India’s manufacturing exports had grown by 40 percent to hit an unprecedented $418 billion in FY21-22.

Buoyed by favourable trends, India’s manufacturing exports are likely to hit $1 trillion by FY28, said the consultant firm Bain & Company in a recent report.

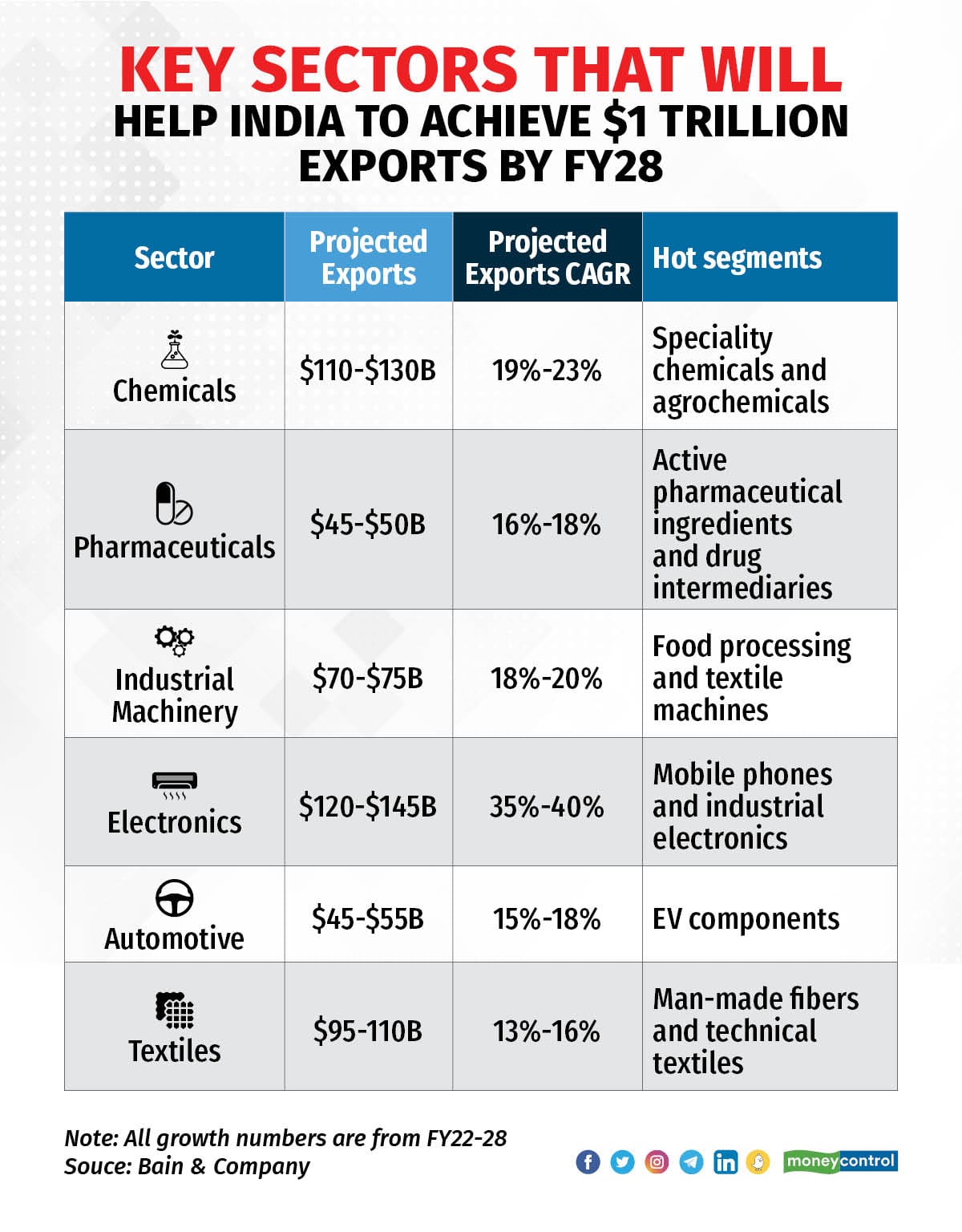

Chemicals, pharmaceuticals, electronics, automotive, industrial machinery, and textiles will be the key sectors primarily driving the growth in exports.

Despite being the sixth-largest economy in the world, India’s export contribution to global trade stood at only 1.6 percent. But this seems to be on course for a turnaround. “The positive developments in the manufacturing sector, driven by production capacity expansion, government policy support, heightened M&A activity, and PE/VC-led investment, are creating a robust pipeline for the country’s sustained economic growth in the years to come,” the report stated.

India’s manufacturing exports had grown by 40 percent to hit an unprecedented $418 billion in FY21-22. This was even more than the pre-pandemic peak of $328 billion in FY18-19.

The report attributes the growth in manufacturing exports to six megatrends – supply chain diversification, sectoral advantages, government-led initiatives, capex-led growth, M&As, and PE/VC-led investments.

The diversification of global supply chain after the pandemic had a positive impact on India as big economies began looking towards the country as an alternative to China for sourcing their requirements. Moreover, India’s lesser C02 emissions compared to China’s meant that shifting to the country would help companies to comply with their environmental and safety standards.

India’s key manufacturing sectors have seen rapid growth over the past few years due to factors such as low cost of manufacturing and increasing investments.

India’s pharmaceutical manufacturing cost is about 35 percent lower than that of the US and Europe. Indian carmakers exported 1,27,115 vehicles between April and June FY22. This is more than double the 43,619 units exported a year ago. Similar growth in exports can be seen in chemicals, electronics, industry machinery and textiles.

Government-led initiatives have helped boost outbound shipments from India. “While the PLI outlay of $47.8 billion planned over five years, starting in 2021, has increased in-country production and helped manufacturing-led exports, the foreign direct investment (FDI) policy initiatives aimed at decreasing the FDI restrictive index have augmented the capital inflow; this is visible from the fact that FDI investments increased by about 65 percent between 2015 and 2020,” said the report.

The post-pandemic economic growth is expected to boost India’s capex cycle. The government has budgeted $100 billion for capex in FY23, a year-over-year increase of 35 percent.

Several manufacturing companies are also using mergers and acquisitions (M&A) to expand their portfolios and capabilities. According to Bain, while scope acquisitions outside companies’ core operations account for 4 out of 10 transactions, first-time buyers represent about 80 percent of the $108 billion in M&A deals in India in 2021. Nearly 16 percent of such deals happened in the manufacturing sector.