrant population to their respective hometowns in the wake of the Covid-19 outbreak brought the evolving Co-Living sector to an immediate halt.

Between December 2020 and March 2021, the occupancy in most Co-living facilities crossed the 45 – 50% mark as the market improved and 60-70% in Q4 of 2021. However, the second wave proved to be a dampener from Q2 onwards as occupancy dipped sharply.

The Co-living segment is further expected to witness recovery in occupancy in 2022 with factors such as increasing workforce, migration to urban centers for jobs, the unorganized shared living sector and the growing student population increasingly looking for the organized modern co-living model.

“Co-Living has a strong long-term potential in the metro cities. However, the current market scenario has presented an opportunity to consolidate and reconfigure the market. While many players have exited the business as they could not sustain the financial stress of the previous year, others have capitalized on the opportunity to strengthen their position by strategic acquisitions and expansion in prime locations in metro cities,” said Subhankar Mitra, Managing Director, Advisory Services, Colliers India.

The shift in perception amongst millennials to ‘sharing’ instead of ‘owning’ has made the co-living concept popular. For all groups – corporate occupiers, start-ups, entrepreneurs, and millennials – renting offers flexibility and savings. Co-working offers cost savings of 20-25 per cent compared to traditional office space leasing.

Many investors already actively pursue options in the market to create flexible co-living facilities. The lucrativeness of a higher yield compared to a traditionally rented house has resulted in an influx of new players every year where this trend is expected to continue for the next few years. Co-living offers attractive returns; 2-4 times higher than the traditional residential yield of 2-3 per cent.

However, Co-living in India is still in its nascent stage and the operators are constantly updating their metrics. The Covid-19 pandemic has further pushed the operators back to the drawing boards to reinvent their strategy to provide an attractive and safe housing solution.

https://www.financialexpress.com/money/indias-co-living-market-likely-to-double-by-2024-colliers/2386531/